On Wednesday, Bitcoin price experienced a minor setback, with its price declining by 1.75% to trade at $27,325. This dip comes amidst a flourishing economy, suggesting that now might be an opportune moment for investors to delve deeper into the world of Bitcoin.

Notably, the stability of Bitcoin is evident, with 95% of its supply remaining unshaken over the past month, underscoring its strong dominance in the cryptocurrency realm.

Further emphasizing Bitcoin’s unique standing, a recent report by Fidelity Digital Assets elucidates how Bitcoin distinctly carves its niche, setting itself apart from other assets in the crypto economy.

Is it time to invest in Bitcoin?

In light of the robust state of the US economy, the price of Bitcoin may receive a much-needed boost, especially with the upcoming Bitcoin halving.

Despite the rising long-term Treasury bond yields and surging mortgage rates, the US economy continues to thrive, adding a significant 336,000 jobs in September, exceeding expectations and demonstrating its resilience.

The bond market’s historic sell-off may be approaching its end, potentially marking the beginning of a new bull market for risk assets.

When it comes to cryptocurrencies, Bitcoin’s short-term price performance is highly influenced by regulatory decisions, particularly those related to a Bitcoin spot ETF.

A green light for a spot ETF could lead to substantial inflows of BTC. The Federal Reserve’s decisions and potential regulatory clarity may set the stage for a positive market environment.

With the festive season just around the corner, a “Santa rally” and Bitcoin’s halving in April 2024 offer hope for a brighter crypto market outlook, despite macroeconomic uncertainties.

The regulatory landscape and the Fed’s messaging will be key determinants of market direction.

BTC Supremacy Remains Strong Despite Stable Supply

Bitcoin’s dominance in the cryptocurrency market has been steadily increasing and reached a three-month high in October, surpassing 51%. This resurgence in Bitcoin’s dominance is attributed to market de-risking in the range of $27,400 to $27,300.

This is a positive sign and suggests renewed confidence among investors, which is reflected in their appetite for capital inflows.

In addition, data shows that almost 95% of the Bitcoin supply has remained stationary over the past month, marking an all-time high.

This indicates that a significant portion of Bitcoin holders have chosen a long-term investment approach, demonstrating their trust in the cryptocurrency’s potential for the future.

Bitcoin’s value as a safe-haven asset is emphasized as its dominance grows, potentially leading to improved market outlook and price recovery by drawing investors away from riskier altcoins during times of uncertainty.

