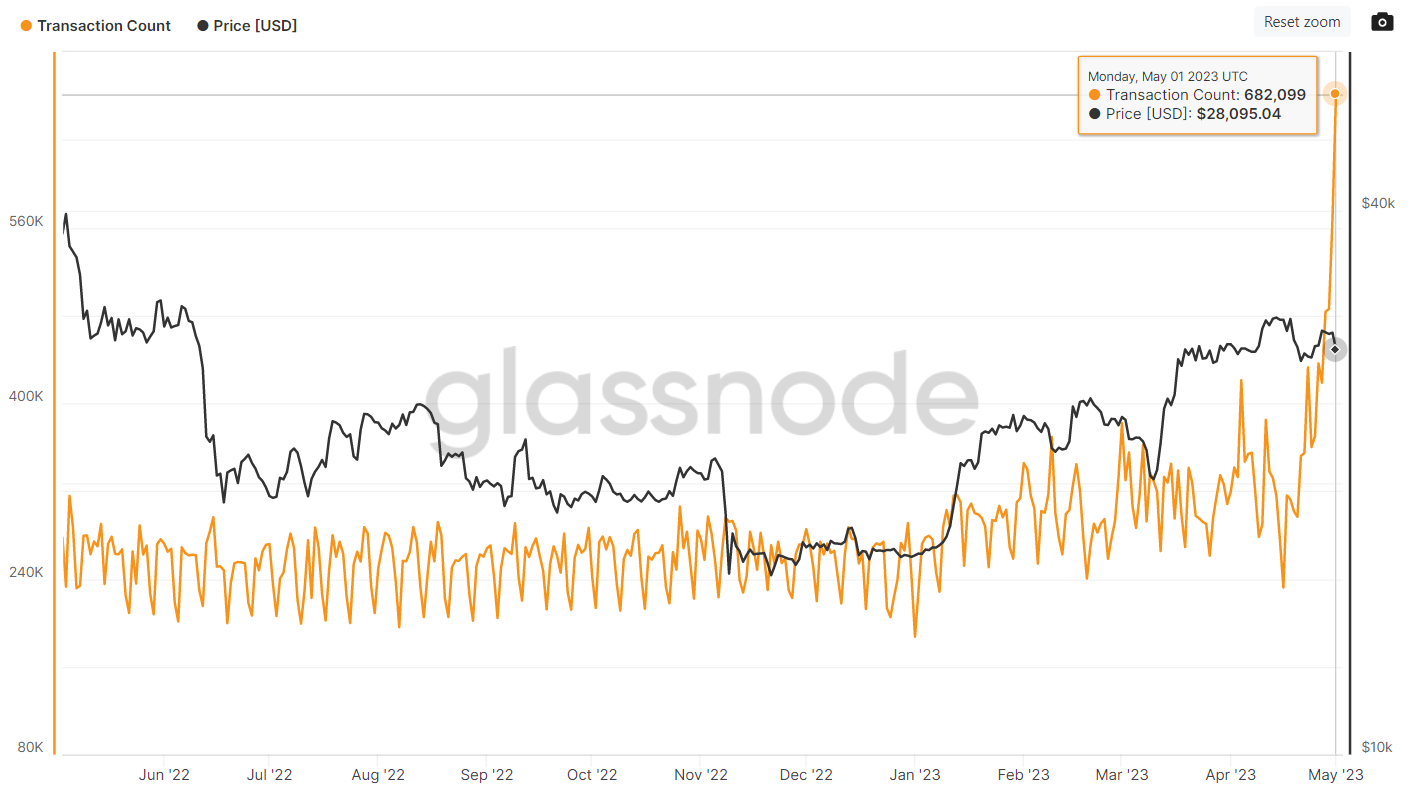

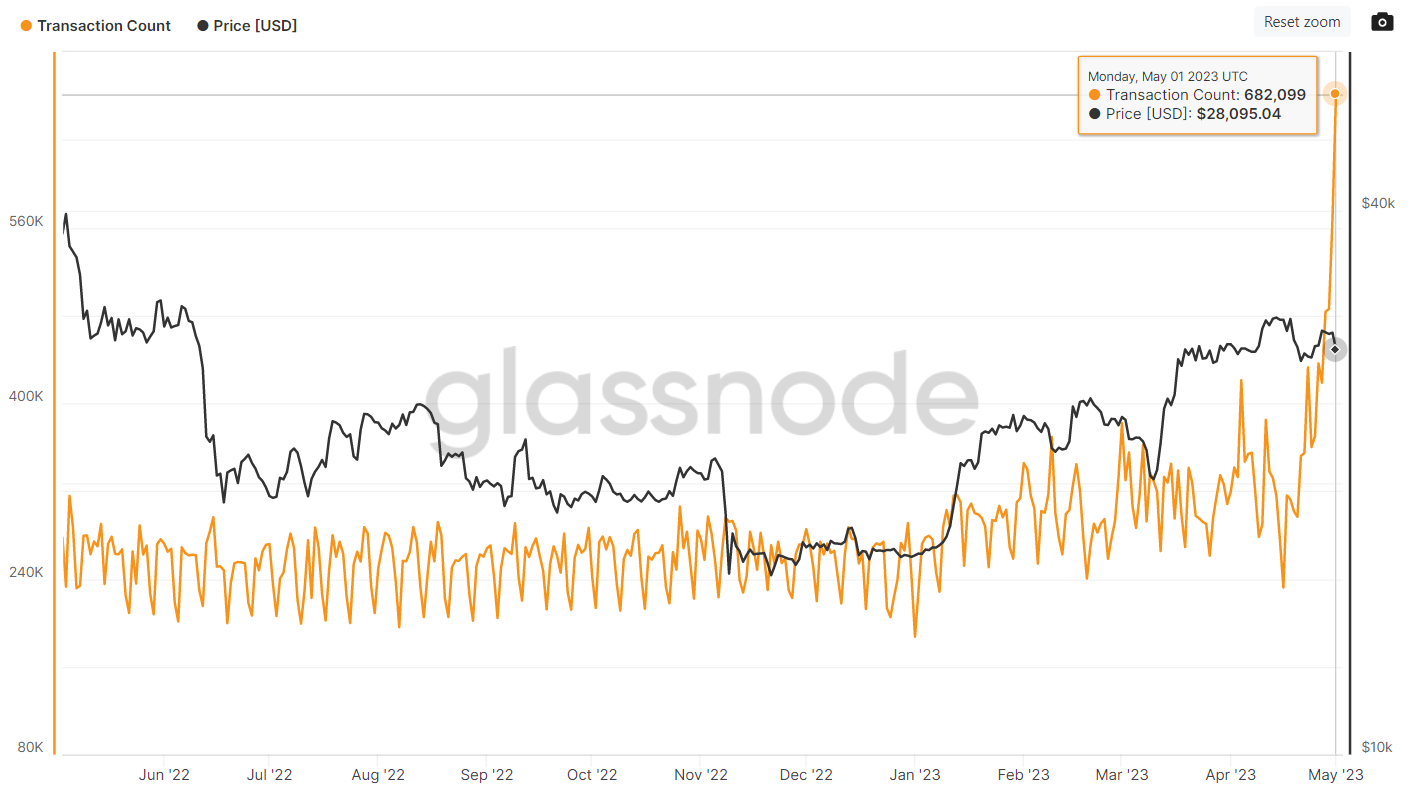

The number of transactions taking place on the Bitcoin network hit a record high of 682,099 on Monday, according to data presented by crypto analytics firm Glassnode.

A surge in the last few days has seen the number of Bitcoin transactions fly past its prior record high of around 425,000 printed back in 2019, back when the Bitcoin price was around $5,500.

