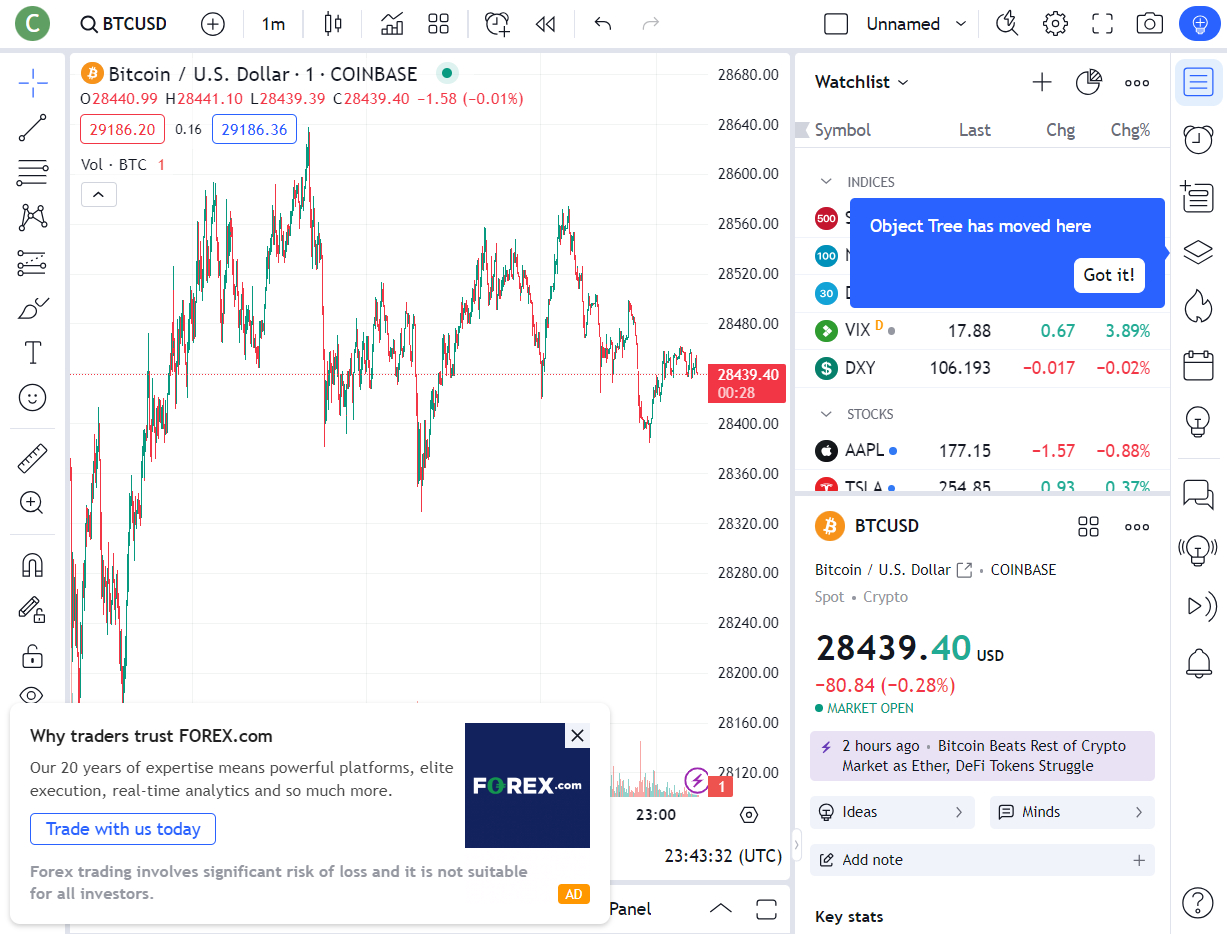

BTC/USD Chart (Coinbase)/ Source: TradingView

Bitcoin prices have retained their strength today, managing to achieve relative stability in spite of the latest news that Binance.US has stopped its customers from directly withdrawing the U.S. dollar.