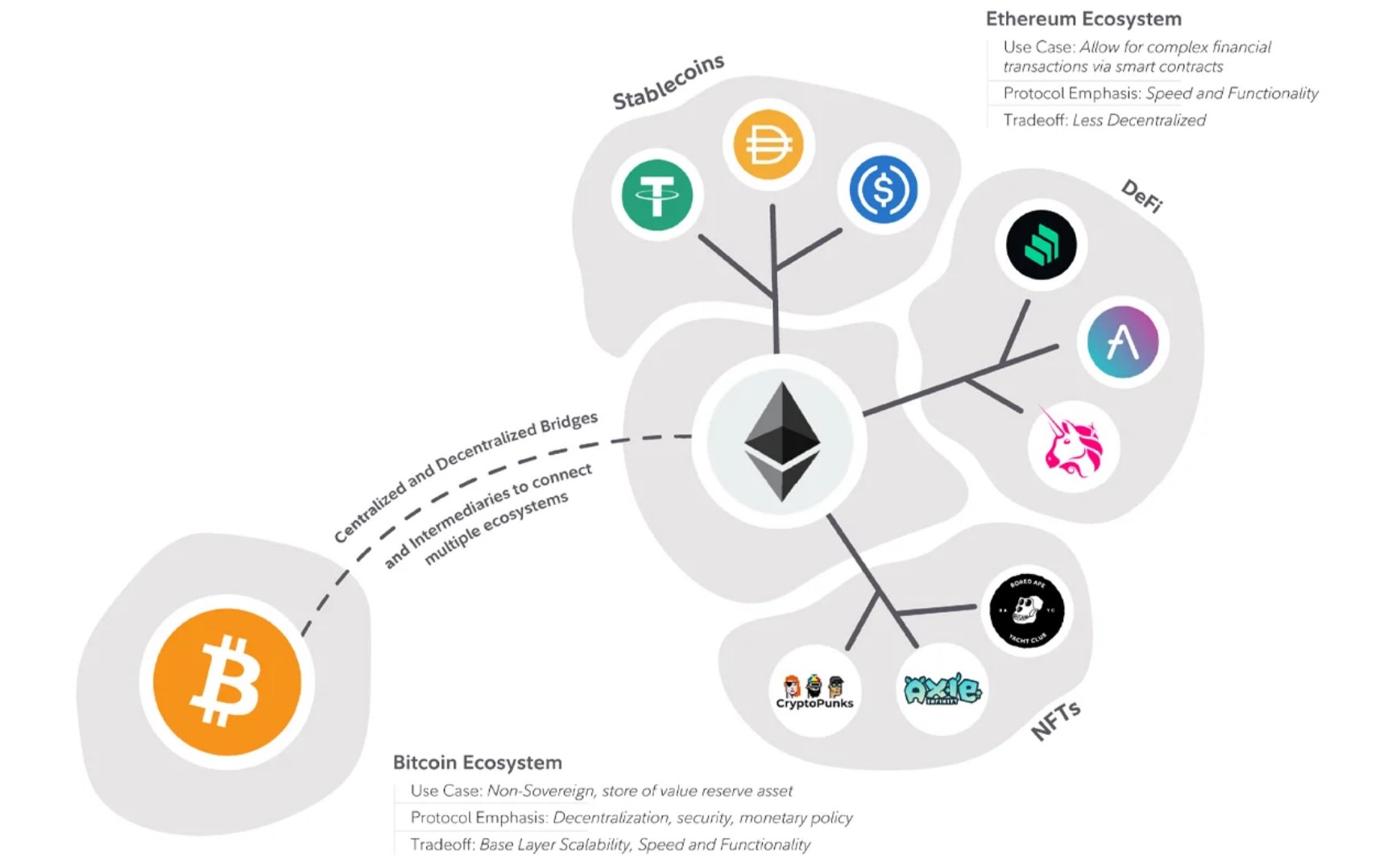

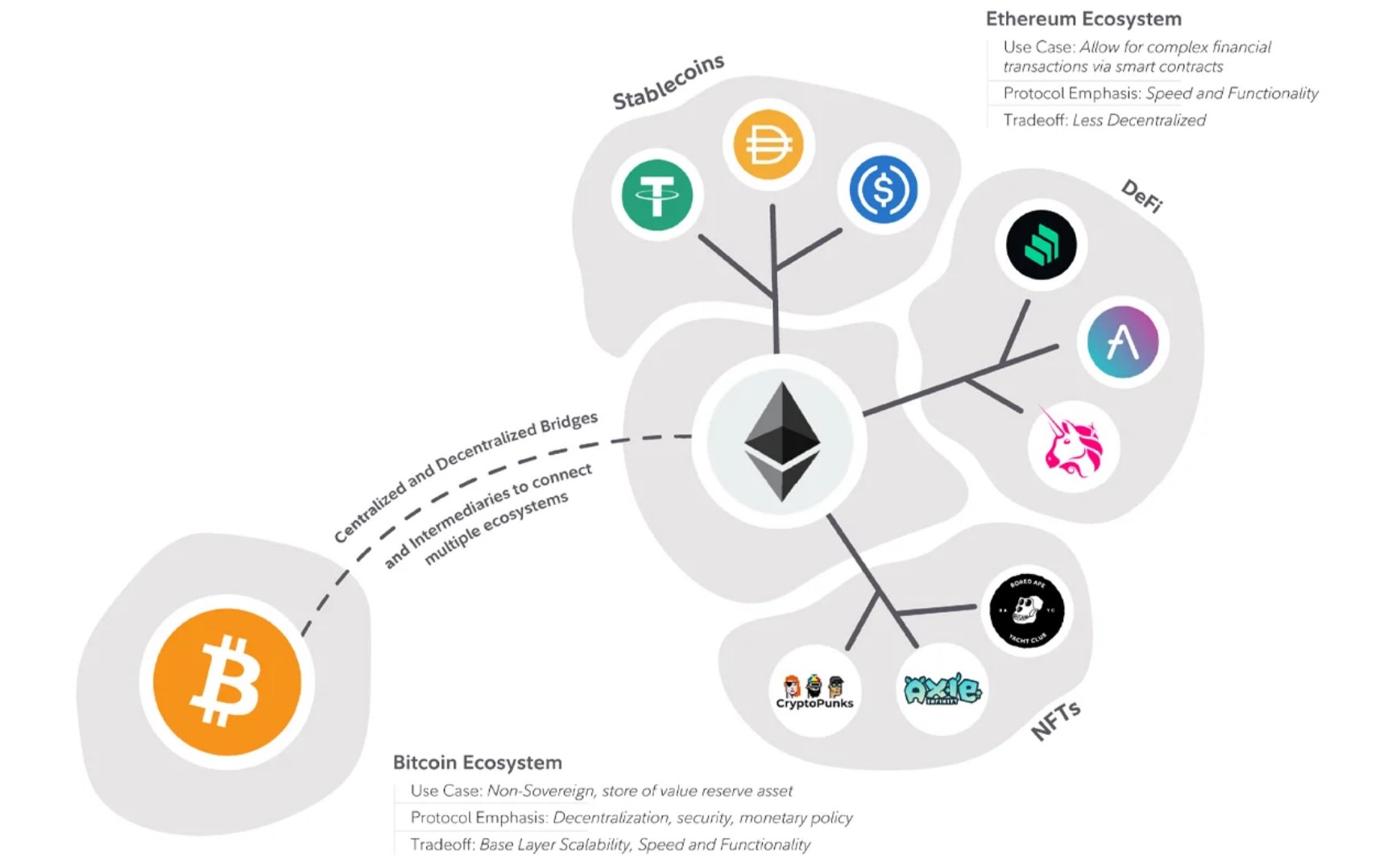

New Fidelity Digital Assets Report Highlights Unique Features of Bitcoin in Crypto Economy

A recent Fidelity Digital Assets (FDA) report states that Bitcoin should be evaluated separately from other digital assets in crypto investment portfolios.

Fidelity Digital Assets is affiliated with the third-largest asset manager worldwide and has a bullish stance on Bitcoin.

The report suggests that Bitcoin serves as a scarce monetary asset and a store of value, while other digital assets exhibit venture capital-like properties.

The report highlights Bitcoin’s security and decentralization, making it the most secure and decentralized monetary network. This sets it apart from competitors in different use cases.

The report recommends assessing Bitcoin as a monetary asset before considering other, higher-risk digital assets complementing a portfolio.

This distinctive evaluation approach recognizes Bitcoin’s potential as a dominant monetary network.

Bitcoin Price Prediction

Analyzing the 4-hour chart, Bitcoin’s pivot point is placed at $27,919. Resistance levels to watch are $28,630, $29,308, and $30,030.

On the downside, support can be found at $27,242, $26,519, and $25,842. The Relative Strength Index (RSI) registers a value of 31.72, hovering close to the oversold territory.

Furthermore, Bitcoin is trading slightly below its 50-Day Exponential Moving Average (EMA) of $27,577.21, indicating a short-term bearish trend.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023.

Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

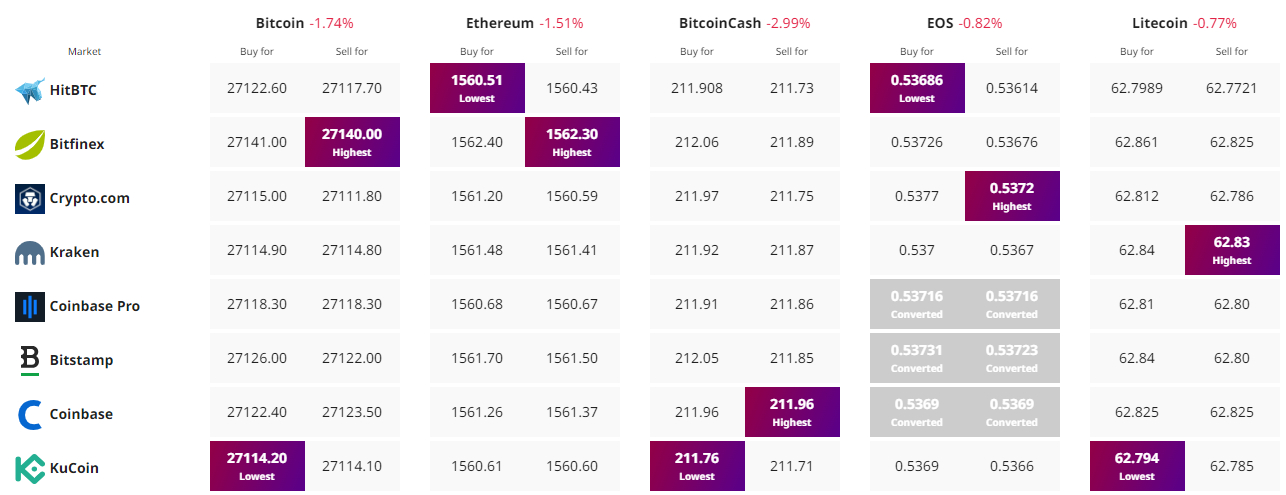

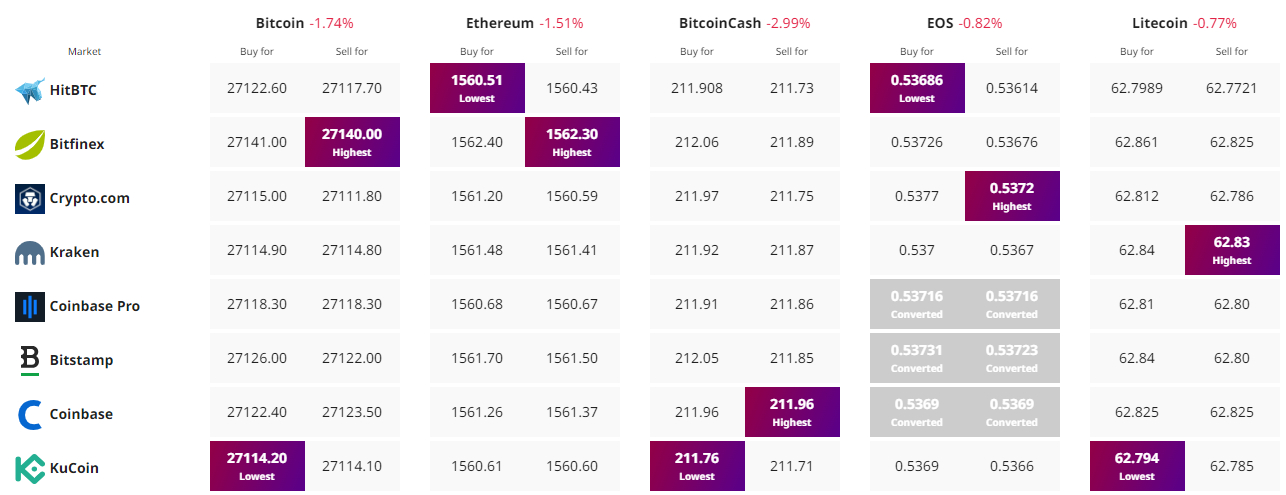

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

On Wednesday, Bitcoin price experienced a minor setback, with its price declining by 1.75% to trade at $27,325. This dip comes amidst a flourishing economy, suggesting that now might be an opportune moment for investors to delve deeper into the world of Bitcoin.