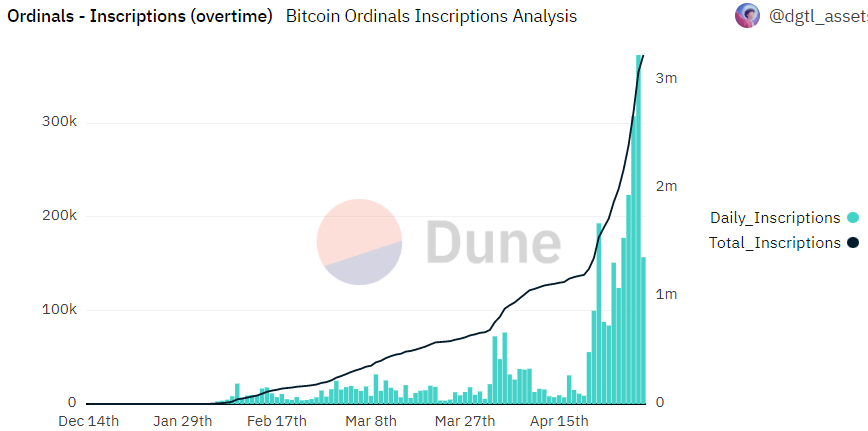

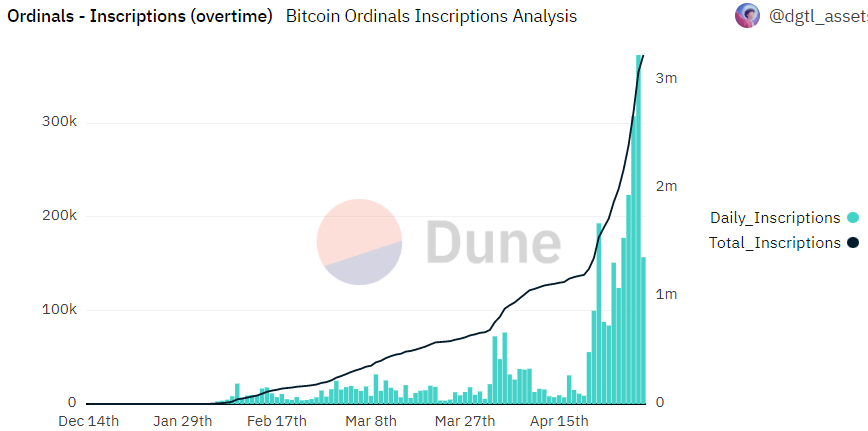

Analysts have ascribed the jump in network transactions to a surge in the number of Bitcoin non-fungible token (NFT) ordinal inscriptions taking place on the network.

According to crypto analytics website Dune, there have now been a total of 3.225 million ordinal NFTs inscribed to date, which has generated $7,394,739 in fees.

