Bitcoin bears are eyeing a potential break below the psychologically important $40,000 level as post-spot Bitcoin ETF approval sell pressure ramps up and macro headwinds rise.

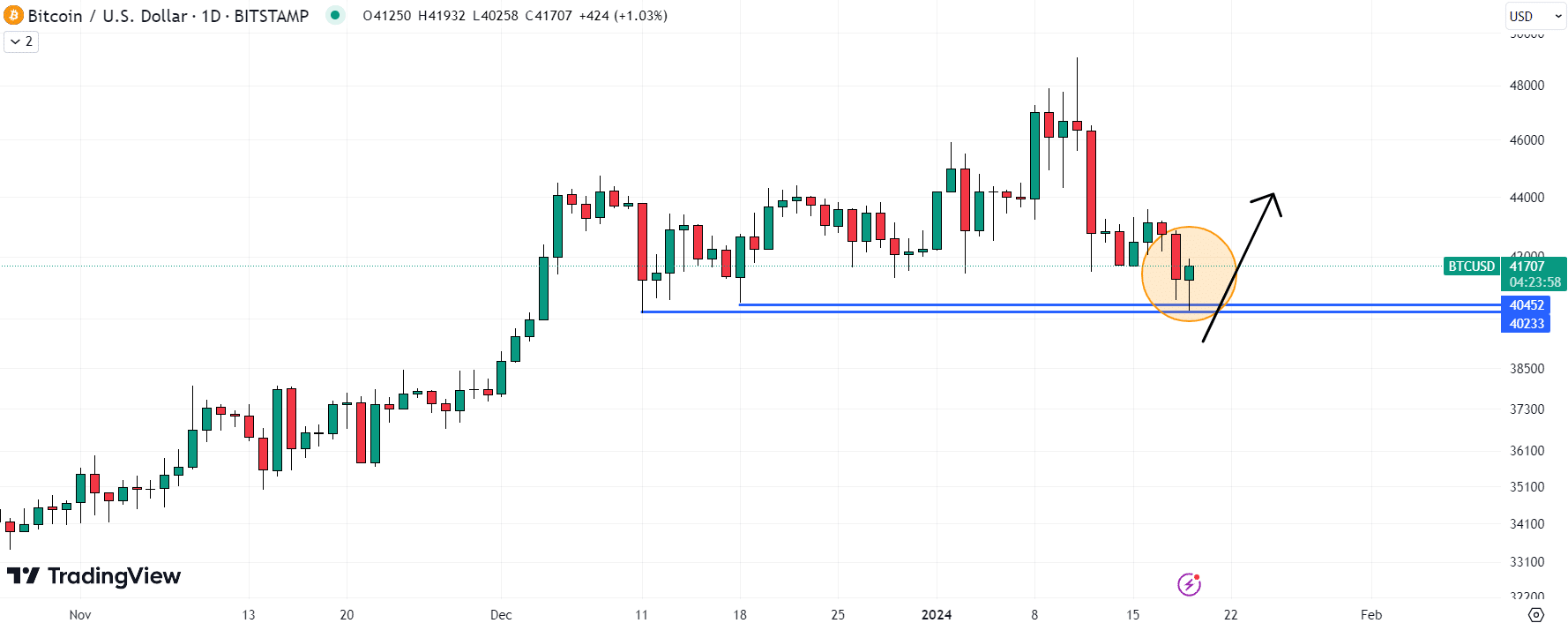

The Bitcoin (BTC) price dipped as low as the $40,200s on Friday, though has since rebounded towards $42,000.

Despite a solid near-4% recovery from intra-day lows, the Bitcoin price remains about 15% lower versus yearly highs above $49,000.

And the BTC price is still trading well below its 21 and 50DMAs, suggesting the Bitcoin bears remain in control.

Stronger-than-expected US economic data in the past few weeks has dampened expectations for rate cuts from the Fed.

This has pushed US bond yields and the US Dollar Index (DXY) higher, creating macro headwinds for the crypto space.

But post-Bitcoin ETF approval profit-taking, particularly in Grayscale’s Bitcoin Trust (GBTC), and Bitcoin investment product rotations has also weighed heavily.

High Bitcoin Sell Pressure Amid GBTC Profit-Taking and Bitcoin Investment Product Rotation

Newly launched Bitcoin ETFs from Blackrock and Fidelity have enjoyed substantial demand.

Both have already exceeded inflows of $1 billion since launch.

With over $30 billion in total assets under management across Bitcoin ETF products, Bitcoin already ranks as the second most popular commodity ETF product, lagging only gold, which has ETFs worth around $95 billion.

However, this doesn’t tell the whole story.

Traders are clearly concerned by a higher-than-expected level of rotation from existing Bitcoin investment products to new Bitcoin investment products.

GBTC continues to see substantial outflows, having sold a total of 52,800 BTC since becoming a spot ETF.

Whilst some of these flows might be going to cheaper spot ETF products offered by rivals, some may represent outright profit-taking by traders who had been betting on the closure of the GBTC discount to net asset value (NAV).

As recently as early 2023 and before becoming an ETF, GBTC’s discount to NAV had reached as much as 50%.

Some traders may have bought GBTC back then not to express a bullish view on Bitcoin, but instead to express a view that GBTC would be converted to an ETF, and become redeemable on a 1:1 basis to actual Bitcoin.

JP Morgan estimated in a research note on Friday that profit-taking flows of $1.5 billion had already exited GBTC.

But the US bank reckons that there could be another $1.5 billion in GBTC profit-taking.

