Bitcoin’s price fluctuating journey continues as it trades just below the $28,500 mark, with a modest increase of less than 0.50% on Wednesday. Several noteworthy events have punctuated the cryptocurrency landscape.

Fidelity, not one to be left behind, has revamped its spot in BTC ETF registration in light of the SEC’s recent critiques, placing itself alongside giants like Ark Invest and Invesco.

Meanwhile, El Salvador, a nation that recently embraced Bitcoin as legal tender, witnesses its ‘Rebirth’, attributed by Vice President Felix Ulloa to the cryptocurrency’s adoption. However, it’s not all positive news.

The US subsidiary of the global crypto behemoth, Binance, has paused direct dollar withdrawals, adding another layer of intrigue to Bitcoin’s narrative.

Fidelity Responds to SEC: Upgrades BTC ETF Registration, Aligning with Ark Invest and Invesco

Fidelity Funds Management LLC, in collaboration with Ark Invest and Invesco, has updated its filings for a spot Bitcoin Exchange-Traded Fund (ETF) after engaging with the US Securities and Exchange Commission (SEC).

This progress suggests ongoing dialogues between institutional entities and the SEC, nurturing hopes for future approval.

Notably, Ark Invest resubmitted its filing on October 12, with Invesco Galaxy following shortly after, highlighting shared concerns for the SEC.

These encompass addressing hard forks, complying with GAAP valuations and pricing, disclosing regulatory uncertainties, considering the energy intensity of mining, and assessing geographical implications.

These revisions illuminate the SEC’s priorities as a slew of applications is expected in Q1 2024.

Consequently, SEC Chair Gary Gensler is facing increased pressure for an imminent Spot BTC ETF endorsement.

A recent miscommunication regarding the approval of BlackRock’s iShares Spot BTC ETF influenced market sentiment, leading to a brief price decline.

However, the considerable latent demand for a BTC ETF is projected to bolster BTC prices in light of these events.

Presently, BTC prices are ascending, to approximately at $28,300, signaling renewed confidence.

El Salvador’s ‘Rebirth’: Vice President Felix Ulloa Credits Bitcoin Adoption

Salvadoran Vice President Felix Ulloa credits the nation’s “rebirth” to its historic decision to adopt Bitcoin as legal tender. He underscored its instrumental role in magnetizing both investors and tourists.

In 2021, El Salvador carved its name in history by becoming the maiden country to welcome Bitcoin as an official currency, a move that drew skepticism from influential bodies like the International Monetary Fund.

Yet, for Ulloa, this stride is commendable, pointing out the influx of investors intrigued by the nation’s burgeoning digital economy.

Furthermore, he draws attention to the symbiotic relationship between Bitcoin and El Salvador’s rejuvenated tourism sector.

With Bitcoin’s acceptance, tourists find transactions streamlined, bypassing the usual currency exchange hurdles.

In Ulloa’s perspective, the synergy of Bitcoin and tourism has been instrumental in El Salvador’s resurgence, echoing sentiments previously voiced by President Bukele.

Binance US Subsidiary Halts Direct Dollar Withdrawals

Binance’s U.S. subsidiary, Binance.US, announced on Monday a change in its withdrawal policy, no longer permitting direct dollar withdrawals for its users.

This decision comes after Binance.US had previously suspended dollar deposits in early June, a response to the U.S. Securities and Exchange Commission (SEC) pushing for an asset freeze.

According to the updated terms, users wishing to make U.S. dollar withdrawals must now first convert their funds into stablecoins or other digital assets.

Reuters, seeking a comment on this development, has yet to receive a response from Binance.US. The backdrop to this situation traces back to June when the SEC initiated a lawsuit against Binance, its CEO Changpeng Zhao, and Binance.US.

The regulatory body levelled allegations of deceptive practices, exaggerated trading volumes, and mismanagement of customer funds, with a total of 13 charges.

This unfolding situation might sway Bitcoin (BTC) prices, potentially bolstering the appeal of stablecoins and other digital assets as alternatives to direct dollar withdrawals from the platform.

Bitcoin Price Prediction

On the 4-hour chart, Bitcoin is currently trading at $28,498.50, experiencing minor fluctuations over the past 24 hours.

The key price levels to watch are a pivot point at $28,141, resistance levels at $28,634, $29,258, and $29,911, and support levels at $27,712, $27,144, and $26,576.

Diving into the technical indicators, the RSI stands at 71, indicating that the asset is in the overbought region, which could hint at potential price consolidation or a slight pullback in the near term.