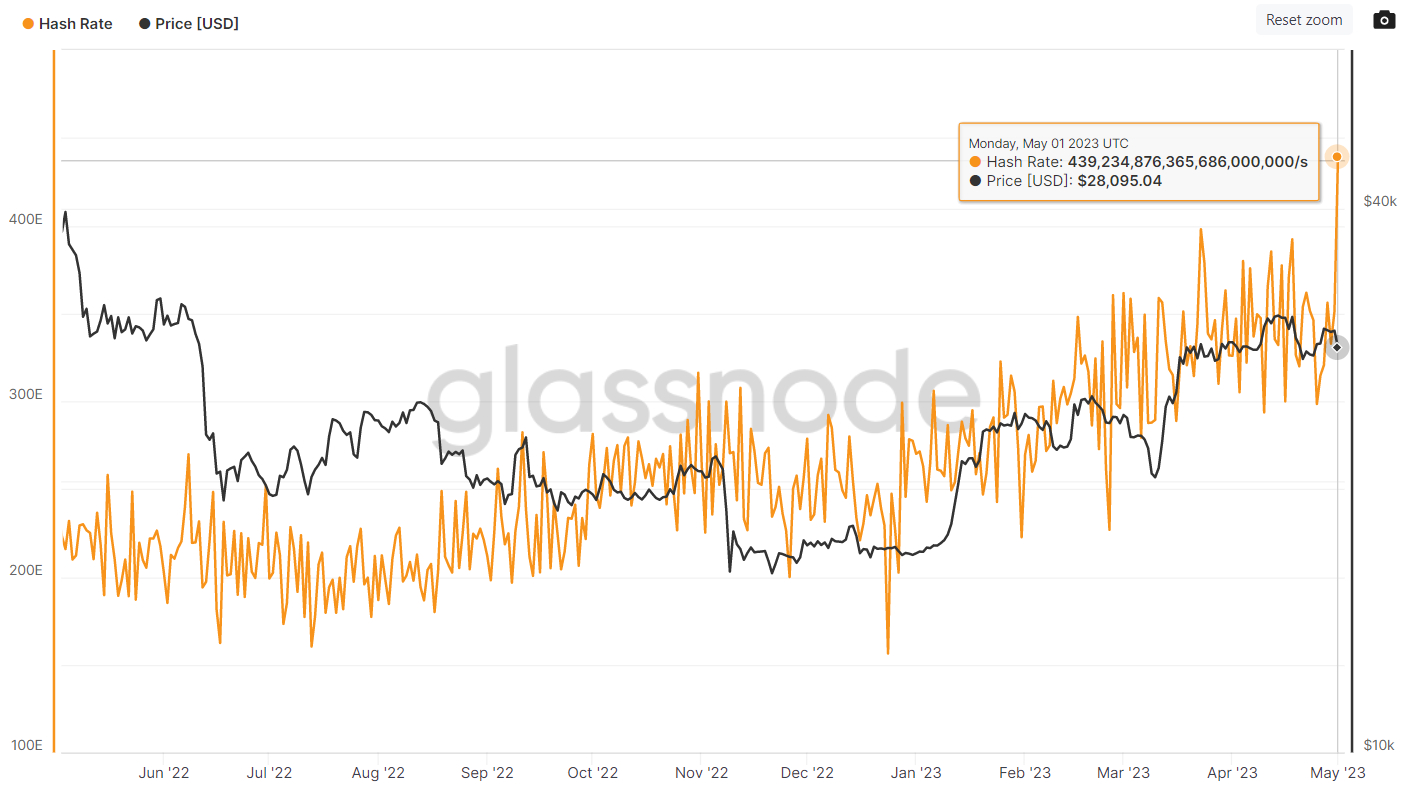

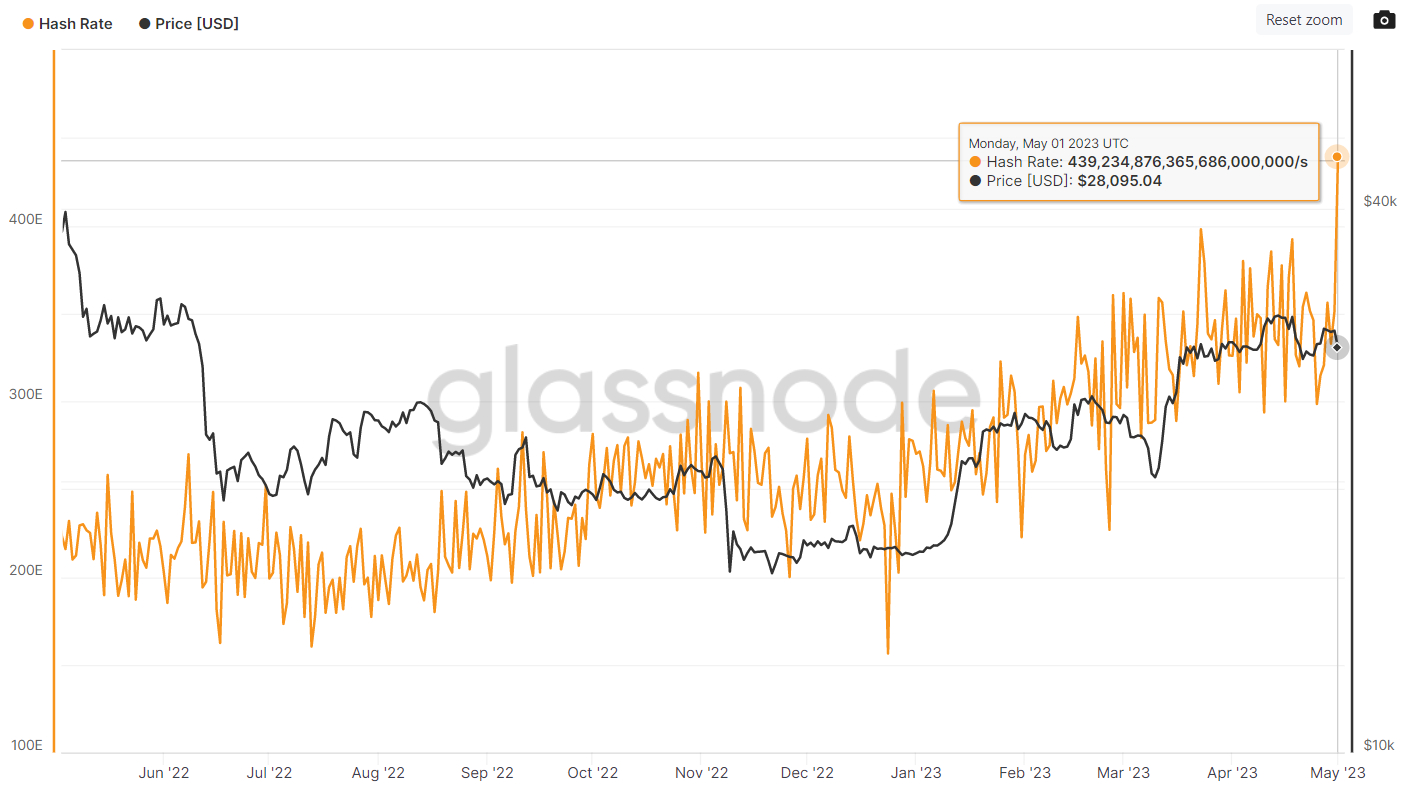

The surge in Bitcoin network transactions has helped power a sharp jump in the Bitcoin network’s hash rate (i.e. computing power) to new record highs of around 440 exahashes per second (EHS).

While higher transactions, a rising hash rate and higher fees are