The price of Bitcoin currently stands at $30,442, reflecting a less than 0.50% drop on Wednesday.

As Cathie Wood’s ARK Investment Management positions itself for a leading role in the Bitcoin ETF race, all eyes turn to the potential impact on Bitcoin’s price trajectory.

This update delves into the Bitcoin price prediction amid these unfolding market dynamics and explores the potential implications of ARK’s ambitious move in the cryptocurrency ETF space.

Reports Suggest Cathie Wood’s ARK Takes Leading Spot in Bitcoin ETF Race

The Bitcoin ETF spot was filed by ARK Invest in collaboration with 21Shares, preceding BlackRock’s application, and currently sits at the top of the list for SEC approval.

In the middle of June, BlackRock, a financial behemoth, lodged a proposal for a spot Bitcoin ETF, effectively boosting market confidence.

Several executives and experts suggest that contrary to popular narratives, BlackRock may not be the first to launch a spot Bitcoin ETF in the US.

Bloomberg’s Senior ETF Analyst, Eric Balchunas, succinctly captured the case for a spot Bitcoin ETF in his tweet: “What does BlackRock know?” Nate Geraci, the co-founder of the ETF Store, expressed a similar sentiment in his tweet on June 26th.

BlackRock’s timing in filing the spot Bitcoin ETF application has caught the attention of several industry analysts, leading some to speculate that the company might have insider information about the SEC’s forthcoming BTC ETF regulations.

Considering the lack of progress since the Winklevoss twins’ application back in 2017, Wade Guenther, a partner at Wilshire Phoenix, told Cointelegraph that it’s unlikely the SEC will approve a spot Bitcoin ETF in 2023.

Guenther further stated:

“Given that the review period is still ongoing, we don’t anticipate a spot Bitcoin ETF becoming available to the public anytime soon. Hence, we may not see a Bitcoin ETF spot until next year, or perhaps the year after that.”

Previously, Nate Geraci, the co-founder of the ETF Institute, predicted that a Bitcoin ETF wouldn’t be available until 2023.

These pessimistic views pressure the world’s leading cryptocurrency, dampening the initial optimism sparked by BlackRock’s ETF application.

Bitcoin Price Prediction

Bitcoin continues to consolidate within a defined trading range, encountering resistance at the upper boundary of $31,000 and support at the lower boundary of $30,000.

Upon analyzing the daily timeframe with leading technical indicators, such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD), it’s evident that they remain in the overbought zone, hinting at a potential bearish correction in BTC.

However, strong fundamentals continue to curtail the bearish momentum in Bitcoin.

From a technical perspective, Bitcoin’s substantial resistance persists around the $31,000 mark.

If Bitcoin manages to break through this level, the next target is likely to be at $32,500, and beyond this, a further target could be identified at $34,000.

Conversely, on the downside, if Bitcoin breaks below the support at $30,000, it could drive the cryptocurrency toward the 38.2% Fibonacci correction level of $28,700 or the 50% correction level of $28,000.

The 50-day exponential moving average may also significantly resist Bitcoin’s downtrend around the $28,000 level.

In summary, the strategy is to wait for Bitcoin to break out of the narrow range discussed above before making any significant trading decisions.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