The MACD, meanwhile, is showing a bearish sentiment as the main MACD line is currently below the signal line. This suggests that investors should remain cautious of potential trend reversals.

Additionally, Bitcoin’s price is currently above the 50 EMA, which is set at $27,611, pointing to a short-term bullish momentum.

In conclusion, the overall trend for BTC/USD seems bullish, especially if the price remains above the $28,600 mark.

The short-term forecast suggests that Bitcoin might attempt to breach the immediate resistance level of $28,634 in the forthcoming trading sessions.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023.

Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

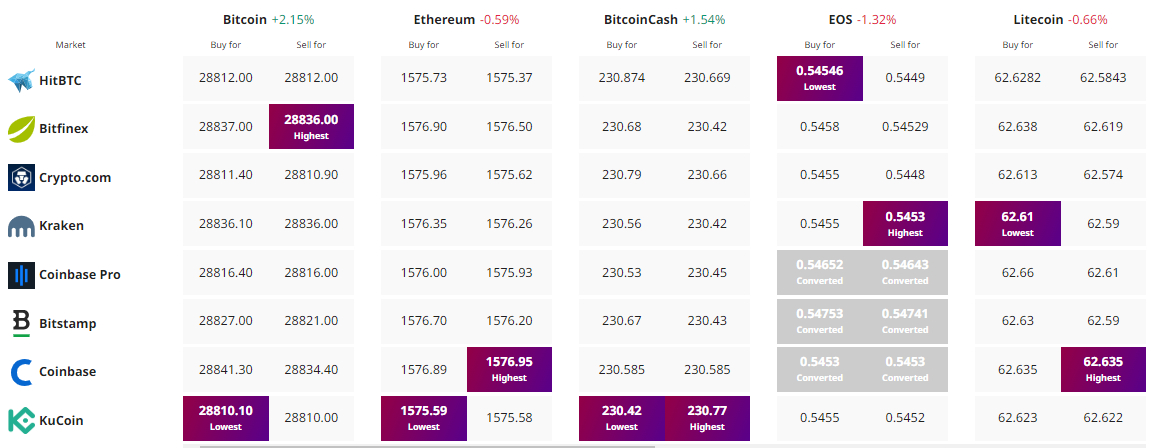

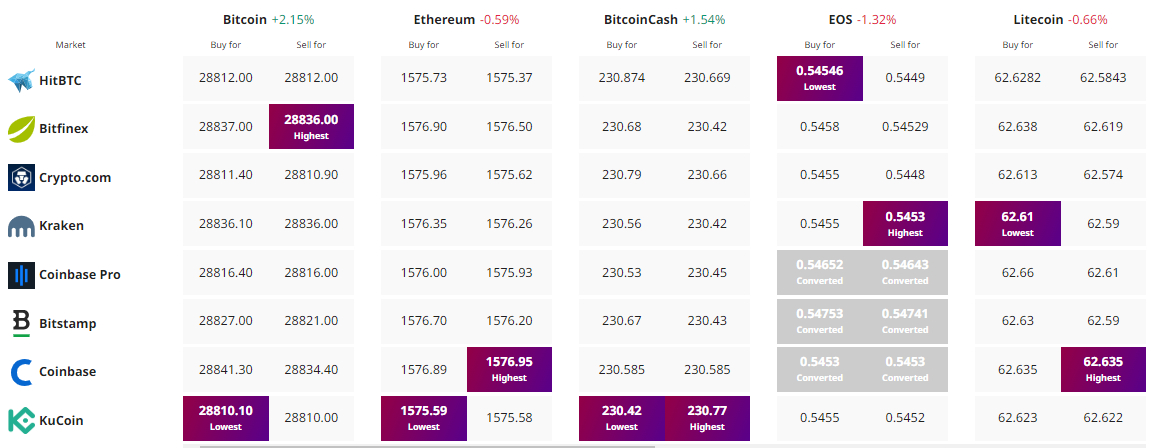

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

Bitcoin’s price fluctuating journey continues as it trades just below the $28,500 mark, with a modest increase of less than 0.50% on Wednesday. Several noteworthy events have punctuated the cryptocurrency landscape.

Fidelity, not one to be left behind, has revamped its spot in BTC ETF registration in light of the SEC’s recent critiques, placing itself alongside giants like Ark Invest and Invesco.

Meanwhile, El Salvador, a nation that recently embraced Bitcoin as legal tender, witnesses its ‘Rebirth’, attributed by Vice President Felix Ulloa to the cryptocurrency’s adoption. However, it’s not all positive news.

