Risks of a short-term pullback in the Bitcoin (BTC) price appear to be rising, according to chart analysis.

Bitcoin was last changing hands close to $27,500, about 6% below the nine-month highs it hit on Friday in the $29,300s.

The cryptocurrency’s repeated failure to hold above resistance in the form of the late-May 2022 lows in the low-$28,000s this week has gotten some traders worried that a short-term pullback to key support in the mid-$25,000s might be incoming.

And Bitcoin’s failure to hold above $28,000 isn’t the factor suggesting an increased risk of a short-term pullback.

In recent days, Bitcoin’s 14-day Relative Strength Index (RSI) has experienced bearish divergence.

This is where despite a continued rise in the Bitcoin price, the RSI has been falling. Some technicians view this as indicative of an incoming correction.

Moreover, Bitcoin’s latest push into the upper-$20,000s pushed an indicator of price momentum to historically high levels, signifying a potentially overheating market.

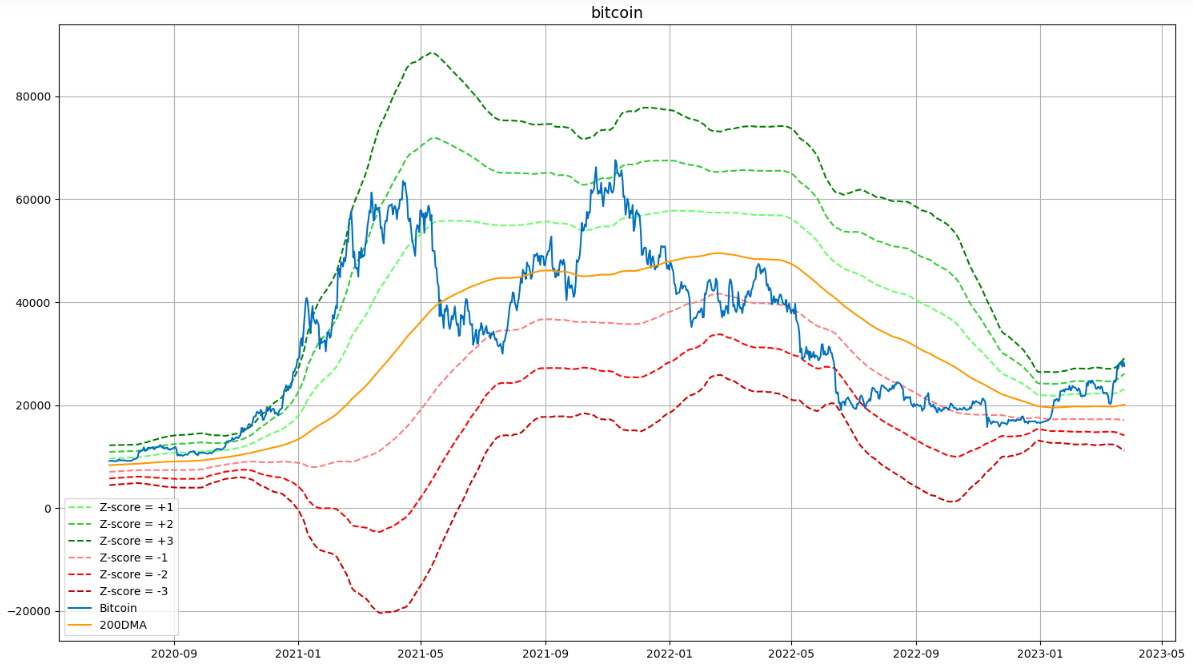

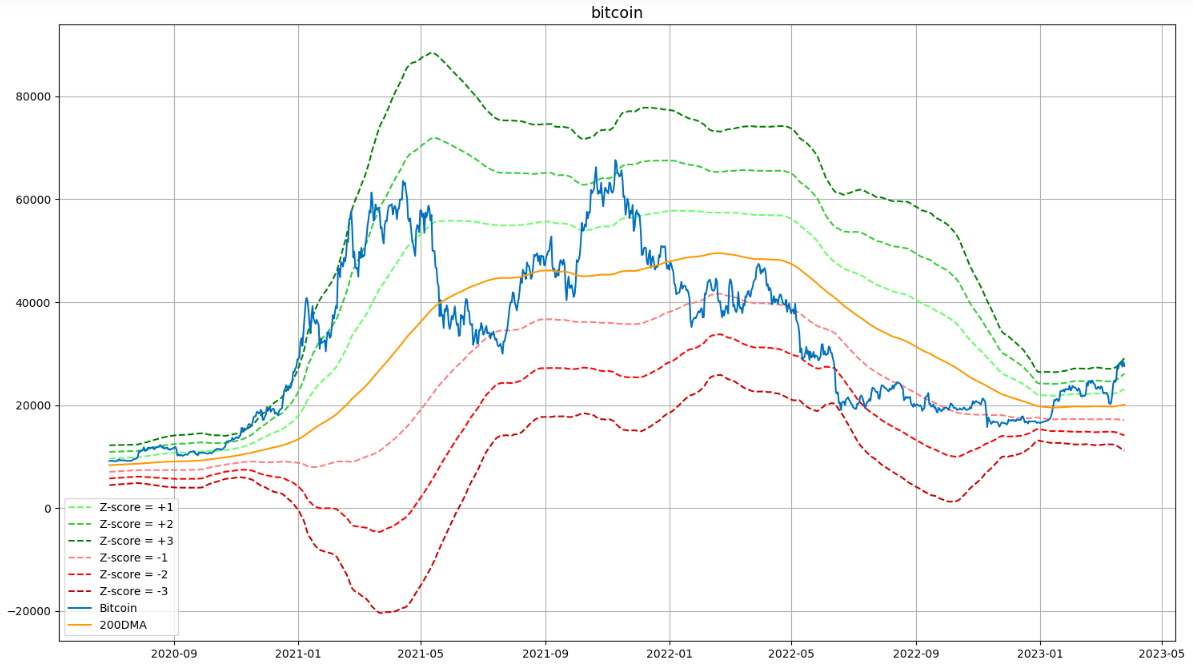

Earlier this week, Bitcoin’s Z-score to its 200-Day Moving Average (DMA) rose above 3.0.

That means the price was more than three standard deviations above its average over the past 200 days, a highly rare event that could signal that upside momentum is getting overstretched.

Bitcoin’s Z-score to its 200DMA was last around 2.5, still very high by historical standards and its highest since early 2020.

Dip-buying Demand to Remain Elevated

So, the risk of a short-term pullback appears to have risen. But Bitcoin bulls shouldn’t fret too much.

That’s because the fundamental narratives that drove the spectacular bounce from mid-March lows under $20,000 are likely to remain tailwinds for the foreseeable future.

Readers will recall that three US banks went under earlier this month, sparking concerns about a broader global banking crisis and pushing traders to aggressively pare back on bets on more tightening from the US Federal Reserve.

As expected, the Fed delivered a dovish pivot in its rate guidance at its meeting this week (despite still lifting interest rates by another 25 bps), with investors now betting that a cutting cycle will commence in the second half of the year.

The combination of financial crisis concerns and bets on easier monetary policy have given Bitcoin the dual tailwind of safe-haven demand (as a fiat currency alternative) and demand for assets that perform well in a lower interest rate environment (which Bitcoin typically has).

Bank contagion risks remain high and the US economic outlook has darkened substantially, meaning that these tailwinds should remain strong.

