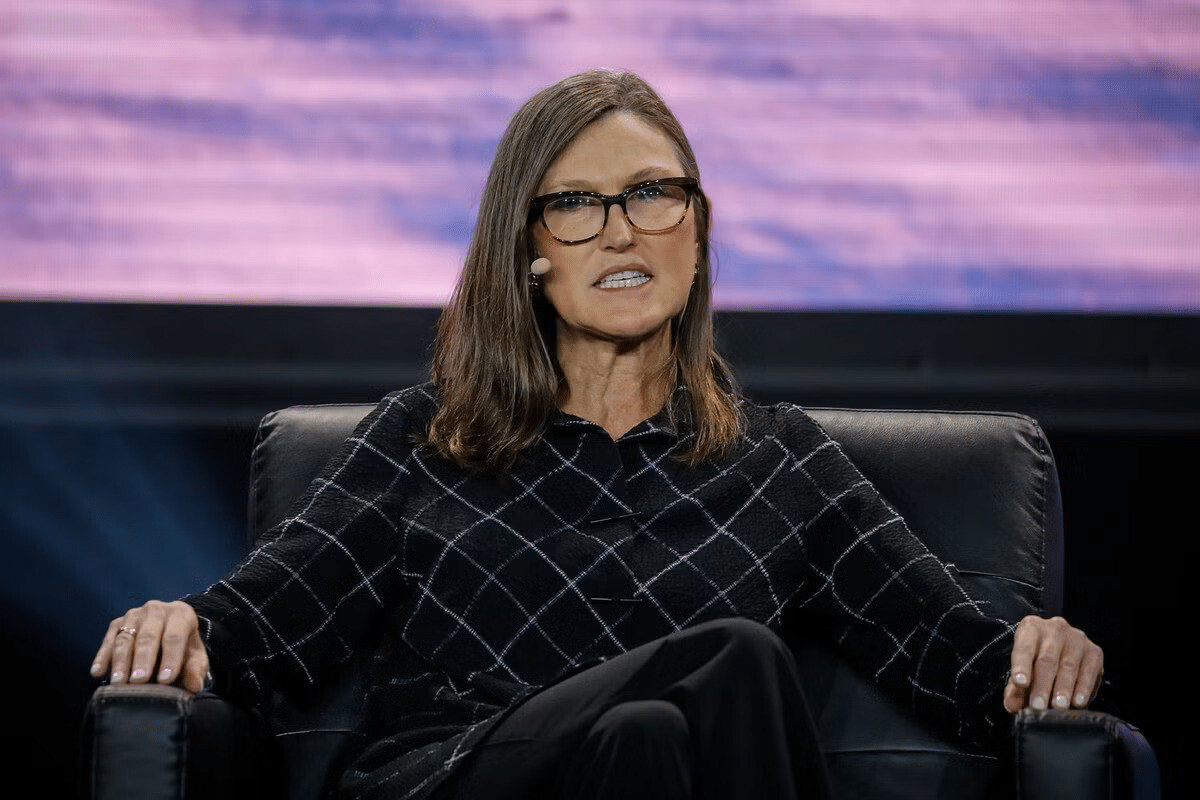

Cathie Wood – CEO of tech-focused investment manager ARK Invest – says her conviction in Bitcoin (BTC) remains unshaken despite the asset’s recent “sell the news” market wipeout.

Bitcoin climbed for four months in a row after Bitcoin asset manager Grayscale bested crypto-skeptical federal regulators in court.

The event bolstered market confidence that a Bitcoin spot ETF would finally launch in the United States within the next few months. Yet after the product finally hit the market earlier this month, the asset’s bullish momentum quickly turned around.

“We’re very excited that Bitcoin is now in the ETF wrapper, and therefore very accessible at very low prices,” said Wood during an interview with CNBC on Wednesday.

CATHIE WOOD: The selloff has not disturbed our point of view at all – we think #Bitcoin is one of the most important investments of our lifetimes 👀🙌 pic.twitter.com/trObEG0gSe

— Bitcoin News (@BitcoinNewsCom) January 24, 2024

Wood’s investment firm owns one of nine new Bitcoin ETFs to launch on January 11. After eight days of trading, the fund holds $480 million in assets.

The CEO said that Ark expected a sell the news event after the launch, noting how bankrupt crypto exchange FTX has already sold nearly $1 billion worth of shares in the Grayscale Bitcoin Trust (GBTC).

“I think some people expected [Bitcoin’s price] to hold a little more than it has,” she said. “But this has not disturbed our point of view at all.”

Wood went on to call Bitcoin “one of the most important investments of our lifetimes,” highlighting its specialty as a global, rules-based monetary system. “We think its the biggest of all the crypto ideas out there,” she added.

Bitcoin VS Altcoins

Bitcoin’s origins lie in an attempt by cryptographers to create a fairer form of money in response to bank bailouts during the 2008 financial crisis. The asset’s wealthiest promotors like BlackRock CEO Larry Fink now characterize it as “digital gold,” with its absolutely fixed supply of 21 million coins.

Fidelity, fund manager with a popular Bitcoin ETF, published a report in January 2022 claiming Bitcoin should be “considered separately from other digital assets.” Nevertheless, both Fidelity and BlackRock are currently pining to launch a spot Ethereum ETF, pending regulatory approval.

Meanwhile, Franklin Templeton has also taken a multi-chain approach to crypto. The asset manager has donned laser-eyes in its profile picture on X, and claimed that it is continuing to monitor and support networks beyond Bitcoin, Ethereum, and Solana.