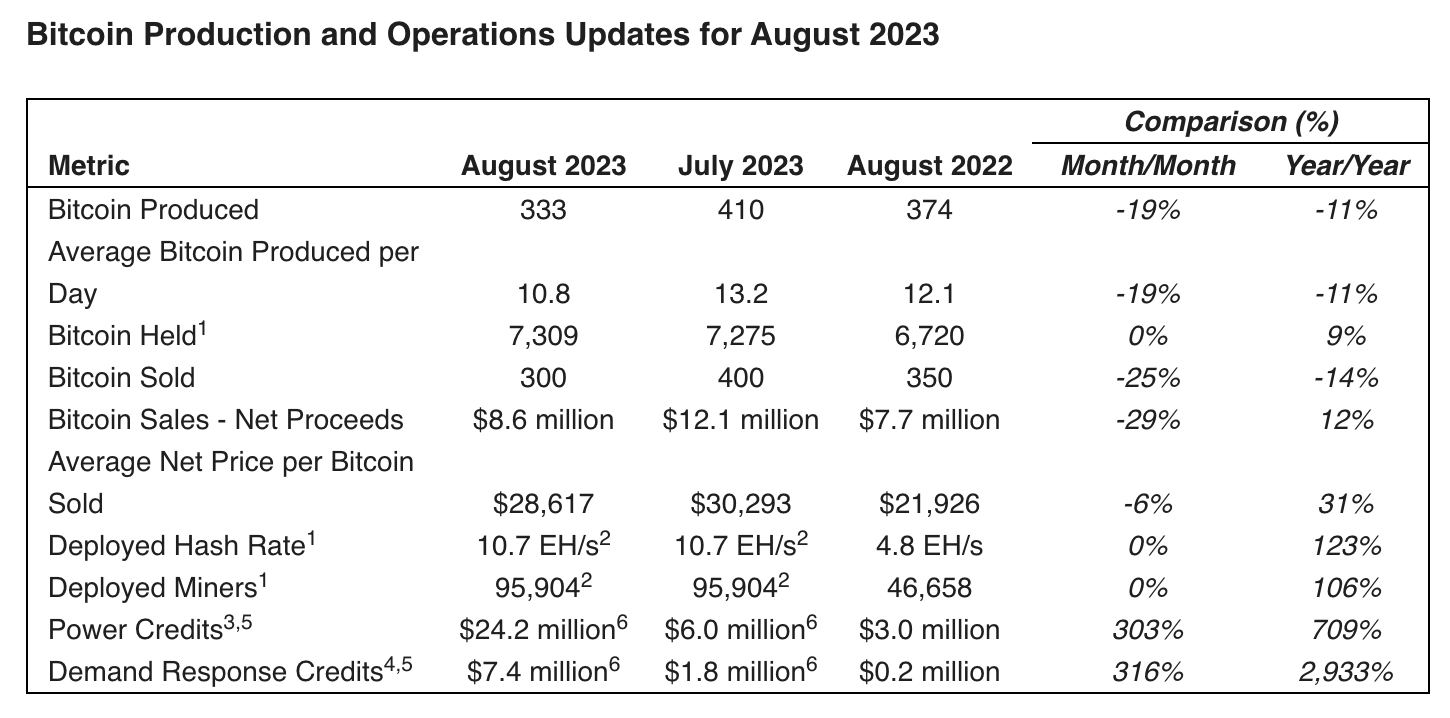

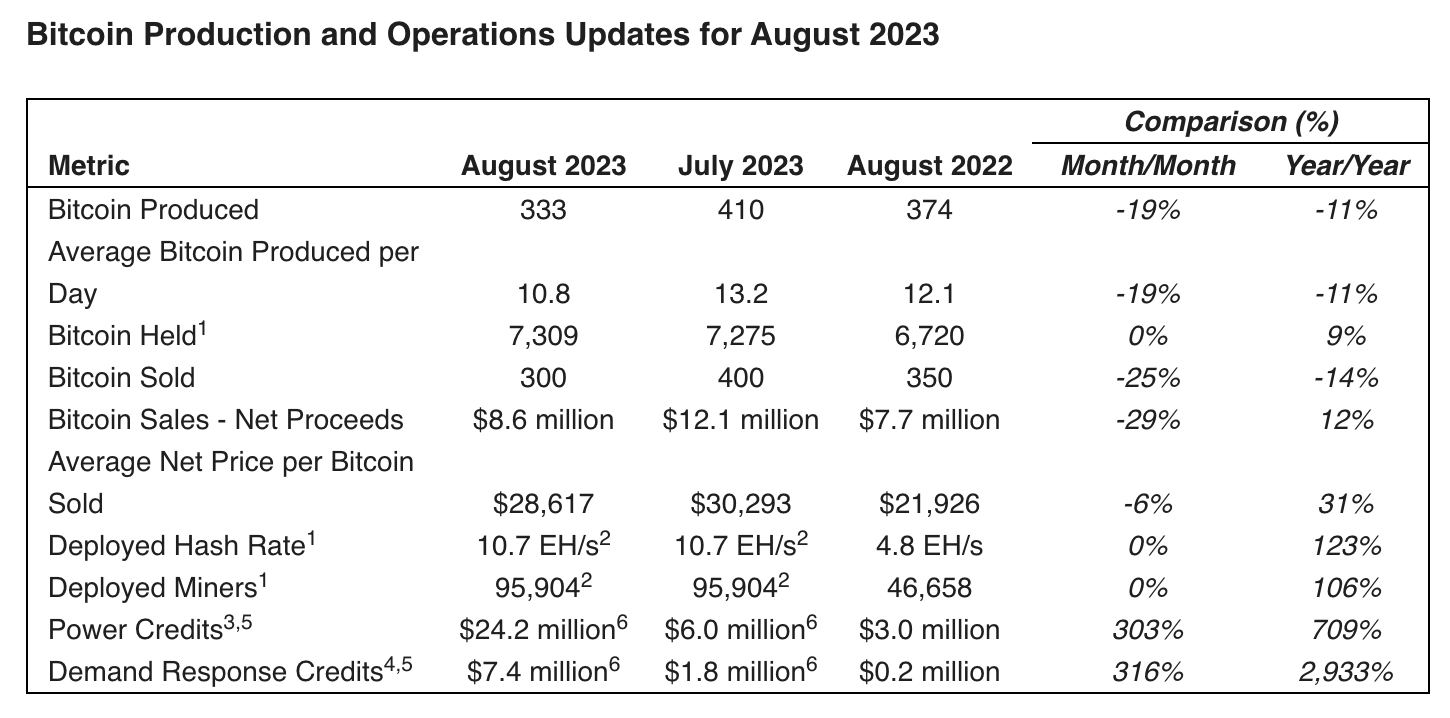

Prominent Bitcoin (BTC) mining firm Riot Platforms has reported significant cost savings and operational achievements due to an innovative energy strategy that saved the firm around $31 million in August alone.

In a press release from Wednesday, CEO Jason Les announced that Riot achieved a new monthly record for Power and Demand Response Credits, totaling $31.7 million in August.

This figure surpassed the total amount of all credits received by the company in 2022.

These credits equated to approximately 1,136 Bitcoin, based on the average Bitcoin price in August.

The Power and Demand Response credits have had a substantial impact on reducing Riot’s Bitcoin mining costs, solidifying its position as one of the lowest-cost producers in the industry.

Energy strategy plays pivotal role for Riot

Riot’s unique power strategy has played a pivotal role in its cost savings.

Coupled with its strong financial position and efficient miner fleet, this strategy positions Riot as a leading player as the Bitcoin ‘halving’ event approaches next year.

Riot is actively working to repair the damage caused by a severe winter storm in Texas in December 2022, and it aims to achieve a total self-mining hash rate capacity of 12.5 EH/s at its Rockdale facility by the end of 2023.

Additionally, Riot has entered a long-term purchase agreement with MicroBT, which includes an initial order of 7.6 EH/s of next-generation Bitcoin miners for its Corsicana Facility.

Upon full deployment of this order by mid-2024, Riot’s total self-mining hash rate capacity is expected to reach 20.1 EH/s.

Riot curtailed power usage during Texas heatwave

During the extreme heatwave experienced in Texas in August 2023, Riot’s power strategy played a critical role in stabilizing the state’s energy grid.

The company curtailed its power usage by more than 95% during peak demand periods, redirecting energy resources to the Texas grid operator ERCOT (Electric Reliability Council of Texas) instead of Bitcoin mining.

The power curtailment contributed significantly to reducing overall power demand in ERCOT, ensuring uninterrupted service for consumers during what was described as critical periods for the state’s electric grid.