Yesterday, the exchange updated its terms of use.

The updated terms specified that “In the event that customers wish to withdraw U.S. dollar funds from their account, they may do so by converting U.S. dollar funds to stablecoin or other digital assets, which can subsequently be withdrawn,” Reuters reported earlier today.

Interestingly enough, bitcoin, the world’s most prominent digital currency, seemed unfazed, trading primarily between $28,300 and $28,500, according to Coinbase data provided by TradingView.

When asked about the market’s response to this latest Binance-related news, several analysts did not appear shocked.

“While the binance.us news is definitely bearish, it also comes as no surprise,” said Tim Enneking, managing director of Digital Capital Management.

“The vast majority of binance.us users have long since pulled all assets off of the exchange, so this announcement surprised literally no one,” he added.

Armando Aguilar, an independent cryptocurrency analyst, also offered his point of view.

“As of February (Binance averted shutdown in June 2023), Binance.US had ~700k users and the market had priced Binance’s potential U.S. problems during late summer so the halting of USD withdrawals might not be considered bearish news,” he stated.

Aguilar elaborated, speaking to some major developments in the space.

“The headlines has been CEO of BlackRock, Larry Fink calling crypto a ‘flight to safety’ on public national television as a response to ongoing unrest in Israel and other events around the world,” said Aguilar.

“It’s important to understand the magnitude of such a statement as a few years ago, Larry Fink called BTC an “index for money laundering” in 2017, but now BlackRock has skin in the game and will benefit from the rise in BTC prices if it’s awaited Spot BTC ETF is approved,” he added.

“Several other spot BTC ETFs are in the pipeline as well.”

“Given Bloombergs analyst high approval rate, investors seem to be bullish on spot BTC ETFs thus keeping small price momentum given the global macroeconomic environment,” Aguilar noted.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

BTC/USD Chart (Coinbase)/ Source: TradingView

Bitcoin prices have retained their strength today, managing to achieve relative stability in spite of the latest news that Binance.US has stopped its customers from directly withdrawing the U.S. dollar.

Yesterday, the exchange updated its terms of use.

The updated terms specified that “In the event that customers wish to withdraw U.S. dollar funds from their account, they may do so by converting U.S. dollar funds to stablecoin or other digital assets, which can subsequently be withdrawn,” Reuters reported earlier today.

Interestingly enough, bitcoin, the world’s most prominent digital currency, seemed unfazed, trading primarily between $28,300 and $28,500, according to Coinbase data provided by TradingView.

When asked about the market’s response to this latest Binance-related news, several analysts did not appear shocked.

“While the binance.us news is definitely bearish, it also comes as no surprise,” said Tim Enneking, managing director of Digital Capital Management.

“The vast majority of binance.us users have long since pulled all assets off of the exchange, so this announcement surprised literally no one,” he added.

Armando Aguilar, an independent cryptocurrency analyst, also offered his point of view.

“As of February (Binance averted shutdown in June 2023), Binance.US had ~700k users and the market had priced Binance’s potential U.S. problems during late summer so the halting of USD withdrawals might not be considered bearish news,” he stated.

Aguilar elaborated, speaking to some major developments in the space.

“The headlines has been CEO of BlackRock, Larry Fink calling crypto a ‘flight to safety’ on public national television as a response to ongoing unrest in Israel and other events around the world,” said Aguilar.

“It’s important to understand the magnitude of such a statement as a few years ago, Larry Fink called BTC an “index for money laundering” in 2017, but now BlackRock has skin in the game and will benefit from the rise in BTC prices if it’s awaited Spot BTC ETF is approved,” he added.

“Several other spot BTC ETFs are in the pipeline as well.”

“Given Bloombergs analyst high approval rate, investors seem to be bullish on spot BTC ETFs thus keeping small price momentum given the global macroeconomic environment,” Aguilar noted.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.