Veteran trader Peter Brandt suggested the probability of an upward price trajectory for Bitcoin on April 18, citing recurring patterns in its market behavior. His analysis showed that Bitcoin prices tend to follow a repeating pattern, suggesting a bullish trajectory.

Peter Brandt Bitcoin Price Prediction Entails Three Phases

The seasoned trader analyzed Bitcoin’s market behavior in a thread on X, where he classified the asset into three phases: Hump-Slump, Bump-Rump, and Pump-Dump.

According to the chart presented by the popular trader, the current Bitcoin market has completed the first and second phases and is in the third phase.

Brandt noted that the “dump” part of the third stage had taken place while the “pump” phase was yet to materialize, suggesting a forthcoming BTC price increase.

His deduction of a potential major Bitcoin price move came amid a bearish trend in the cryptocurrency market, largely due to the news of the geopolitical tensions between Israel and Iran.

Brandt’s analysis offers a potentially deeper perspective on the recent trajectory of BTC’s price, however.

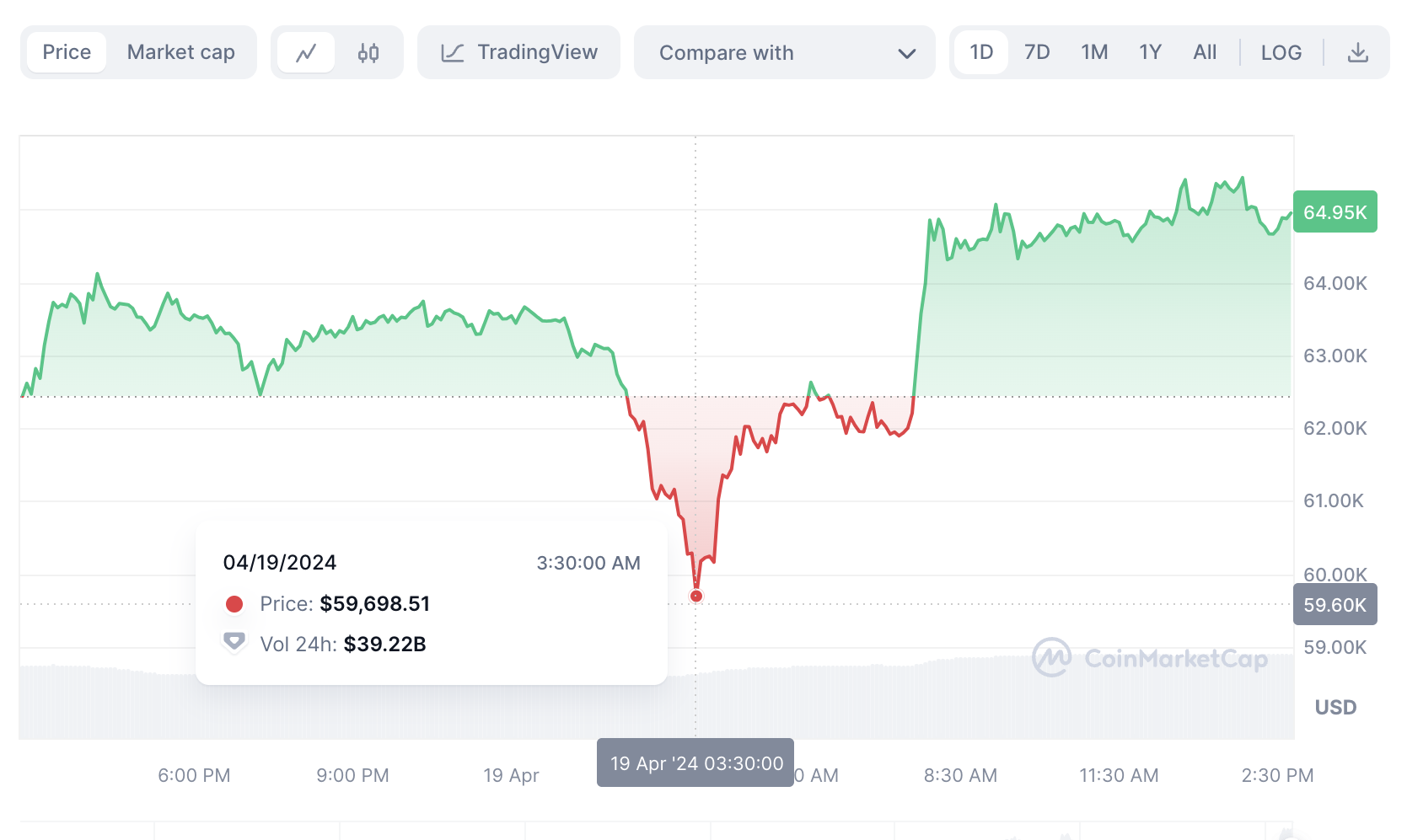

For instance, when Israel launched a retaliatory attack on Iran overnight, Bitcoin briefly dipped to $59K from its prior price of $63.4K before recovering to $65K. This rapid shift in trend has also fueled gains in other cryptocurrencies, indicating the possibility of an altcoin rally.

Meanwhile, CryptoQuant data indicates that large Bitcoin holders (crypto whales) may have used the price dip to accumulate more cryptocurrencies at a discount.

Earlier this week, Cryptonews.com reported a transfer of over 27.7K BTC ($1.75 billion) sent into accumulation wallet addresses between April 16 and April 17. This exceeded the previous record of 25,500 BTC (almost $1.6 billion) sent to such wallets on March 23, when the Bitcoin price was around $63.5K.

Additionally, the impending Bitcoin halving event strengthens Brandt’s Bitcoin price prediction. The halving is designed to reduce incentives for mining new blocks, thereby slowing down the rate at which new Bitcoins are created.

JUST IN: 100 blocks remain until #Bitcoin halving. pic.twitter.com/w6NkuxlqF5

— Watcher.Guru (@WatcherGuru) April 19, 2024

Bitcoin halving has a history of driving up the demand and price of BTC.

Peter Brandt’s “Pump” Phase May Kickoff Soon

Peter Brandt’s optimism on BTC price increase aligns with market analysis insights from experts, including pseudonymous trader Rekt Capital.

The trader claimed that the current dip period of BTC, which is dubbed as the third stage “Dump” in Brandt’s projection, might be the last opportunity for Bitcoin holders to purchase BTC at a relatively low value before post-halving sets in.

In a post on X, Rekt Capital explained that BTC price movement features are similar to previous Bitcoin halving cycles, which entails price declines before it sets off.

3 Phases of The Bitcoin Halving

1. Final Pre-Halving Retrace

Bitcoin has produced two -18% retraces prior to the Halving in the span of just over a month

In mid-March, BTC pulled back -18% before recovering to $70000 and now in mid-April BTC has retraced -18% again

This… pic.twitter.com/2BKBQXpPOV

— Rekt Capital (@rektcapital) April 17, 2024

Rekt projected a “re-accumulation phase” for Bitcoin following the halving event scheduled for April 20, adding that this phase has a history of lasting over a year (385 days).

Due to current market conditions, however, Rekt Capital suggests that this phase could be shorter, leading to a potential BTC price increase compared to previous cycles.