Bitcoin (BTC), the world’s largest cryptocurrency, experienced some gains but remained below the $27,000 mark on Friday morning.

Meanwhile, the total value of all cryptocurrencies stood at $1.07 trillion at the time of this report, showing a 2.50% increase in the last 24 hours.

Bitcoin’s price surged past the $27,200 mark before stabilizing above $26,900, seemingly due to Valkyrie Funds LLC’s approval to include Ethereum futures in its Bitcoin futures exchange-traded fund.

Bitcoin’s recognition in Shanghai has boosted its value and influenced positive sentiment towards it as a digital asset. Investors are closely watching these developments.

Ethereum Futures Approved in Valkyrie Bitcoin ETF, Boosting Crypto Market Optimism

It is important to note that Valkyrie Funds LLC has received approval from the US Securities and Exchange Commission (SEC) to include Ethereum futures in their existing Bitcoin futures exchange-traded fund (ETF).

The ETF has been renamed as the Valkyrie Bitcoin and Ether Strategy ETF (BTF.O) and is set to launch next Monday.

This is a significant development as it will be the first time that Ethereum or “ether” futures contracts will be available to investors through an ETF, which is a big deal for the cryptocurrency market.

Several firms, including Valkyrie Funds LLC, VanEck, and ProShares, are preparing to launch dedicated Ethereum futures ETFs.

The SEC’s approval of these ETFs is a positive development for the cryptocurrency industry, which has been seeking more investment options.

As a result of this news, Ethereum prices have already started to rise, with an increase of almost 6% this week, including a 3.3% gain on Thursday.

Bitcoin Price Prediction

Bitcoin’s resurgence is undeniable, having recently experienced a surge that propelled its price to $27,148, representing a significant 4% increase in just one day.

As trading volume also rose dramatically, reaching an impressive $13.98 billion, Bitcoin’s position as a leading cryptocurrency remains unchallenged.

It maintains its top rank on CoinMarketCap and boasts a market capitalization of around $529.36 billion, with 19.5 million BTC coins currently in circulation out of a capped supply of 21 million BTC.

On a 4-hour chart, the asset’s pivot point is evident at $26,629. Bitcoin faces immediate resistance at $27,100, followed by resistance levels at $27,958 and $28,438, while support levels are identified at $25,772, $25,283, and $24,426.

Technical indicators show that the Relative Strength Index (RSI) rests at 67, hovering near the overbought threshold, and that the Moving Average Convergence Divergence (MACD) values signal potential shifts in momentum.

Bitcoin’s price remains above the 50-day Exponential Moving Average (EMA) of $26,500, indicating a short-term bullish trend.

Bitcoin’s charts show an upward trendline, currently testing the $27,100 resistance. It’s an important level that could amplify buying sentiments or trigger selling.

If Bitcoin sustains above $27,000, the trend leans bullish. However, if it goes below $27,000, bearish tides might dominate.

Traders should monitor the test of the $27,100 resistance closely for short-term movements.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023.

Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

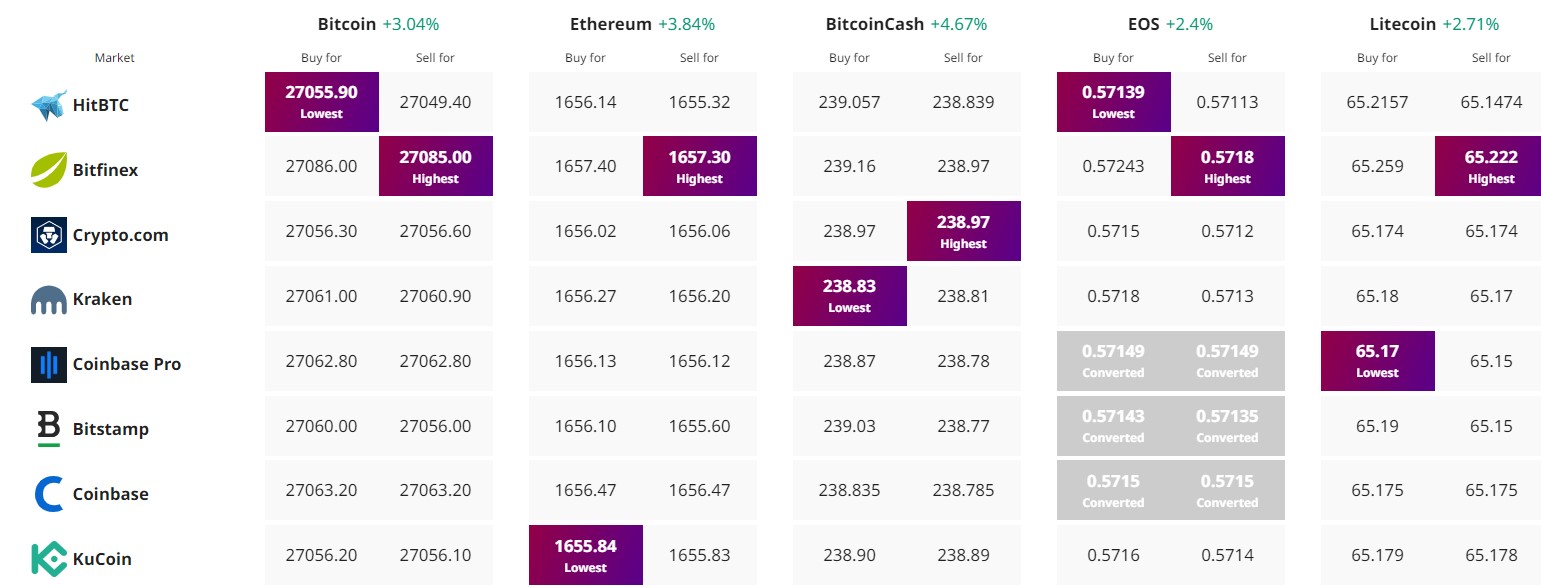

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

Bitcoin (BTC), the world’s largest cryptocurrency, experienced some gains but remained below the $27,000 mark on Friday morning.

Meanwhile, the total value of all cryptocurrencies stood at $1.07 trillion at the time of this report, showing a 2.50% increase in the last 24 hours.

Bitcoin’s price surged past the $27,200 mark before stabilizing above $26,900, seemingly due to Valkyrie Funds LLC’s approval to include Ethereum futures in its Bitcoin futures exchange-traded fund.

Bitcoin’s recognition in Shanghai has boosted its value and influenced positive sentiment towards it as a digital asset. Investors are closely watching these developments.

Ethereum Futures Approved in Valkyrie Bitcoin ETF, Boosting Crypto Market Optimism

It is important to note that Valkyrie Funds LLC has received approval from the US Securities and Exchange Commission (SEC) to include Ethereum futures in their existing Bitcoin futures exchange-traded fund (ETF).

The ETF has been renamed as the Valkyrie Bitcoin and Ether Strategy ETF (BTF.O) and is set to launch next Monday.

This is a significant development as it will be the first time that Ethereum or “ether” futures contracts will be available to investors through an ETF, which is a big deal for the cryptocurrency market.

Several firms, including Valkyrie Funds LLC, VanEck, and ProShares, are preparing to launch dedicated Ethereum futures ETFs.

The SEC’s approval of these ETFs is a positive development for the cryptocurrency industry, which has been seeking more investment options.

As a result of this news, Ethereum prices have already started to rise, with an increase of almost 6% this week, including a 3.3% gain on Thursday.

Bitcoin Price Prediction

Bitcoin’s resurgence is undeniable, having recently experienced a surge that propelled its price to $27,148, representing a significant 4% increase in just one day.

As trading volume also rose dramatically, reaching an impressive $13.98 billion, Bitcoin’s position as a leading cryptocurrency remains unchallenged.

It maintains its top rank on CoinMarketCap and boasts a market capitalization of around $529.36 billion, with 19.5 million BTC coins currently in circulation out of a capped supply of 21 million BTC.