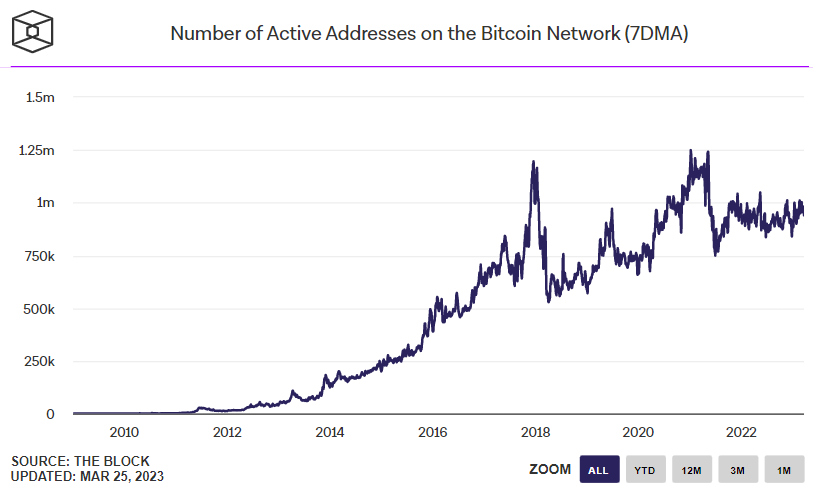

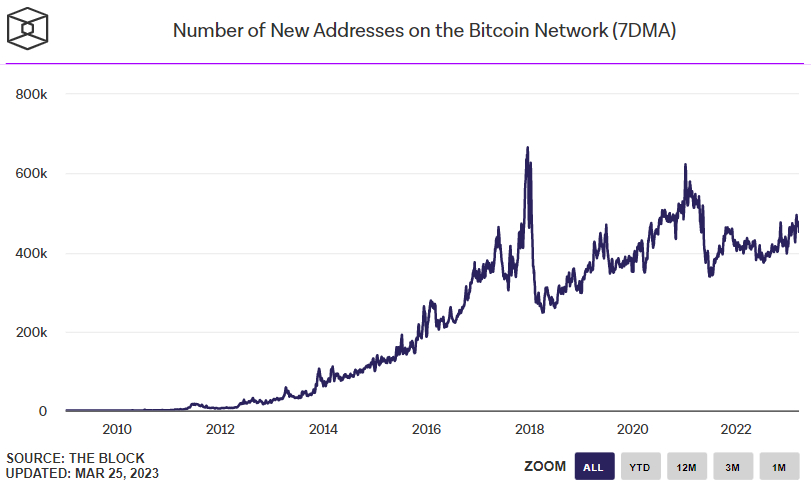

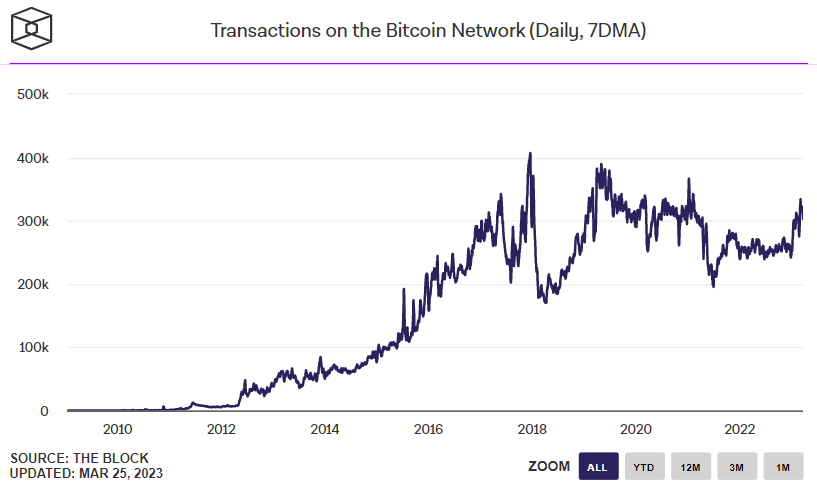

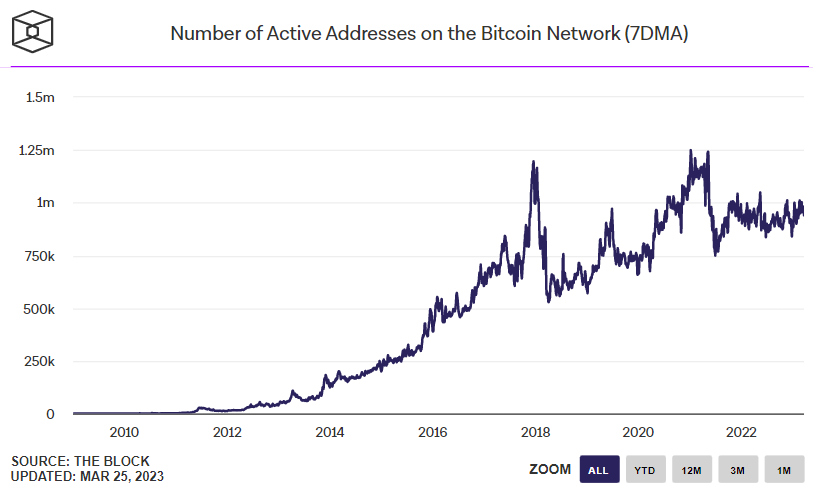

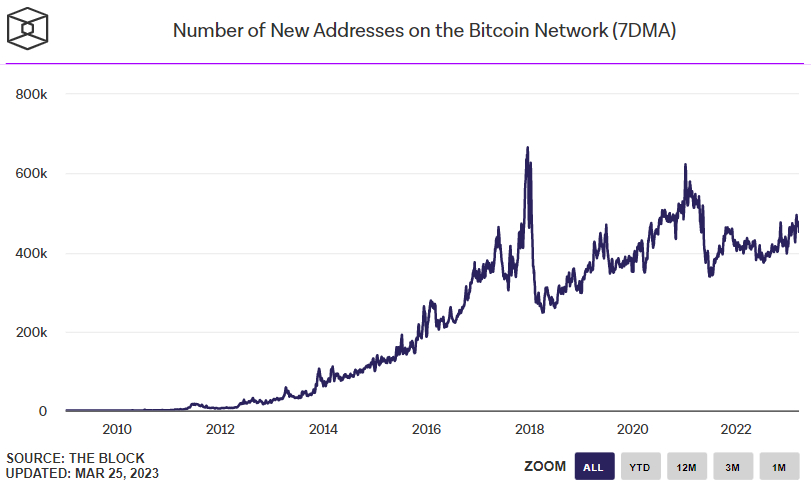

Bitcoin is also likely to continue deriving longer-term tailwinds from positive on-chain trends.

These include a steady but sustained rise in daily transactions, non-zero balance wallet addresses, the rate of new address creation and daily active wallets interacting with the blockchain.

Any fall back to the $25,000 area in the Bitcoin price would likely be met with aggressive dip buying demand.

Longer-term risks remain tilted towards a push into the $30,000s in the coming weeks and months.

