Bitcoin, the leading cryptocurrency, has been gaining momentum as it establishes a strong support level at $30,000. The recent insights from industry experts add an interesting perspective to Bitcoin’s future.

According to Arthur Hayes, the former CEO of BitMEX, Bitcoin has the potential to become the predominant currency for artificial intelligence (AI), highlighting its unique attributes and resemblance to pure energy.

Additionally, the price of Bitcoin has been influenced by investors reevaluating Federal Reserve forecasts following the release of employment data.

In this Bitcoin price prediction, we delve into the factors influencing BTC’s outlook and explore the potential scenarios that await the digital asset.

Bitcoin Poised to Become the Predominant Currency for Artificial Intelligence, According to Arthur Hayes

In a recently published blog post, the former CEO of the cryptocurrency derivatives marketplace Bitmex, Arthur Hayes, argues that Bitcoin is the optimal currency for artificial intelligence (AI).

Hayes suggests that BTC will be the preferred medium of exchange for AIs due to its constant availability, digital nature, and complete automation.

Blockchain-driven systems possess appealing characteristics, and among them, BTC emerges as the top choice due to its scarcity, resistance to censorship, and ability to store value.

In comparing BTC to gold and fiat money, Hayes highlights the limitations and inefficiencies of traditional forms of currency.

Arthur Hayes Highlights BTC’s Resemblance to Pure Energy, Underscoring its Unique Attributes

In his recent letter, Hayes reminds readers that the market may be willing to overpay for the expansion of the Bitcoin network if there is a possibility that his estimates could materialize in the future.

Significant profits can be made as sentiment shifts from skepticism to cautious optimism. In response to Hayes’ remarks, Bitcoin prices experienced an increase on Saturday.

As investors reassess their expectations regarding the Federal Reserve’s projections, the price of Bitcoin exhibits fluctuations.

Bitcoin Price Reacts to Investors’ Reevaluation of Fed Forecasts After Employment Data

The US NFP report for June fell short of market forecasts, adding only 209,000 Nonfarm Payrolls.

Simultaneously, the unemployment rate decreased to 3.6%, casting doubts on the likelihood of future interest rate hikes by the US Federal Reserve.

These developments have placed selling pressure on the US Dollar, contributing to the rise of Bitcoin.

The unemployment rate decreased somewhat and was in line with the forecast of 3.6%.

Due to these data points, the chance of further rate increases by the US Federal Reserve has decreased.

The research publication has heightened selling pressure on the US dollar, opening the door for new advances in risky assets like Bitcoin. The US Dollar index is now down 0.45% for the day as of the time of writing.

The declining prices of the US dollar helped BTC prices gain momentum on Saturday.

Bitcoin Price Prediction

Bitcoin is currently displaying some volatility, but it is maintaining its position around the $30,000 level, which is functioning as a psychological support for BTC.

When examining the broader daily timeframe, Bitcoin is consolidating within a narrow range, with resistance seen near $31,400 and support at approximately $29,600.

A definitive close above the $29,600 level has the potential to initiate a bullish movement for Bitcoin.

Conversely, if there is a clear break below $29,600, Bitcoin could find support around $28,450 and potentially even lower towards $27,450.

Looking towards the upside, if Bitcoin successfully surpasses the $31,350 level, the following notable target to monitor would be around $32,500.

Therefore, it is advisable to closely monitor the $29,600 level as a crucial pivot point for today’s trading activities.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