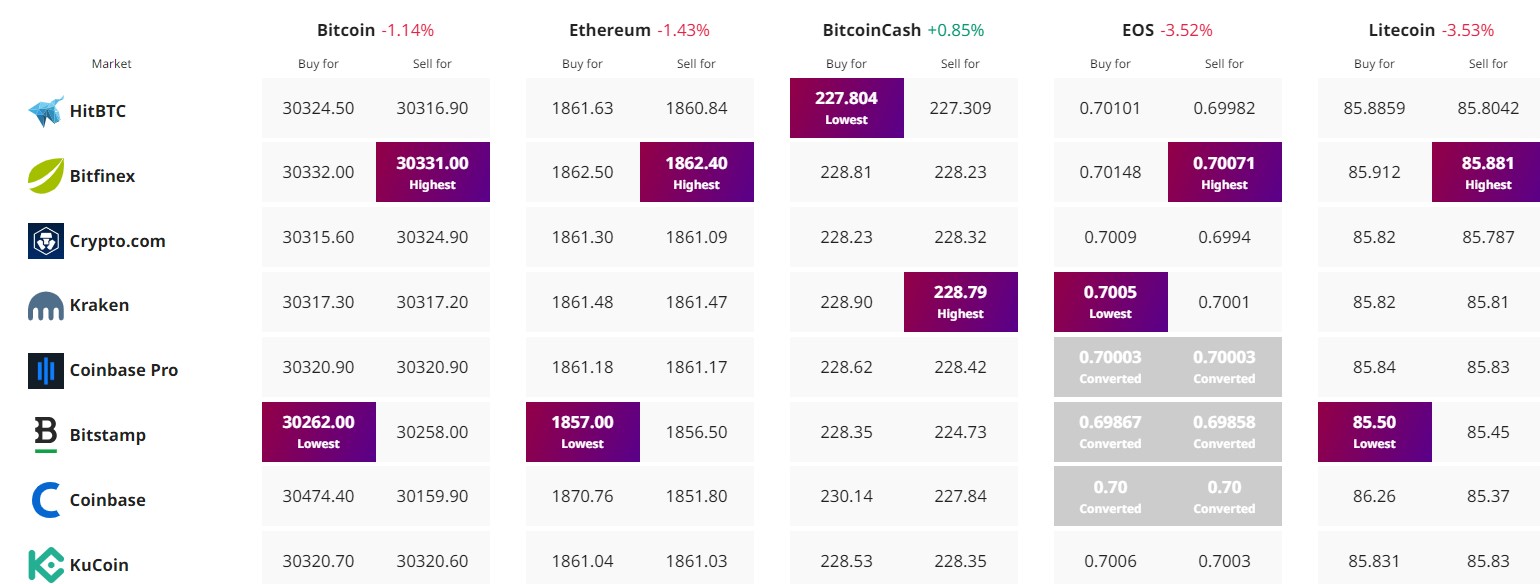

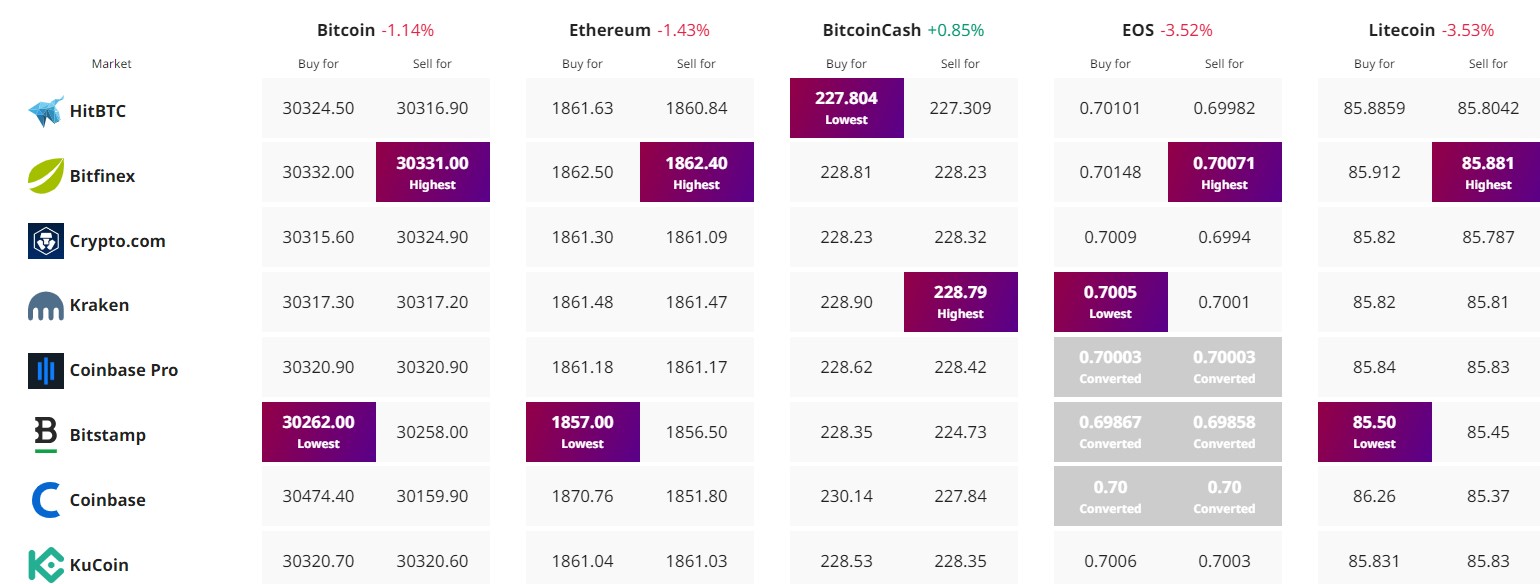

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

The price of Bitcoin currently stands at $30,442, reflecting a less than 0.50% drop on Wednesday.

As Cathie Wood’s ARK Investment Management positions itself for a leading role in the Bitcoin ETF race, all eyes turn to the potential impact on Bitcoin’s price trajectory.

This update delves into the Bitcoin price prediction amid these unfolding market dynamics and explores the potential implications of ARK’s ambitious move in the cryptocurrency ETF space.

Reports Suggest Cathie Wood’s ARK Takes Leading Spot in Bitcoin ETF Race

The Bitcoin ETF spot was filed by ARK Invest in collaboration with 21Shares, preceding BlackRock’s application, and currently sits at the top of the list for SEC approval.

In the middle of June, BlackRock, a financial behemoth, lodged a proposal for a spot Bitcoin ETF, effectively boosting market confidence.

Several executives and experts suggest that contrary to popular narratives, BlackRock may not be the first to launch a spot Bitcoin ETF in the US.

Bloomberg’s Senior ETF Analyst, Eric Balchunas, succinctly captured the case for a spot Bitcoin ETF in his tweet: “What does BlackRock know?” Nate Geraci, the co-founder of the ETF Store, expressed a similar sentiment in his tweet on June 26th.

BlackRock’s timing in filing the spot Bitcoin ETF application has caught the attention of several industry analysts, leading some to speculate that the company might have insider information about the SEC’s forthcoming BTC ETF regulations.

Considering the lack of progress since the Winklevoss twins’ application back in 2017, Wade Guenther, a partner at Wilshire Phoenix, told Cointelegraph that it’s unlikely the SEC will approve a spot Bitcoin ETF in 2023.