Prominent Bitcoin (BTC) mining firm Riot Platforms has reported significant cost savings and operational achievements due to an innovative energy strategy that saved the firm around $31 million in August alone.

In a press release from Wednesday, CEO Jason Les announced that Riot achieved a new monthly record for Power and Demand Response Credits, totaling $31.7 million in August.

This figure surpassed the total amount of all credits received by the company in 2022.

These credits equated to approximately 1,136 Bitcoin, based on the average Bitcoin price in August.

The Power and Demand Response credits have had a substantial impact on reducing Riot’s Bitcoin mining costs, solidifying its position as one of the lowest-cost producers in the industry.

Energy strategy plays pivotal role for Riot

Riot’s unique power strategy has played a pivotal role in its cost savings.

Coupled with its strong financial position and efficient miner fleet, this strategy positions Riot as a leading player as the Bitcoin ‘halving’ event approaches next year.

Riot is actively working to repair the damage caused by a severe winter storm in Texas in December 2022, and it aims to achieve a total self-mining hash rate capacity of 12.5 EH/s at its Rockdale facility by the end of 2023.

Additionally, Riot has entered a long-term purchase agreement with MicroBT, which includes an initial order of 7.6 EH/s of next-generation Bitcoin miners for its Corsicana Facility.

Upon full deployment of this order by mid-2024, Riot’s total self-mining hash rate capacity is expected to reach 20.1 EH/s.

Riot curtailed power usage during Texas heatwave

During the extreme heatwave experienced in Texas in August 2023, Riot’s power strategy played a critical role in stabilizing the state’s energy grid.

The company curtailed its power usage by more than 95% during peak demand periods, redirecting energy resources to the Texas grid operator ERCOT (Electric Reliability Council of Texas) instead of Bitcoin mining.

The power curtailment contributed significantly to reducing overall power demand in ERCOT, ensuring uninterrupted service for consumers during what was described as critical periods for the state’s electric grid.