In the dynamic world of cryptocurrencies, Bitcoin and Ethereum continue to be the key players with their recent price movements catching the attention of investors. Bitcoin, the trailblazer of the crypto market, has recently rebounded, breaking through the $42,000 resistance level and registering a current price of $42,292. This nearly 0.50% increase in the last 24 hours coincides with the overall crypto market valuation at $1.63 trillion, despite a slight 0.15% drop.

Bitcoin’s surge is linked to favorable stock market trends and the significant achievement of BlackRock’s Bitcoin ETFs amassing over $2 billion in Assets Under Management. This bullish trend in Bitcoin’s price is a focal point for price prediction analyses.

#GM $BTC at 42k today!📈#CoinHome #Bitcoin #Ethereum $btc $eth pic.twitter.com/0P07r30Ccg

— CoinHome (@CoinHomePro) January 29, 2024

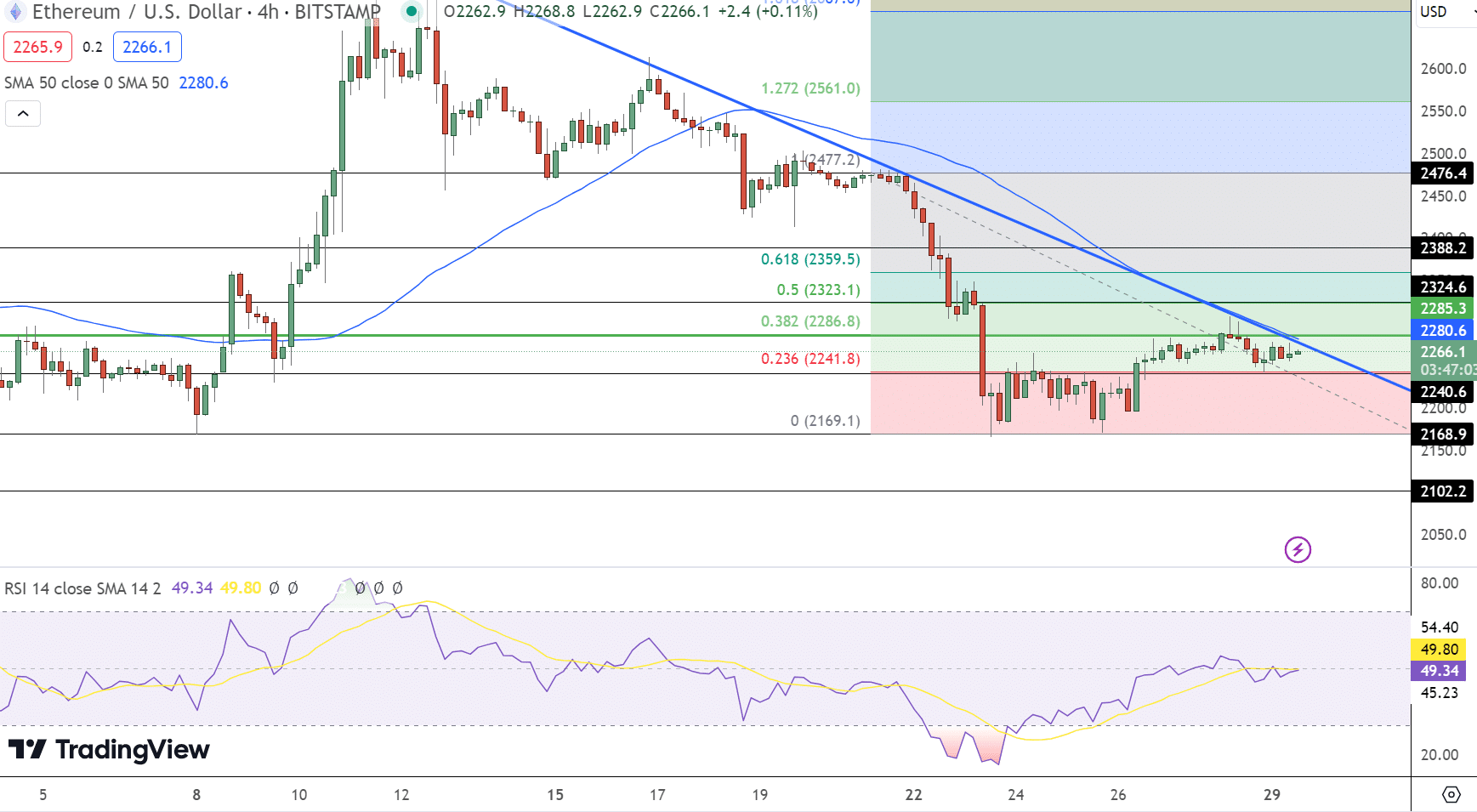

On the other side, Ethereum, the second most notable cryptocurrency, has seen a minor setback, trading at $2,269 with nearly 0.50% decline. However, the buzz around the potential approval of a spot Ethereum ETF, as suggested by analyst James Seyffart, signals an optimistic future for Ethereum. The approval, expected in May, could attract more investment, influencing Ethereum’s price positively.

