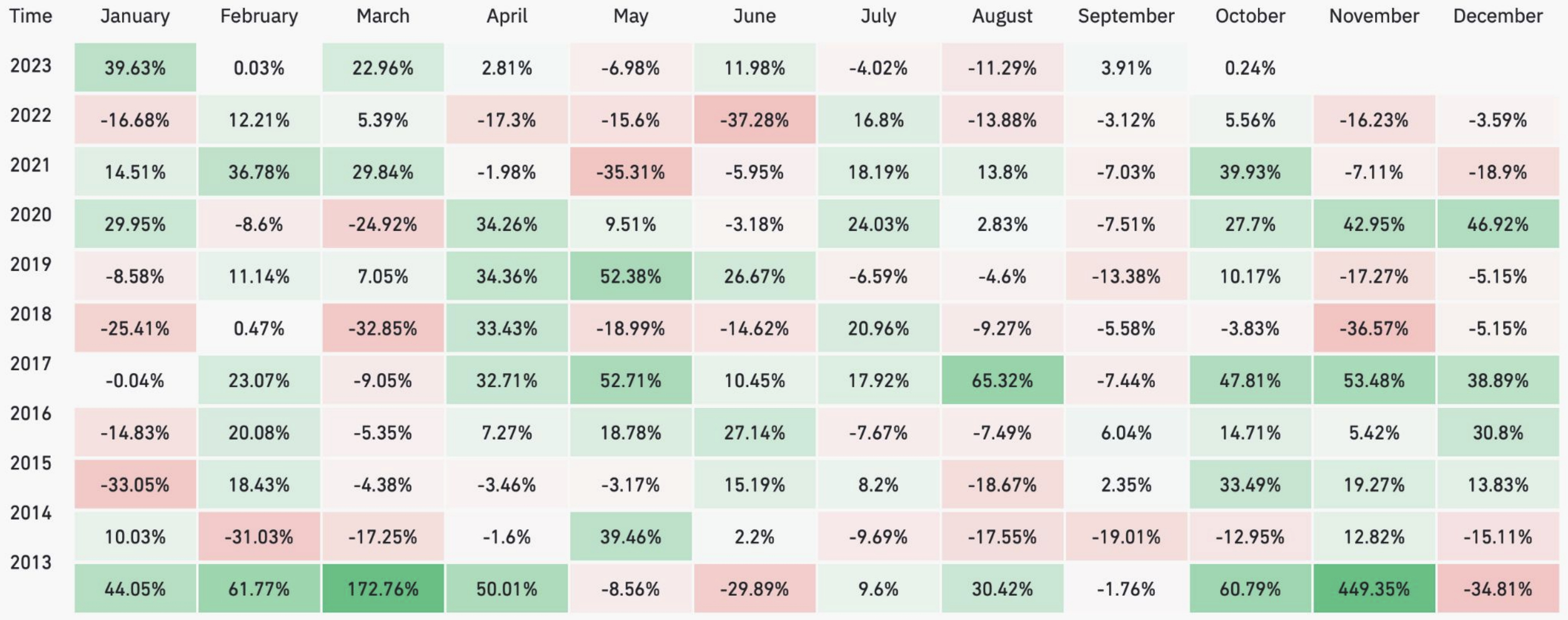

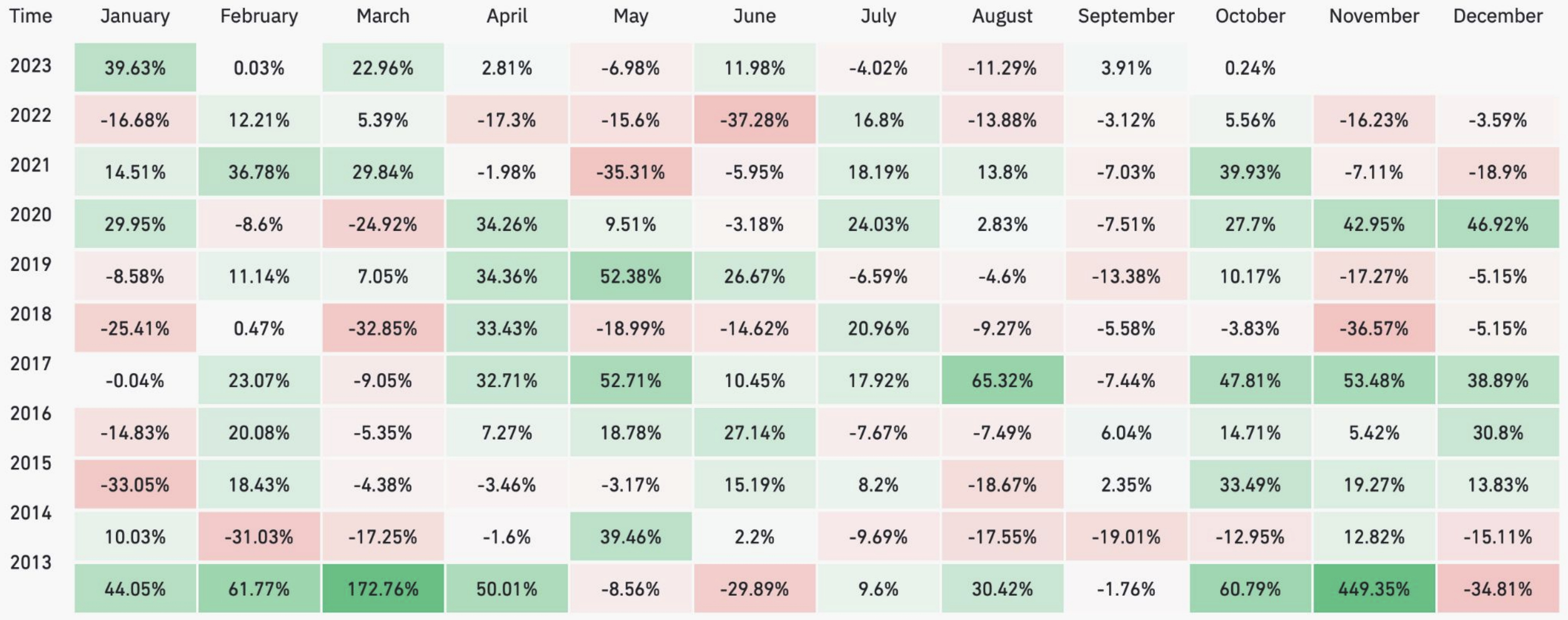

Bitcoin’s performance in September, which saw it closing the month in the green, has piqued the interest of analysts at the crypto exchange Bitfinex, who suggest this could signal a bullish October for the number one cryptocurrency.

Historically, a positive September has often set the stage for a bullish October in the Bitcoin market.

Bitfinex analysts point out that the combined crypto market cap increased by 6.1% during September, marking a rare occurrence of the month closing positively.

The Bitfinex Alpha report for the week highlights that several factors support a forecast of increased volatility and potential upside for Bitcoin in the coming month.

Futures market metrics and other indicators hint at the possibility of more significant price movements, particularly on higher timeframes.

Options data reveals higher volatility expectations

In the report, the analysts also said the crypto options market is showing signs of anticipating higher market volatility.

When implied volatility surpasses historical volatility, it often indicates that traders are bracing for increased price swings.

Strong on-chain support at current price

Bitfinex’s report also references on-chain data that suggests strong support for Bitcoin’s current price levels.

Long-term holders appear determined to maintain their positions, which is contributing to the cryptocurrency’s stability.

Additionally, the report notes that Bitcoin held for periods between 6 and 12 months remains relatively static, while BTC supply aged more than three years has been largely inactive since February 2023.

These trends suggest that long-term investors are holding onto their Bitcoin holdings, often referred to as “HODLing” in crypto circles.

Bitcoin began September at approximately $25,900 and closed the month just under $27,000, representing a 3.9% gain for the month.