Guenther further stated:

“Given that the review period is still ongoing, we don’t anticipate a spot Bitcoin ETF becoming available to the public anytime soon. Hence, we may not see a Bitcoin ETF spot until next year, or perhaps the year after that.”

Previously, Nate Geraci, the co-founder of the ETF Institute, predicted that a Bitcoin ETF wouldn’t be available until 2023.

These pessimistic views pressure the world’s leading cryptocurrency, dampening the initial optimism sparked by BlackRock’s ETF application.

Bitcoin Price Prediction

Bitcoin continues to consolidate within a defined trading range, encountering resistance at the upper boundary of $31,000 and support at the lower boundary of $30,000.

Upon analyzing the daily timeframe with leading technical indicators, such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD), it’s evident that they remain in the overbought zone, hinting at a potential bearish correction in BTC.

However, strong fundamentals continue to curtail the bearish momentum in Bitcoin.

From a technical perspective, Bitcoin’s substantial resistance persists around the $31,000 mark.

If Bitcoin manages to break through this level, the next target is likely to be at $32,500, and beyond this, a further target could be identified at $34,000.

Conversely, on the downside, if Bitcoin breaks below the support at $30,000, it could drive the cryptocurrency toward the 38.2% Fibonacci correction level of $28,700 or the 50% correction level of $28,000.

The 50-day exponential moving average may also significantly resist Bitcoin’s downtrend around the $28,000 level.

In summary, the strategy is to wait for Bitcoin to break out of the narrow range discussed above before making any significant trading decisions.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.