all positive signs for Bitcoin, as all indicate a more in-demand, stronger and more secure network, the Bitcoin bulls shouldn’t be careful not to get too excited.

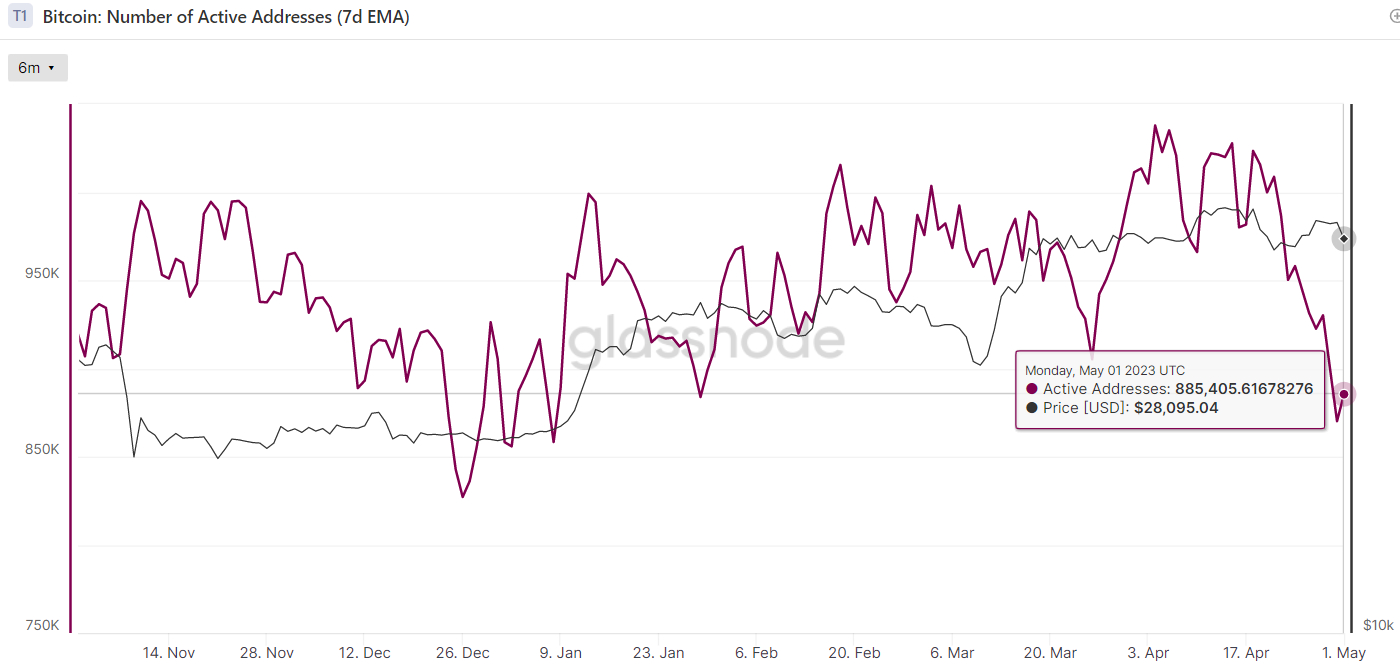

That’s because other widely followed on-chain indicators pertaining to Bitcoin network utilization are sending more conservative signals.