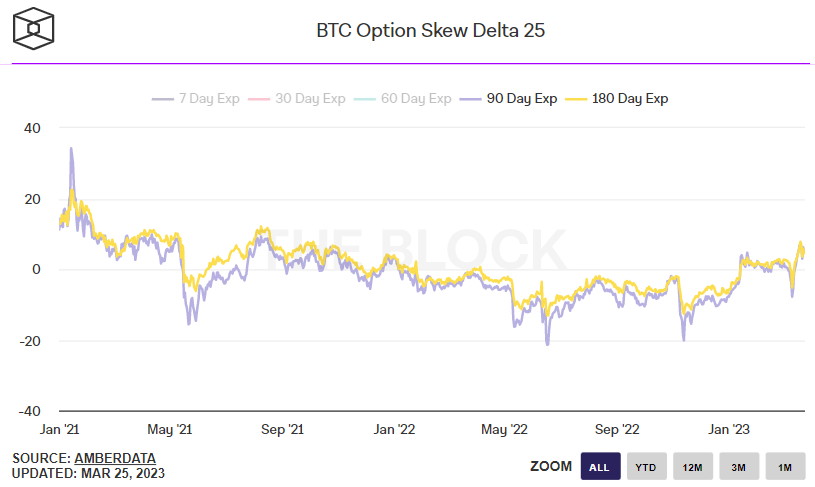

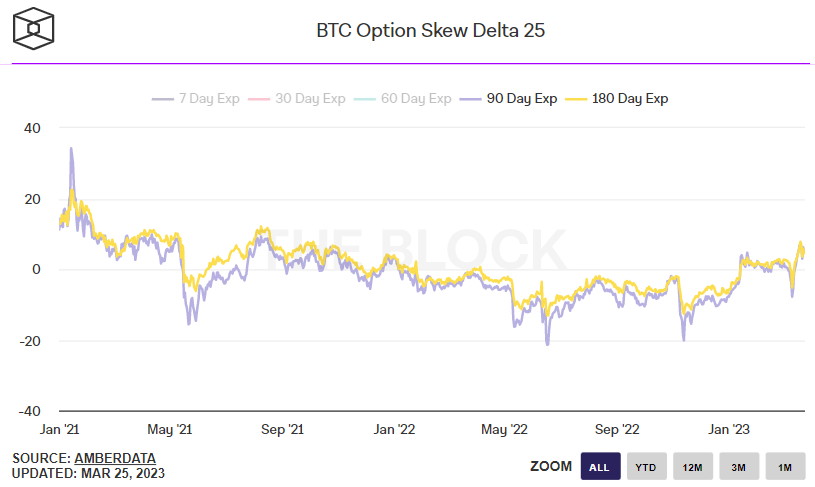

At least, that’s the message from Bitcoin options markets – The 25% delta skew of Bitcoin options expiring in 90 and 180-days remain close to their highest levels since late 2021 when Bitcoin hit all-time highs above $69,000.

Risks of a short-term pullback in the Bitcoin (BTC) price appear to be rising, according to chart analysis.

Bitcoin was last changing hands close to $27,500, about 6% below the nine-month highs it hit on Friday in the $29,300s.

The cryptocurrency’s repeated failure to hold above resistance in the form of the late-May 2022 lows in the low-$28,000s this week has gotten some traders worried that a short-term pullback to key support in the mid-$25,000s might be incoming.

And Bitcoin’s failure to hold above $28,000 isn’t the factor suggesting an increased risk of a short-term pullback.

In recent days, Bitcoin’s 14-day Relative Strength Index (RSI) has experienced bearish divergence.

This is where despite a continued rise in the Bitcoin price, the RSI has been falling. Some technicians view this as indicative of an incoming correction.

Moreover, Bitcoin’s latest push into the upper-$20,000s pushed an indicator of price momentum to historically high levels, signifying a potentially overheating market.

Earlier this week, Bitcoin’s Z-score to its 200-Day Moving Average (DMA) rose above 3.0.

That means the price was more than three standard deviations above its average over the past 200 days, a highly rare event that could signal that upside momentum is getting overstretched.

Bitcoin’s Z-score to its 200DMA was last around 2.5, still very high by historical standards and its highest since early 2020.

Dip-buying Demand to Remain Elevated

So, the risk of a short-term pullback appears to have risen. But Bitcoin bulls shouldn’t fret too much.

That’s because the fundamental narratives that drove the spectacular bounce from mid-March lows under $20,000 are likely to remain tailwinds for the foreseeable future.

Readers will recall that three US banks went under earlier this month, sparking concerns about a broader global banking crisis and pushing traders to aggressively pare back on bets on more tightening from the US Federal Reserve.

As expected, the Fed delivered a dovish pivot in its rate guidance at its meeting this week (despite still lifting interest rates by another 25 bps), with investors now betting that a cutting cycle will commence in the second half of the year.

The combination of financial crisis concerns and bets on easier monetary policy have given Bitcoin the dual tailwind of safe-haven demand (as a fiat currency alternative) and demand for assets that perform well in a lower interest rate environment (which Bitcoin typically has).

Bank contagion risks remain high and the US economic outlook has darkened substantially, meaning that these tailwinds should remain strong.

Bitcoin is also likely to continue deriving longer-term tailwinds from positive on-chain trends.

These include a steady but sustained rise in daily transactions, non-zero balance wallet addresses, the rate of new address creation and daily active wallets interacting with the blockchain.

Any fall back to the $25,000 area in the Bitcoin price would likely be met with aggressive dip buying demand.

Longer-term risks remain tilted towards a push into the $30,000s in the coming weeks and months.

At least, that’s the message from Bitcoin options markets – The 25% delta skew of Bitcoin options expiring in 90 and 180-days remain close to their highest levels since late 2021 when Bitcoin hit all-time highs above $69,000.