Bitcoin (BTC) dipped slightly by 0.20%, settling at $63,000, yet maintains a bullish stance in the latest bitcoin price prediction. The rise in jobless claims to 231,000, the highest since August 2023, suggests a cooling U.S. labour market, prompting anticipatory actions by the Federal Reserve.

This could lead to rate reductions earlier than projected, influencing Bitcoin’s appeal as a non-traditional investment.

U.S. Jobs Data Sparks Rate Cut Speculation—What’s Next for BTC

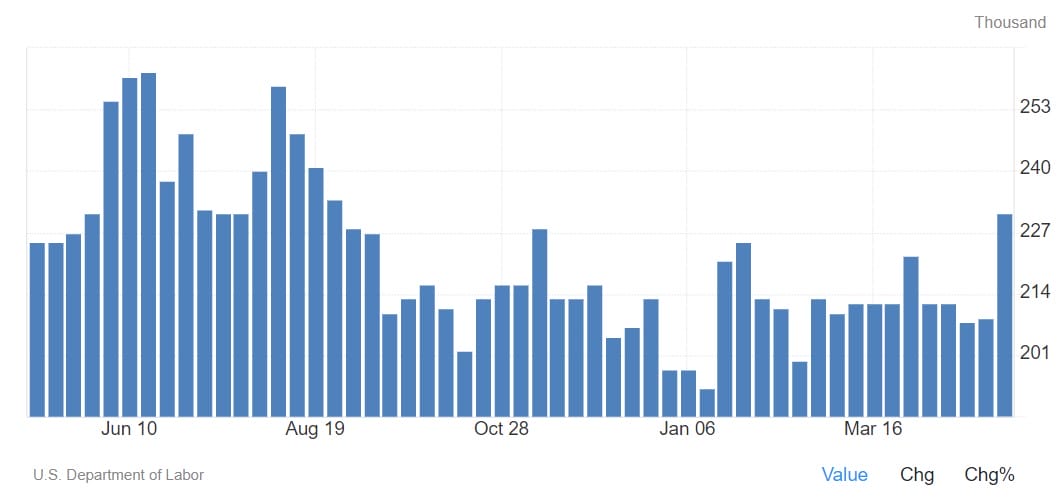

The Labor Department reported a notable increase in initial jobless claims for the week ending May 4, reaching 231,000—22,000 more than the previous week and well above the Dow Jones estimate of 214,000.

This marks the highest level since August 26, 2023, signalling possible economic strains and a cooling labour market that had previously shown resilience.

Continuing claims also increased, rising by 17,000 to 1.78 million, while the four-week moving average of claims climbed to 215,000. These figures suggest a gradual economic slowdown, prompting discussions about the Federal Reserve’s potential early rate cuts to stimulate growth.

Such a softening in the labour market has historically been a catalyst for Bitcoin price as investors turn to non-traditional assets.

Nonfarm Payroll Adds to Concern

April’s nonfarm payroll data added to these concerns, showing a gain of only 175,000 jobs, far below the expected 240,000. This was the smallest increase since October 2023. However, the unemployment rate remains stable at 3.9%, under 4% since February 2022, indicating that the job market is not in crisis but may be normalizing.Analysts Christopher Rupkey and Robert Frick have noted the volatility and surprising rise in jobless claims, suggesting potential further fluctuations in the labour market. Officials of the Federal Reserve, whose goal is to maintain a 2% inflation rate, carefully examine these circumstances.

- The recent spike in U.S. jobless claims suggests a potential economic slowdown.

- April’s modest job gains and stable unemployment hint at market normalization.

- The Fed may cut rates sooner, possibly boosting Bitcoin investment as lower rates reduce fixed-income asset yields.

As expectations mount for the Fed to ease monetary policy in response to a weakening job market, possibly starting rate cuts as early as September, Bitcoin could benefit. Lower interest rates make riskier assets like cryptocurrencies more appealing.

Bitcoin Price Prediction

Bitcoin

(BTC) observes a minor decline of 0.20%, with the current trading price at $63,000, however, bitcoin price prediction still remains bullish.

The pivot point at $61,011 sets the stage for determining directional movements, with immediate resistance observed at $64,851. Should bullish momentum prevail, subsequent resistance levels at $67,084 and $69,356 could be tested.

Conversely, immediate support forms at $58,852, with further downside protection seen at $56,677 and $54,327. The RSI at 54 indicates a relatively neutral market stance, while the 50-day EMA at $62,375 provides underlying support near the $62,000 mark, suggesting a balanced yet cautious market sentiment.

A decisive move below $62,500 could trigger a significant selling trend, highlighting the importance of this threshold in BTC’s near-term price actions.

Unlock Early Benefits: 99Bitcoins Token Presale Now Live!

The 99Bitcoins presale is currently underway, offering a unique opportunity in cryptocurrency education. By participating in this ‘learn-to-earn’ platform, users can enhance their understanding of digital currencies while acquiring $99BTC tokens, which are both a reward mechanism and a gateway to premium content and community benefits.

With the token price set at $0.00104 each, early investors are provided a cost-effective entry point to start growing their expertise and investment simultaneously.

As of now, the presale has successfully raised $1,169,037, moving closer to the target of $1,892,544. With only four days and just over an hour remaining before the next stage price increase, this limited-time offer presents a critical moment for investors to buy into $99BTC and gain access to immediate staking options.

Secure Your 99Bitcoins Today

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.