These Alternative Metrics Bode Less Well for the BTC Price

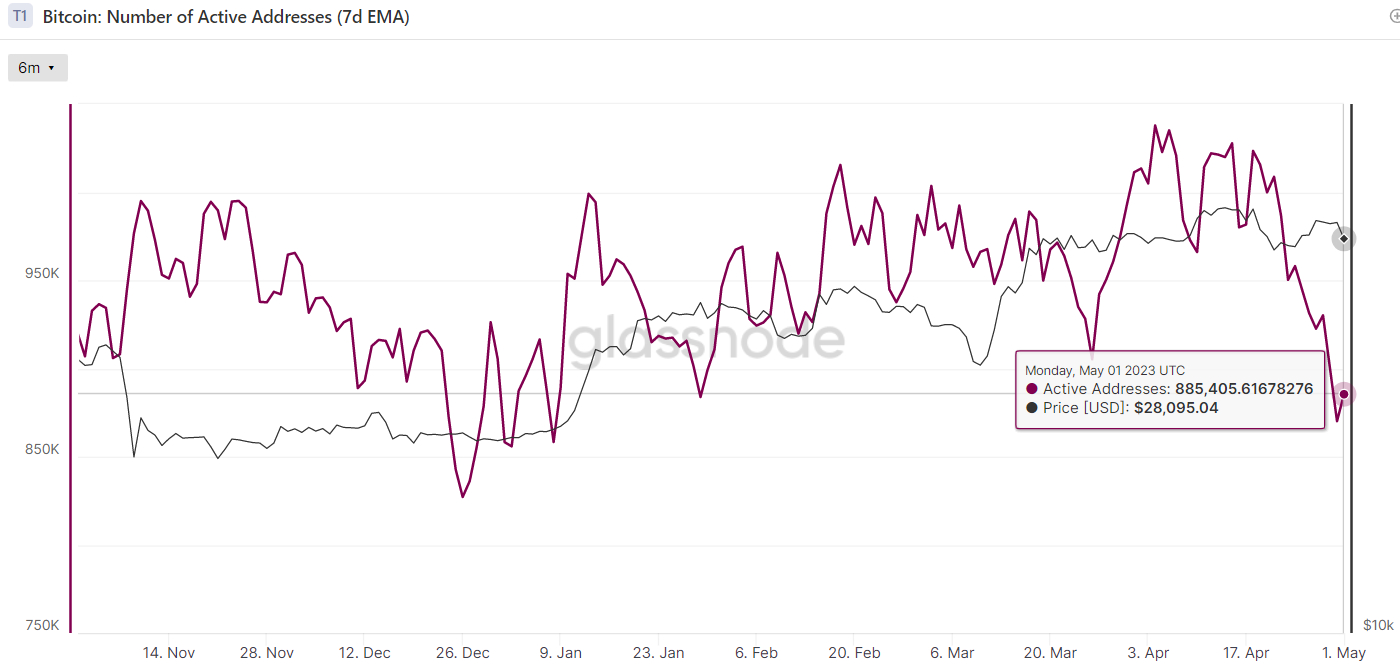

The seven-day moving average of the number of active addresses interacting with the Bitcoin network recently fell to its lowest level since early January of around 870,000, down from over 1 million per day as recently as the 21st of April.

