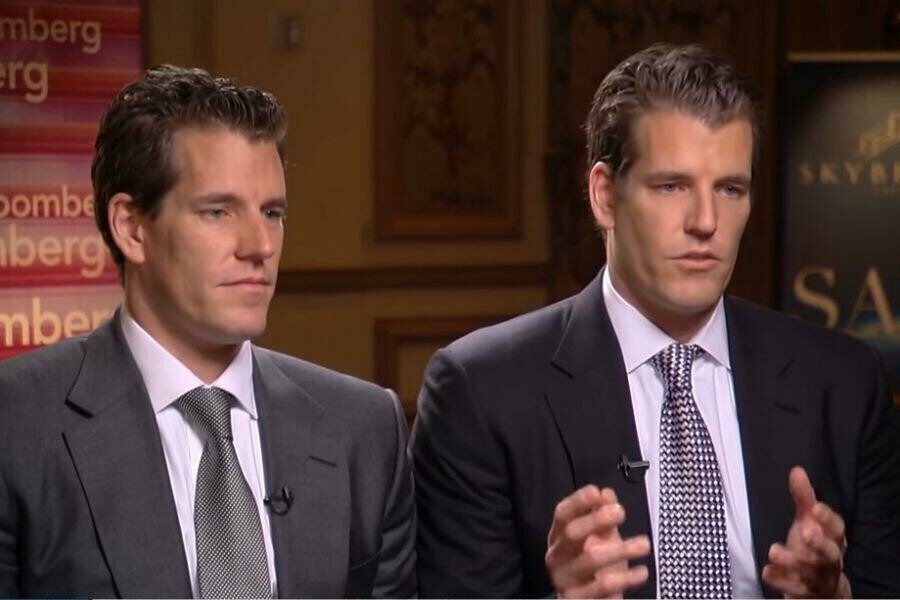

Cameron and Tyler Winklevoss, the billionaire twins who owns crypto exchange Gemini, may have a hidden agenda with their lawsuit against Barry Silbert’s crypto conglomerate Digital Currency Group (DCG), a recent Fortune article has suggested.

According to the article, there is a chance that the lawsuit filed by the Winklevoss twins’ Gemini exchange will not even go to court, but instead be used as leverage by Gemini in an attempt to get a better settlement from DCG.

Gemini sued DCG and its CEO Barry Silbert earlier this month for allegedly defrauding creditors, after a long public feud between the Winklevoss twins and Silbert over missing funds related to Gemini’s “Earn” program.

As usual, the twins shared highlights of the actions taken against DCG via Twitter:

Gemini’s “Earn” program worked through a partnership Gemini had with DCG-subsidiary Genesis, who would take deposits in crypto and pay back interest to depositors.

When Genesis later went bankrupt, partly thanks to its exposure to now-bankrupt crypto hedge fund Three Arrows Capital, “Earn” depositors’ funds could not be paid back.

Lawsuit could be used as leverage

Gemini’s lawsuit has already been dismissed as a “publicity stunt” by DCG, but that did not stop Forbes Crypto writer Jeff John Roberts from suggesting that a large settlement between the two firms could be on the table.

“It’s possible the Winklevii are using the lawsuit as leverage to extract a better settlement from DCG,” Roberts suggested.

The suggestion is backed up by the fact that Cameron Winklevoss has publicly shared detailed proposals for how to settle the dispute with DCG, indicating that he is open to negotiations outside of court.

Meanwhile, another possibility according to the article is that the twins and Silbert, who are all billionaires with large crypto holdings, potentially could decide to make depositors whole “and then work things out between themselves.”

For that to work, however, an “unusual degree of honor” would be required, Roberts wrote, before concluding his piece by adding:

“And there’s not a lot of that in the crypto industry these days.”

Cameron and Tyler Winklevoss, the billionaire twins who owns crypto exchange Gemini, may have a hidden agenda with their lawsuit against Barry Silbert’s crypto conglomerate Digital Currency Group (DCG), a recent Fortune article has suggested.

According to the article, there is a chance that the lawsuit filed by the Winklevoss twins’ Gemini exchange will not even go to court, but instead be used as leverage by Gemini in an attempt to get a better settlement from DCG.

Gemini sued DCG and its CEO Barry Silbert earlier this month for allegedly defrauding creditors, after a long public feud between the Winklevoss twins and Silbert over missing funds related to Gemini’s “Earn” program.

As usual, the twins shared highlights of the actions taken against DCG via Twitter:

Gemini’s “Earn” program worked through a partnership Gemini had with DCG-subsidiary Genesis, who would take deposits in crypto and pay back interest to depositors.

When Genesis later went bankrupt, partly thanks to its exposure to now-bankrupt crypto hedge fund Three Arrows Capital, “Earn” depositors’ funds could not be paid back.

Lawsuit could be used as leverage

Gemini’s lawsuit has already been dismissed as a “publicity stunt” by DCG, but that did not stop Forbes Crypto writer Jeff John Roberts from suggesting that a large settlement between the two firms could be on the table.

“It’s possible the Winklevii are using the lawsuit as leverage to extract a better settlement from DCG,” Roberts suggested.

The suggestion is backed up by the fact that Cameron Winklevoss has publicly shared detailed proposals for how to settle the dispute with DCG, indicating that he is open to negotiations outside of court.

Meanwhile, another possibility according to the article is that the twins and Silbert, who are all billionaires with large crypto holdings, potentially could decide to make depositors whole “and then work things out between themselves.”

For that to work, however, an “unusual degree of honor” would be required, Roberts wrote, before concluding his piece by adding:

“And there’s not a lot of that in the crypto industry these days.”