Bitcoin’s performance in September, which saw it closing the month in the green, has piqued the interest of analysts at the crypto exchange Bitfinex, who suggest this could signal a bullish October for the number one cryptocurrency.

Historically, a positive September has often set the stage for a bullish October in the Bitcoin market.

Bitfinex analysts point out that the combined crypto market cap increased by 6.1% during September, marking a rare occurrence of the month closing positively.

The Bitfinex Alpha report for the week highlights that several factors support a forecast of increased volatility and potential upside for Bitcoin in the coming month.

Futures market metrics and other indicators hint at the possibility of more significant price movements, particularly on higher timeframes.

Options data reveals higher volatility expectations

In the report, the analysts also said the crypto options market is showing signs of anticipating higher market volatility.

When implied volatility surpasses historical volatility, it often indicates that traders are bracing for increased price swings.

Strong on-chain support at current price

Bitfinex’s report also references on-chain data that suggests strong support for Bitcoin’s current price levels.

Long-term holders appear determined to maintain their positions, which is contributing to the cryptocurrency’s stability.

Additionally, the report notes that Bitcoin held for periods between 6 and 12 months remains relatively static, while BTC supply aged more than three years has been largely inactive since February 2023.

These trends suggest that long-term investors are holding onto their Bitcoin holdings, often referred to as “HODLing” in crypto circles.

Bitcoin began September at approximately $25,900 and closed the month just under $27,000, representing a 3.9% gain for the month.