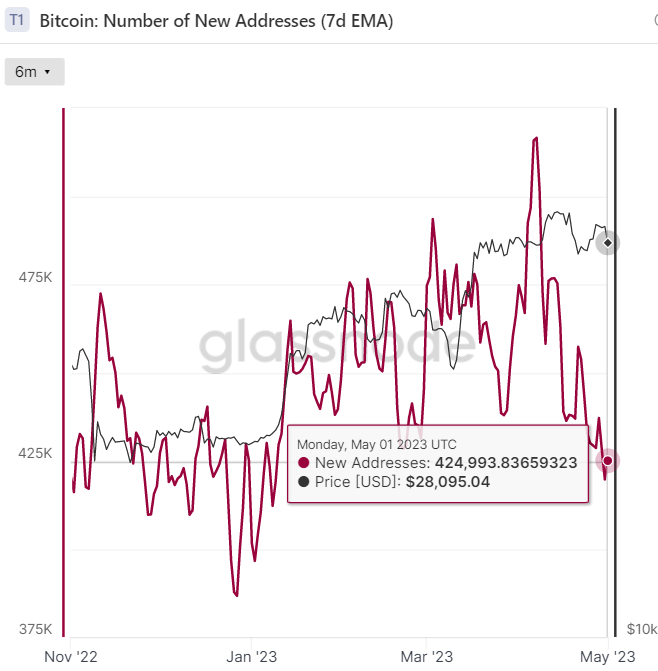

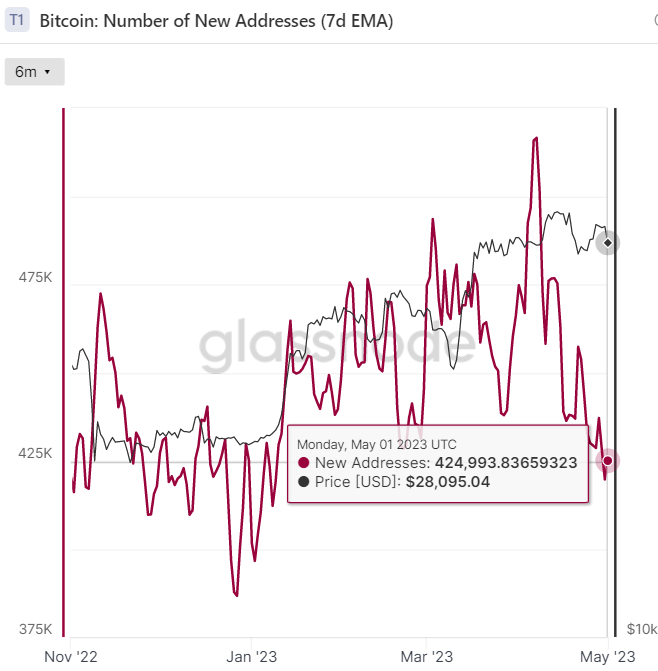

Likewise, the number of new addresses recently fell to a multi-month trough of around 420,000, down sharply from early April highs to the north of 516,000.

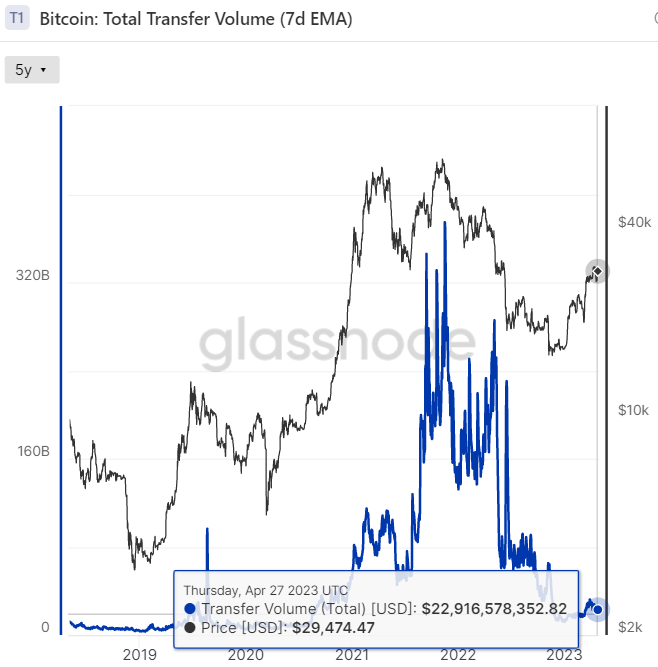

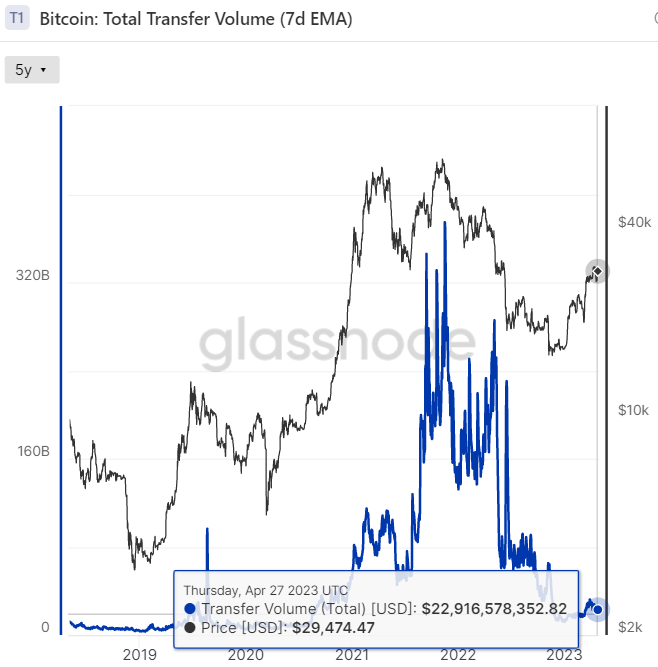

Meanwhile, the USD-denominated value of on-chain trading volumes remains moored close to its lowest levels since 2020 and still exponentially lower than the late-2021/early 2022 highs.