As other Bitcoin products, like those spot ETFs issued in Canada and Europe and futures ETFs see substantial outflows, there is a high risk that near-term sell pressure remains high.

Here’s How Low the Bitcoin Bears Could Push the Price

All said, those betting that the approval of spot Bitcoin ETFs last week would be a “sell-the-fact” appear to have been vindicated.

And if JP Morgan is right, Bitcoin bears are likely to remain in control as sell pressure remains high.

Another factor that could play in the Bitcoin bear’s favor is potential macro headwinds.

Traditional asset investors seem to still be very much betting that Fed interest rate cuts begin as soon as March.

US interest rate future markets are still pricing a near 50% chance of a 25-bps rate cut in March, as per the CME’s Fed Watch Tools.

That’s despite recent data not supporting the case for a rate cut that soon, and Fed policymakers saying March would be too soon.

US money markets are likely to be forced into reducing expectations for a March rate cut to zero.

This could support further gains for US yields and the DXY, bolstering the Bitcoin bear case.

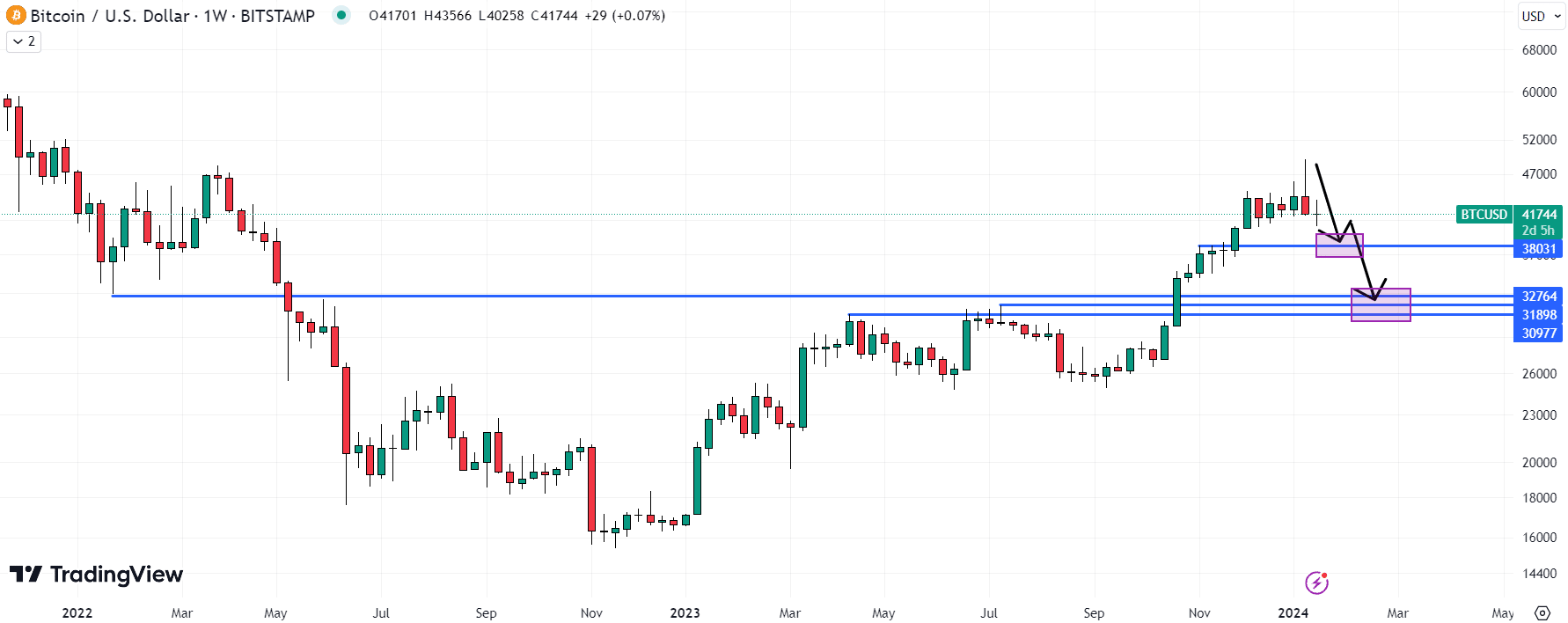

So a break below $40,000 looks to very much be on the cards for the weeks ahead.

That could trigger a fresh wave of technical selling given that $40,000 is a key support zone.

The November 2023 highs in the $38,000 area would be the first area targeted by the Bitcoin bears.

But simple chart analysis suggests that a retest of long-term support-turned-resistance at $32,000-$33,000 is a possibility.

Will Bulls Buy the Dip?

All the above being said, Bitcoin’s bull case for 2024 remains strong.

New spot Bitcoin ETFs add a new structural source of long-term demand.

Meanwhile, the upcoming halving will structurally reduce sell pressure from Bitcoin miners.

And while questions remains about how soon they will start, Fed interest rate cuts are very likely in 2024.

That means liquidity conditions should be about to substantially improve, just as demand rises and supply falls.

That’s a very bullish cocktail.

Long-term bitcoin bulls will be happy to scoop up tokens from the Bitcoin bears as BTC falls into the $30,000s.

Chart analysis also suggests a possibility that Bitcoin bears don’t even get their wish of a sub-$40,000 price.

If the Bitcoin price closes out the day at current levels, its daily candlestick would look like a “hammer”.

Candlestick pattern analysts often refer to such daily candlesticks as indicative of a bullish reversal.

BTC may also benefit from technical buying as the price bounds support in the form of its mid to late-December lows just above $40,000.