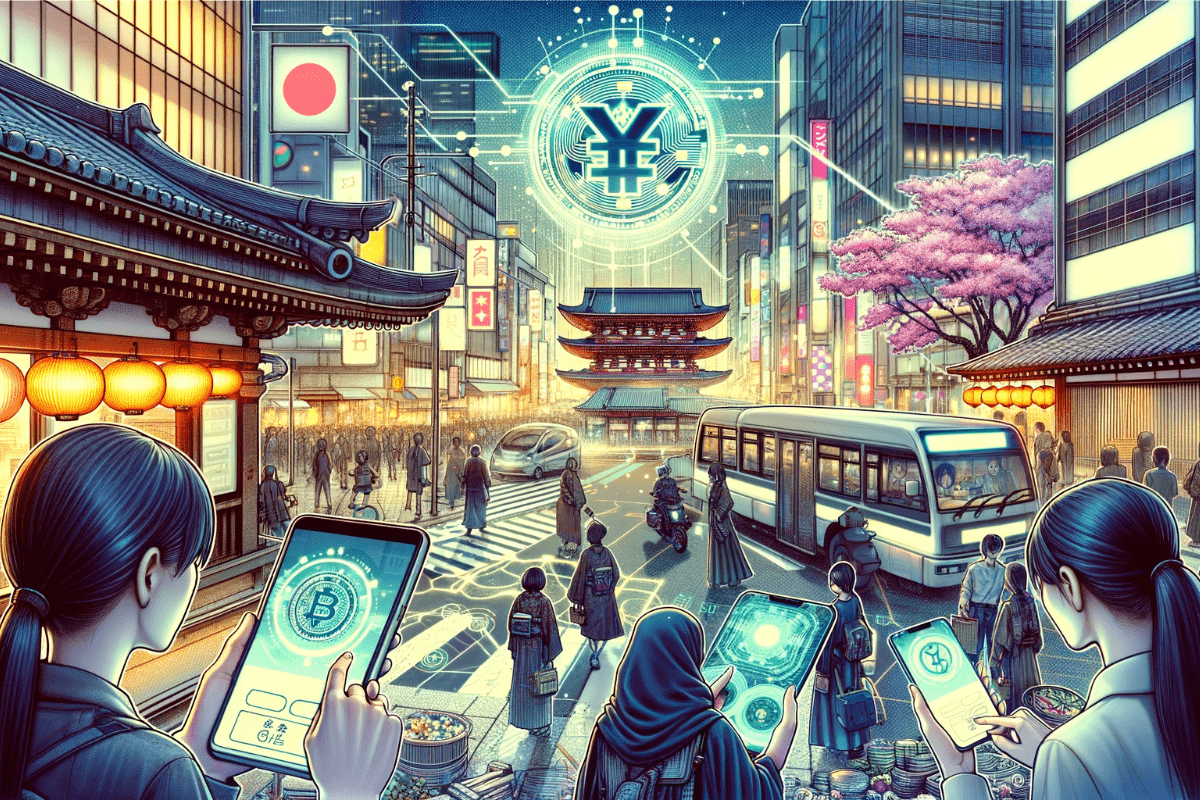

Japan’s central bank and the Finance Ministry reportedly had their first meeting to discuss a potential central bank digital currency (CBDC) on Friday.

Local outlet NHK News reported that executives from relevant ministries and central bank directors discussed issues regarding a CBDC.

The Ministry suggested that a central bank digital currency should work alongside private cashless businesses, prioritizing convenience and personal data protection in design.

Officials from the Cabinet Office and National Police Agency were present at the meeting, per Ledger Insights. Representatives from the Fair Trade Commission and Personal Information Protection Commission also attended.

CBDC is digital money issued and regulated by a country’s central bank. Unlike cryptocurrencies, they are not decentralized. CBDCs aim to offer a safe and dependable way for digital payments, potentially providing advantages like greater financial inclusion and lower transaction expenses.

Japan CBDC Exploration Underway, Decision Pending

Japan is currently exploring the idea of introducing a digital yen, but no decision has been made yet.

The Bank of Japan has been experimenting with a central bank digital currency since April 2021 to test its technical feasibility.

In 2020, the bank indicated it would consider issuing a CBDC if cash usage significantly drops in the future. But regardless of cash circulation, it may be issued to support private payment services if it is necessary to improve overall systems, the BoJ added.

Japan initiated a pilot program for its digital yen for its digital yen in April 2023. By July, discussions began with companies like Sony, Toyota’s financial arm, and East Japan Railway for digital yen development.

The government and parliament will ultimately decide on issuing a CBDC after public discussion and, possibly, a referendum.

Over 100 Countries Exploring CBDC Adoption

Many other countries are also looking into or have already introduced their central bank digital currencies.

The Bahamas, Jamaica, and Nigeria have already rolled out their CBDCs, while over 100 countries are currently in the exploration stage, according to the IMF.

China is among those actively leading CBDC-related initiatives.

Last month, former China central bank governor Dai Xianglong stressed China’s need to lead in CBDC adoption with its ongoing digital yuan pilot.