Notably, the stability of Bitcoin is evident, with 95% of its supply remaining unshaken over the past month, underscoring its strong dominance in the cryptocurrency realm.

Further emphasizing Bitcoin’s unique standing, a recent report by Fidelity Digital Assets elucidates how Bitcoin distinctly carves its niche, setting itself apart from other assets in the crypto economy.

Is it time to invest in Bitcoin?

In light of the robust state of the US economy, the price of Bitcoin may receive a much-needed boost, especially with the upcoming Bitcoin halving.

Despite the rising long-term Treasury bond yields and surging mortgage rates, the US economy continues to thrive, adding a significant 336,000 jobs in September, exceeding expectations and demonstrating its resilience.

The bond market’s historic sell-off may be approaching its end, potentially marking the beginning of a new bull market for risk assets.

When it comes to cryptocurrencies, Bitcoin’s short-term price performance is highly influenced by regulatory decisions, particularly those related to a Bitcoin spot ETF.

A green light for a spot ETF could lead to substantial inflows of BTC. The Federal Reserve’s decisions and potential regulatory clarity may set the stage for a positive market environment.

With the festive season just around the corner, a “Santa rally” and Bitcoin’s halving in April 2024 offer hope for a brighter crypto market outlook, despite macroeconomic uncertainties.

The regulatory landscape and the Fed’s messaging will be key determinants of market direction.

BTC Supremacy Remains Strong Despite Stable Supply

Bitcoin’s dominance in the cryptocurrency market has been steadily increasing and reached a three-month high in October, surpassing 51%. This resurgence in Bitcoin’s dominance is attributed to market de-risking in the range of $27,400 to $27,300.

This is a positive sign and suggests renewed confidence among investors, which is reflected in their appetite for capital inflows.

In addition, data shows that almost 95% of the Bitcoin supply has remained stationary over the past month, marking an all-time high.

This indicates that a significant portion of Bitcoin holders have chosen a long-term investment approach, demonstrating their trust in the cryptocurrency’s potential for the future.

Bitcoin’s value as a safe-haven asset is emphasized as its dominance grows, potentially leading to improved market outlook and price recovery by drawing investors away from riskier altcoins during times of uncertainty.

New Fidelity Digital Assets Report Highlights Unique Features of Bitcoin in Crypto Economy

A recent Fidelity Digital Assets (FDA) report states that Bitcoin should be evaluated separately from other digital assets in crypto investment portfolios.

Fidelity Digital Assets is affiliated with the third-largest asset manager worldwide and has a bullish stance on Bitcoin.

The report suggests that Bitcoin serves as a scarce monetary asset and a store of value, while other digital assets exhibit venture capital-like properties.

The report highlights Bitcoin’s security and decentralization, making it the most secure and decentralized monetary network. This sets it apart from competitors in different use cases.

The report recommends assessing Bitcoin as a monetary asset before considering other, higher-risk digital assets complementing a portfolio.

This distinctive evaluation approach recognizes Bitcoin’s potential as a dominant monetary network.

Bitcoin Price Prediction

Analyzing the 4-hour chart, Bitcoin’s pivot point is placed at $27,919. Resistance levels to watch are $28,630, $29,308, and $30,030.

On the downside, support can be found at $27,242, $26,519, and $25,842. The Relative Strength Index (RSI) registers a value of 31.72, hovering close to the oversold territory.

Furthermore, Bitcoin is trading slightly below its 50-Day Exponential Moving Average (EMA) of $27,577.21, indicating a short-term bearish trend.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023.

Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.