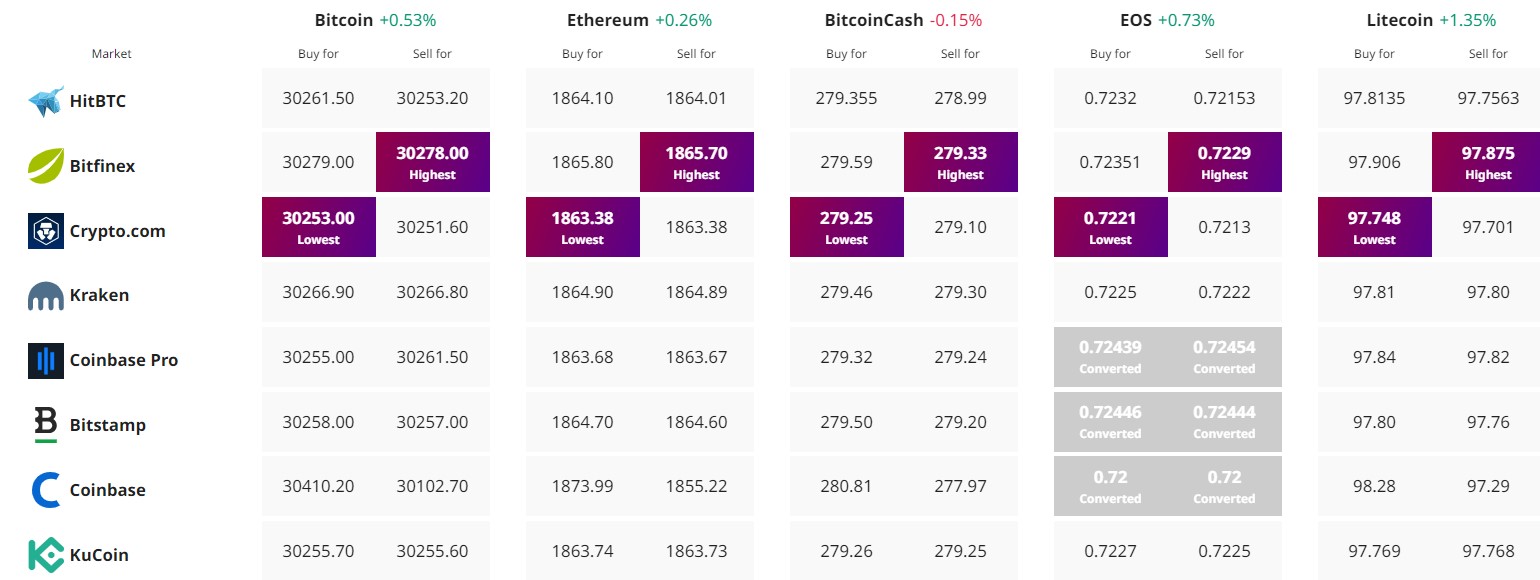

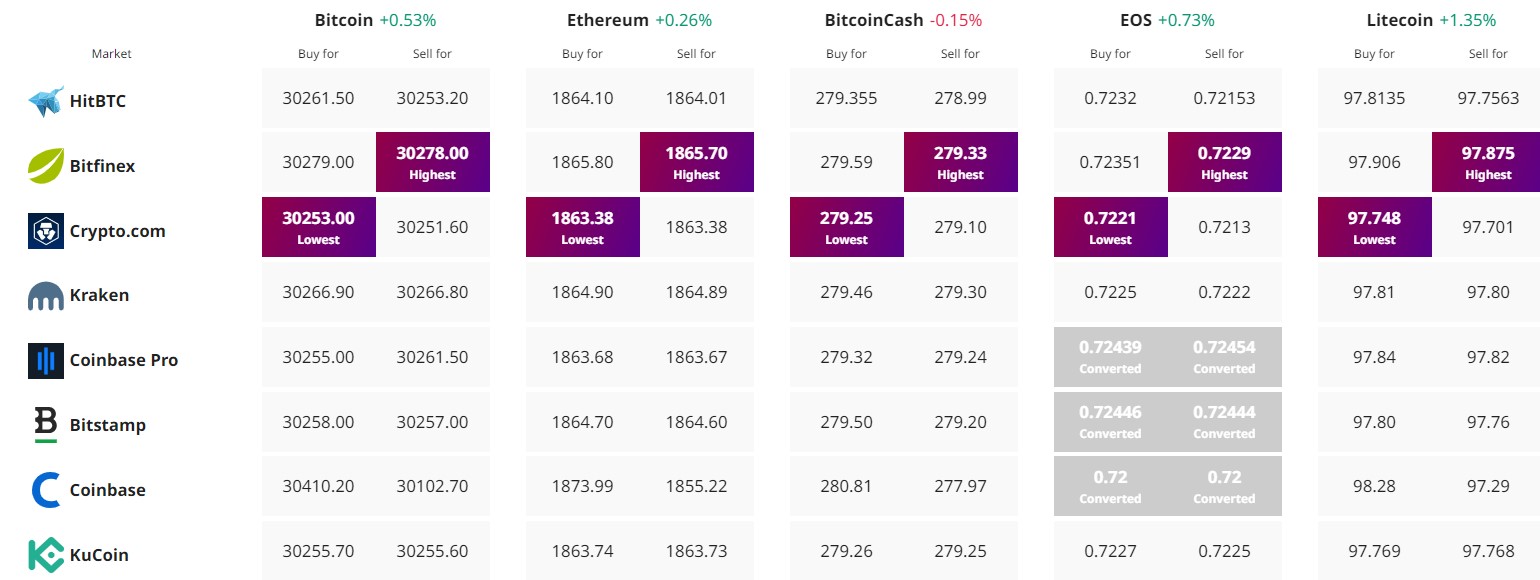

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

Bitcoin, the leading cryptocurrency, has been gaining momentum as it establishes a strong support level at $30,000. The recent insights from industry experts add an interesting perspective to Bitcoin’s future.

According to Arthur Hayes, the former CEO of BitMEX, Bitcoin has the potential to become the predominant currency for artificial intelligence (AI), highlighting its unique attributes and resemblance to pure energy.

Additionally, the price of Bitcoin has been influenced by investors reevaluating Federal Reserve forecasts following the release of employment data.

In this Bitcoin price prediction, we delve into the factors influencing BTC’s outlook and explore the potential scenarios that await the digital asset.

Bitcoin Poised to Become the Predominant Currency for Artificial Intelligence, According to Arthur Hayes

In a recently published blog post, the former CEO of the cryptocurrency derivatives marketplace Bitmex, Arthur Hayes, argues that Bitcoin is the optimal currency for artificial intelligence (AI).

Hayes suggests that BTC will be the preferred medium of exchange for AIs due to its constant availability, digital nature, and complete automation.

Blockchain-driven systems possess appealing characteristics, and among them, BTC emerges as the top choice due to its scarcity, resistance to censorship, and ability to store value.

In comparing BTC to gold and fiat money, Hayes highlights the limitations and inefficiencies of traditional forms of currency.

Arthur Hayes Highlights BTC’s Resemblance to Pure Energy, Underscoring its Unique Attributes

In his recent letter, Hayes reminds readers that the market may be willing to overpay for the expansion of the Bitcoin network if there is a possibility that his estimates could materialize in the future.

Significant profits can be made as sentiment shifts from skepticism to cautious optimism. In response to Hayes’ remarks, Bitcoin prices experienced an increase on Saturday.