Where Next for the BTC Price?

The above metrics don’t impact the BTC price on a day-to-day basis, though as the Bitcoin bull market matures, a key pillar of support ought to and is expected to be a sustained rise in network utilization, as has been the case in the past.

In the short-term, macro themes such as an escalating bank crisis in the US, the outlook for the US economy (recession incoming later this year?) and the outlook for US monetary policy (will interest rates fall later this year and liquidity rise?) have a more impact baring on the price action.

Bitcoin is currently in consolidation mode at around the mid-point of its recent $27,000-$31,000ish late-March to early May range.

Regional US bank stocks were back under pressure on Tuesday ahead of another expected rate hike from the Fed on Wednesday, with concerns about a potential US sovereign debt default also bubbling in the background as Congress struggles to agree on raising the debt ceiling.

If further US banks collapse, this could create further safe-haven demand for Bitcoin, catapulting the world’s largest cryptocurrency by market cap sustainably into the $30,000s.

Many analysts think that Bitcoin is in the early stages of a new bull market, thanks to the signals being sent by a series of widely followed on-chain indicators, by Bitcoin’s historic market cycle, as well as an expected continuation of important macro tailwinds (like financial stability concerns).

The number of transactions taking place on the Bitcoin network hit a record high of 682,099 on Monday, according to data presented by crypto analytics firm Glassnode.

A surge in the last few days has seen the number of Bitcoin transactions fly past its prior record high of around 425,000 printed back in 2019, back when the Bitcoin price was around $5,500.

Analysts have ascribed the jump in network transactions to a surge in the number of Bitcoin non-fungible token (NFT) ordinal inscriptions taking place on the network.

According to crypto analytics website Dune, there have now been a total of 3.225 million ordinal NFTs inscribed to date, which has generated $7,394,739 in fees.

The surge in Bitcoin network transactions has helped power a sharp jump in the Bitcoin network’s hash rate (i.e. computing power) to new record highs of around 440 exahashes per second (EHS).

While higher transactions, a rising hash rate and higher fees are all positive signs for Bitcoin, as all indicate a more in-demand, stronger and more secure network, the Bitcoin bulls shouldn’t be careful not to get too excited.

That’s because other widely followed on-chain indicators pertaining to Bitcoin network utilization are sending more conservative signals.

These Alternative Metrics Bode Less Well for the BTC Price

The seven-day moving average of the number of active addresses interacting with the Bitcoin network recently fell to its lowest level since early January of around 870,000, down from over 1 million per day as recently as the 21st of April.

Likewise, the number of new addresses recently fell to a multi-month trough of around 420,000, down sharply from early April highs to the north of 516,000.

Meanwhile, the USD-denominated value of on-chain trading volumes remains moored close to its lowest levels since 2020 and still exponentially lower than the late-2021/early 2022 highs.

Where Next for the BTC Price?

The above metrics don’t impact the BTC price on a day-to-day basis, though as the Bitcoin bull market matures, a key pillar of support ought to and is expected to be a sustained rise in network utilization, as has been the case in the past.

In the short-term, macro themes such as an escalating bank crisis in the US, the outlook for the US economy (recession incoming later this year?) and the outlook for US monetary policy (will interest rates fall later this year and liquidity rise?) have a more impact baring on the price action.

Bitcoin is currently in consolidation mode at around the mid-point of its recent $27,000-$31,000ish late-March to early May range.

Regional US bank stocks were back under pressure on Tuesday ahead of another expected rate hike from the Fed on Wednesday, with concerns about a potential US sovereign debt default also bubbling in the background as Congress struggles to agree on raising the debt ceiling.

If further US banks collapse, this could create further safe-haven demand for Bitcoin, catapulting the world’s largest cryptocurrency by market cap sustainably into the $30,000s.

Many analysts think that Bitcoin is in the early stages of a new bull market, thanks to the signals being sent by a series of widely followed on-chain indicators, by Bitcoin’s historic market cycle, as well as an expected continuation of important macro tailwinds (like financial stability concerns).