On a 4-hour chart, the asset’s pivot point is evident at $26,629. Bitcoin faces immediate resistance at $27,100, followed by resistance levels at $27,958 and $28,438, while support levels are identified at $25,772, $25,283, and $24,426.

Technical indicators show that the Relative Strength Index (RSI) rests at 67, hovering near the overbought threshold, and that the Moving Average Convergence Divergence (MACD) values signal potential shifts in momentum.

Bitcoin’s price remains above the 50-day Exponential Moving Average (EMA) of $26,500, indicating a short-term bullish trend.

Bitcoin’s charts show an upward trendline, currently testing the $27,100 resistance. It’s an important level that could amplify buying sentiments or trigger selling.

If Bitcoin sustains above $27,000, the trend leans bullish. However, if it goes below $27,000, bearish tides might dominate.

Traders should monitor the test of the $27,100 resistance closely for short-term movements.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023.

Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

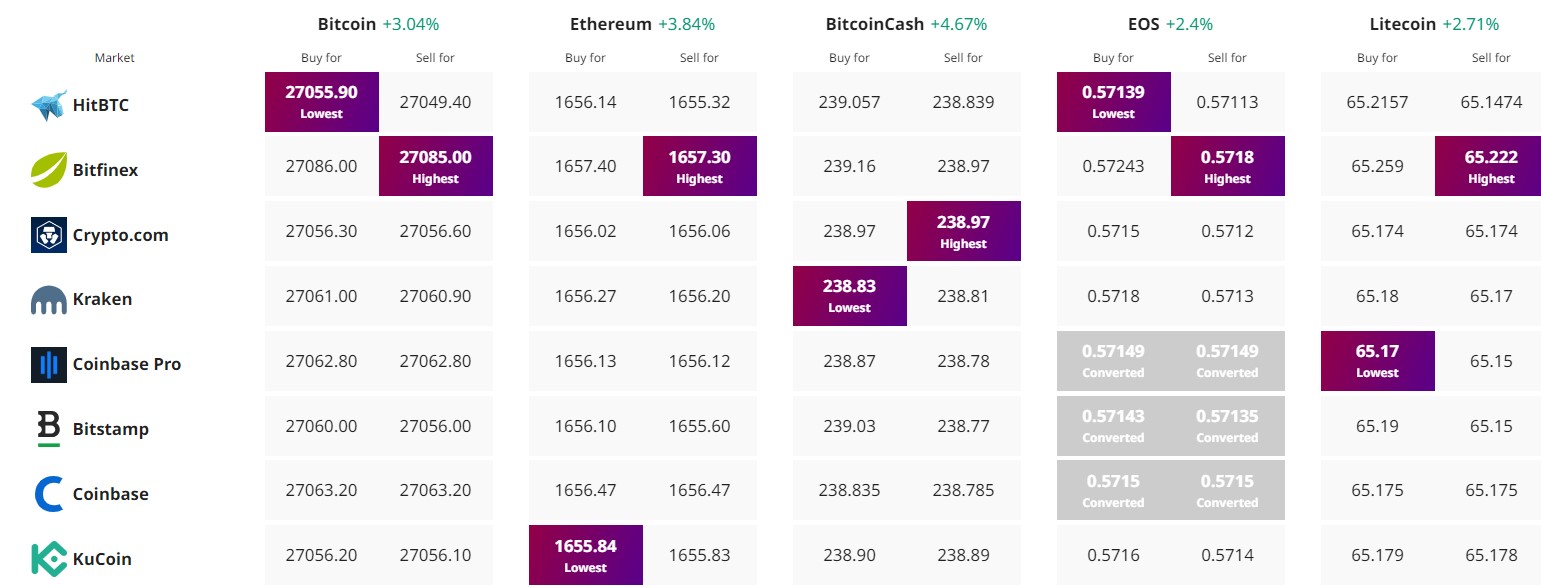

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.