The US subsidiary of the global crypto behemoth, Binance, has paused direct dollar withdrawals, adding another layer of intrigue to Bitcoin’s narrative.

Fidelity Responds to SEC: Upgrades BTC ETF Registration, Aligning with Ark Invest and Invesco

Fidelity Funds Management LLC, in collaboration with Ark Invest and Invesco, has updated its filings for a spot Bitcoin Exchange-Traded Fund (ETF) after engaging with the US Securities and Exchange Commission (SEC).

This progress suggests ongoing dialogues between institutional entities and the SEC, nurturing hopes for future approval.

Notably, Ark Invest resubmitted its filing on October 12, with Invesco Galaxy following shortly after, highlighting shared concerns for the SEC.

These encompass addressing hard forks, complying with GAAP valuations and pricing, disclosing regulatory uncertainties, considering the energy intensity of mining, and assessing geographical implications.

These revisions illuminate the SEC’s priorities as a slew of applications is expected in Q1 2024.

Consequently, SEC Chair Gary Gensler is facing increased pressure for an imminent Spot BTC ETF endorsement.

A recent miscommunication regarding the approval of BlackRock’s iShares Spot BTC ETF influenced market sentiment, leading to a brief price decline.

However, the considerable latent demand for a BTC ETF is projected to bolster BTC prices in light of these events.

Presently, BTC prices are ascending, to approximately at $28,300, signaling renewed confidence.

El Salvador’s ‘Rebirth’: Vice President Felix Ulloa Credits Bitcoin Adoption

Salvadoran Vice President Felix Ulloa credits the nation’s “rebirth” to its historic decision to adopt Bitcoin as legal tender. He underscored its instrumental role in magnetizing both investors and tourists.

In 2021, El Salvador carved its name in history by becoming the maiden country to welcome Bitcoin as an official currency, a move that drew skepticism from influential bodies like the International Monetary Fund.

Yet, for Ulloa, this stride is commendable, pointing out the influx of investors intrigued by the nation’s burgeoning digital economy.

Furthermore, he draws attention to the symbiotic relationship between Bitcoin and El Salvador’s rejuvenated tourism sector.

With Bitcoin’s acceptance, tourists find transactions streamlined, bypassing the usual currency exchange hurdles.

In Ulloa’s perspective, the synergy of Bitcoin and tourism has been instrumental in El Salvador’s resurgence, echoing sentiments previously voiced by President Bukele.

Binance US Subsidiary Halts Direct Dollar Withdrawals

Binance’s U.S. subsidiary, Binance.US, announced on Monday a change in its withdrawal policy, no longer permitting direct dollar withdrawals for its users.

This decision comes after Binance.US had previously suspended dollar deposits in early June, a response to the U.S. Securities and Exchange Commission (SEC) pushing for an asset freeze.

According to the updated terms, users wishing to make U.S. dollar withdrawals must now first convert their funds into stablecoins or other digital assets.

Reuters, seeking a comment on this development, has yet to receive a response from Binance.US. The backdrop to this situation traces back to June when the SEC initiated a lawsuit against Binance, its CEO Changpeng Zhao, and Binance.US.

The regulatory body levelled allegations of deceptive practices, exaggerated trading volumes, and mismanagement of customer funds, with a total of 13 charges.

This unfolding situation might sway Bitcoin (BTC) prices, potentially bolstering the appeal of stablecoins and other digital assets as alternatives to direct dollar withdrawals from the platform.

Bitcoin Price Prediction

On the 4-hour chart, Bitcoin is currently trading at $28,498.50, experiencing minor fluctuations over the past 24 hours.

The key price levels to watch are a pivot point at $28,141, resistance levels at $28,634, $29,258, and $29,911, and support levels at $27,712, $27,144, and $26,576.

Diving into the technical indicators, the RSI stands at 71, indicating that the asset is in the overbought region, which could hint at potential price consolidation or a slight pullback in the near term.

The MACD, meanwhile, is showing a bearish sentiment as the main MACD line is currently below the signal line. This suggests that investors should remain cautious of potential trend reversals.

Additionally, Bitcoin’s price is currently above the 50 EMA, which is set at $27,611, pointing to a short-term bullish momentum.

In conclusion, the overall trend for BTC/USD seems bullish, especially if the price remains above the $28,600 mark.

The short-term forecast suggests that Bitcoin might attempt to breach the immediate resistance level of $28,634 in the forthcoming trading sessions.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023.

Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.