The Bitcoin (BTC) price briefly retook $68,000 on Thursday amid a dip in the US dollar following dovish remarks from US Federal Reserve Chair Jerome Powell, coming within about 2% of the record highs it printed earlier in the week.

Last at $67,500, the Bitcoin price is up roughly 14% versus the lows it printed earlier this week at under $60,000.

After hitting a new ATH on Tuesday, a wave of profit-taking took the market off guard.

A subsequent cascade of leveraged long liquidations drove the Bitcoin price briefly back under $60,000.

But strong continued net inflows into spot Bitcoin ETFs meant the BTC price found strong support.

And macro headwinds are coming into play on Thursday, as traders up their bets on near-term Fed rate cuts.

Fed Chair Powell remarked on Thursday that the central bank is “not far” from reaching a point of sufficient confidence that inflation is heading back to the Fed’s 2.0% goals to begin cutting interest rates.

In simpler terms, Powell is saying that the Fed isn’t far from cutting interest rates.

Macro traders responded by upping their bets that rate cuts start by June.

As per the CME’s Fed Watch Tool, the market-implied odds of at least one 25 bps rate cut by June jumped above 75% from under 70% one day ago.

That weighed on the US dollar as short-term US yields fell, and supported tech stocks.

Crypto tends to have a positive correlation to tech stocks, and a negative correlation to the US dollar and yields.

Where Next for the Bitcoin (BTC) Price?

Traders will be monitoring whether the Bitcoin price can retest Tuesday’s record highs before the end of the week.

Last up over 55% in the past 30 days, some traders are getting nervous that Bitcoin has rallied too fast, too far this side of the upcoming halving.

Historically, the Bitcoin price often rallies but then suffers a correction around the time of the halving.

But others think the introduction of a new source of demand from spot Bitcoin ETFs means this time around could be different.

Amid macro tailwinds, risks seem tilted towards fresh upside this month, with Bitcoin potentially set to push into the $70,000s and beyond.

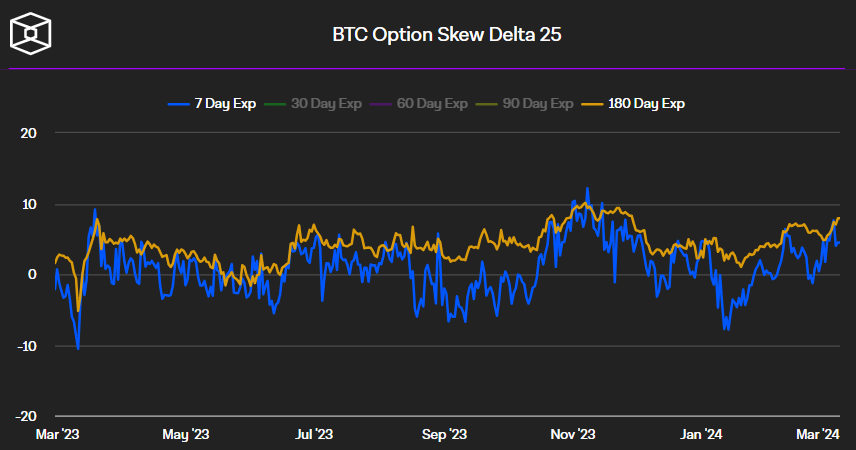

Still, BTC option market pricing suggests nerves about the near-term outlook, but greater confidence that the long-term outlook is positive.

That’s reflected in a 7-day 25% delta skew on Bitcoin options of 4.5, versus a 180-day 25% delta skew on BTC options of nearly 8, as per data presented by The Block.

A positive 25% delta skew suggests that option buyers are paying a premium for bullish calls versus equivalent bearish puts.

The probability that Bitcoin will hit $100,000 in 2024 is still very high.