Moreover, the global interest in cryptocurrencies is evident with developments like Harvest Hong Kong’s application for a Bitcoin ETF and a Binance survey revealing growing crypto acceptance in Europe. These factors collectively contribute to the evolving narrative of Bitcoin and Ethereum price predictions.

Harvest Hong Kong’s ETF Bid: A Global Boost for Bitcoin’s Value

Harvest Hong Kong, a prominent Chinese fund company, has officially submitted an application for a Bitcoin spot exchange-traded fund (ETF) with the Hong Kong Securities and Futures Commission.

The approval of this ETF, which is poised for launch after the Lunar New Year holiday on February 10, would mark Hong Kong’s first Bitcoin spot ETF. This initiative follows the successful introduction of spot Bitcoin ETFs in the United States, igniting worldwide interest.

China’s Financial Giant Files First-Ever Bitcoin Spot ETF Application in Hong Kong#bitcoin #BTC #tafouio #cryptonews pic.twitter.com/5xgGBkHtDj

— tafou.io (@tafouio) January 29, 2024

Rachel Aguirre of BlackRock has acknowledged the impressive performance of the U.S. ETF, which has surpassed expectations. China’s entry into this sector adds a significant dimension to the dynamic landscape of digital asset investments, signaling a transformation in investor preferences.

Thus, Harvest Hong Kong’s application for a Bitcoin ETF reflects increasing global interest. Its potential approval could further elevate Bitcoin’s price by attracting additional investors and reinforcing its legitimacy in mainstream financial markets.

Binance Report: Rising Crypto Acceptance in Europe and Bitcoin’s Prospects

Binance’s latest survey reveals an increasing acceptance of cryptocurrencies in Europe, driven by their potential for high returns, decentralization, and continuous innovation. The study indicates that 73% of Europeans hold a positive view of digital currencies, with 55% utilizing them for regular transactions. This trend aligns with the global increase in cryptocurrency ownership, which soared from 432 million in January to 580 million by December 2023.

Some really positive findings from our #Binance survey across Europe.

73% of respondents were optimistic about the future of crypto & with MiCA implemented soon, there’s a lot to be excited about in the region!

More details from @Finbold here 👇https://t.co/gE3l6e5MtT

— Rachel Conlan (@RachelConlan) January 25, 2024

Despite a temporary decline in adoption following the FTX exchange issues in late 2022, confidence rebounded, partly due to the U.S. Securities and Exchange Commission’s (SEC) approval of 11 Bitcoin ETFs. High-profile sponsorships, including Crypto.com’s collaboration with the LA Lakers and OKX’s partnership with Manchester City, further enhanced trust in the sector.

As a result, the optimistic sentiment in Europe, highlighted by Binance’s survey, may positively impact Bitcoin’s price. The growing adoption, coupled with heightened optimism and usage, could attract more investors, potentially elevating the cryptocurrency’s market value.

Seyffart’s Forecast: Ethereum ETF Approval in May Could Elevate ETH Value

Bloomberg Intelligence analyst James Seyffart sees a 60% chance of a spot Ethereum ETF getting approved in May. Despite recent delays for BlackRock and Grayscale proposals, Seyffart marks May 23 as a crucial date, expecting the SEC’s decision around that time. The SEC, having approved Bitcoin ETFs, is now considering proposals from BlackRock, Grayscale, Ark 21Shares, and VanEck.

The Road Ahead: A View on ETH Spot

This is intended to be a deep dive into the current landscape for crypto spot ETFs generally with emphasis on ETH. Will do this in 4 parts for ease of reference.

1 – General Roadmap

2 – Threshold Issue

3 – BTC Spot Approval

4 – ETH Analysis

🧵— Scott Johnsson (@SGJohnsson) January 25, 2024

Seyffart is hopeful but acknowledges the SEC’s ability to delay decisions. Grayscale aims for a summer 2024 SEC decision on turning its Ethereum Trust into an ETF. As May approaches, Seyffart keeps an eye on filings, with May 23 as a key date for potential updates. Consequently, the prospect of a spot Ethereum ETF approval, highlighted by James Seyffart, could positively impact ETH price.

Bitcoin Price Prediction

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.