As investors reassess their expectations regarding the Federal Reserve’s projections, the price of Bitcoin exhibits fluctuations.

Bitcoin Price Reacts to Investors’ Reevaluation of Fed Forecasts After Employment Data

The US NFP report for June fell short of market forecasts, adding only 209,000 Nonfarm Payrolls.

Simultaneously, the unemployment rate decreased to 3.6%, casting doubts on the likelihood of future interest rate hikes by the US Federal Reserve.

These developments have placed selling pressure on the US Dollar, contributing to the rise of Bitcoin.

The unemployment rate decreased somewhat and was in line with the forecast of 3.6%.

Due to these data points, the chance of further rate increases by the US Federal Reserve has decreased.

The research publication has heightened selling pressure on the US dollar, opening the door for new advances in risky assets like Bitcoin. The US Dollar index is now down 0.45% for the day as of the time of writing.

The declining prices of the US dollar helped BTC prices gain momentum on Saturday.

Bitcoin Price Prediction

Bitcoin is currently displaying some volatility, but it is maintaining its position around the $30,000 level, which is functioning as a psychological support for BTC.

When examining the broader daily timeframe, Bitcoin is consolidating within a narrow range, with resistance seen near $31,400 and support at approximately $29,600.

A definitive close above the $29,600 level has the potential to initiate a bullish movement for Bitcoin.

Conversely, if there is a clear break below $29,600, Bitcoin could find support around $28,450 and potentially even lower towards $27,450.

Looking towards the upside, if Bitcoin successfully surpasses the $31,350 level, the following notable target to monitor would be around $32,500.

Therefore, it is advisable to closely monitor the $29,600 level as a crucial pivot point for today’s trading activities.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.