US stock traders are exacting a big influence on Bitcoin (BTC) prices, a South Korean crypto researcher has claimed.

Per the media outlet KyungHyang Games, the comments came from Kim Min-seung, the head of the Korbit Research Center at the Korbit crypto exchange.

US Stock Traders: Activity Influencing BTC Markets?

Kim noted that prices were once mainly influenced by the activities of Bitcoin miners and BTC whales. But he said that this has changed in recent months.

The Korbit official claimed that the Securities and Exchange Commission (SEC)’s decision to approve Bitcoin spot exchange-traded funds (ETFs) has created a new “market dynamic.”

This dynamic, Kim said, is now “centered on stock market traders.” The researcher said analysts have found that the price of Bitcoin is “sensitive to trends in US spot ETFs.”

NEW: 🇩🇪 Deutsche Bank survey via Reuters shows a big change in how people view #Bitcoin, as only 1%, down from 20% last year, consider it a fad. pic.twitter.com/2BfCBP3w0U

— Bitcoin News (@BitcoinNewsCom) April 9, 2024

Kim also claimed that “macro market factors” such as “interest rates, pandemics, policies, and wars” once had a major impact on BTC markets.

However, the SEC’s decision in January has proven to be a watershed, Kim said. He explained that crypto market trading bots in Asia and elsewhere have reportedly begun “buying and selling” following US stock traders and Bitcoin ETF trading patterns. Kim said:

“Over the past few months, Bitcoin tends to rise or fall during US stock market trading hours. Those same trends are being repeated during Asian market hours. BTC spot ETF approval seems to be behind this.”

Bitcoin’s “halving” later this month, a software code update that is being championed as a catalyst for further price increases, may already be factored in to a degree, according to the head of the largest US crypto miner. https://t.co/isj0DxpKGt

— Bloomberg Markets (@markets) April 9, 2024

BTC Spot, Futures Markets ‘Following Similar Patterns’

Kim said similar patterns were also being repeated in Bitcoin and crypto futures markets, leading to “the liquidation of long and short positions.”

Like other South Korean analysts, he predicted an inflow of “additional institutions” to the market.

If this were to occur in South Korea, this would likely have a seismic effect on the country’s BTC market.

The nation’s Bitcoin and altcoin markets are currently dominated by retail investors. Many institutional investors and funds have expressed an interest in BTC, but are yet to gain access to the markets.

Kim concluded that the above factors, as well as the forthcoming halving event, were “likely to create synergies to increase Bitcoin prices.”

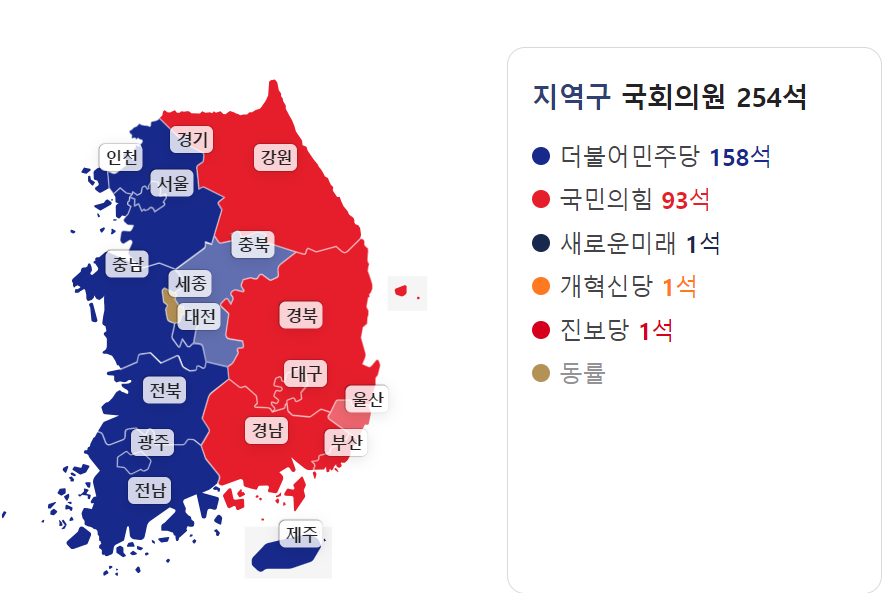

At the time of writing, the Democratic Party was poised to win a massive majority in April 10’s parliamentary elections. Under 5% of votes remained to be counted at 3:30 AM KST.

Before the poll, the Democratic Party promised voters that it would pressure regulators to approve South Korean Bitcoin and altcoin ETFs.