New data released today by Daniel Batten, the co-founder of CH4Capital, revealed that Bitcoin mining is now leading as the most sustainably-powered global industry, with over half of its energy consumption coming from renewable sources.

This development is contrary to widespread criticism that has often labeled the sector as energy-intensive and environmentally damaging. However, the real picture is more nuanced and critics bring up some good points that Bitcoin advocates should not dismiss–which we’ll explore more later in the article.

Transitioning to Green: Bitcoin Mining’s Sustainability Metrics

Batten’s post on social media platform X shows that the Bitcoin mining industry has rapidly incorporated sustainable energy solutions into its operations.

Charts shared by Batten illustrate the growth in the use of renewable energy sources in the Bitcoin mining sector over the past four years. In contrast, other major industries have shown only minimal increases in the use of clean energy.

The banking sector, which ranks second in adopting clean energy, has seen only a 2.6% rise.

Meanwhile, Bitcoin mining has recorded an impressive 38% increase in the use of sustainable energy, pushing the total share to 52.6%. The data clearly establishes Bitcoin mining as the most eco-friendly among global industries.

Bitcoin Metrics and Emission Intensity

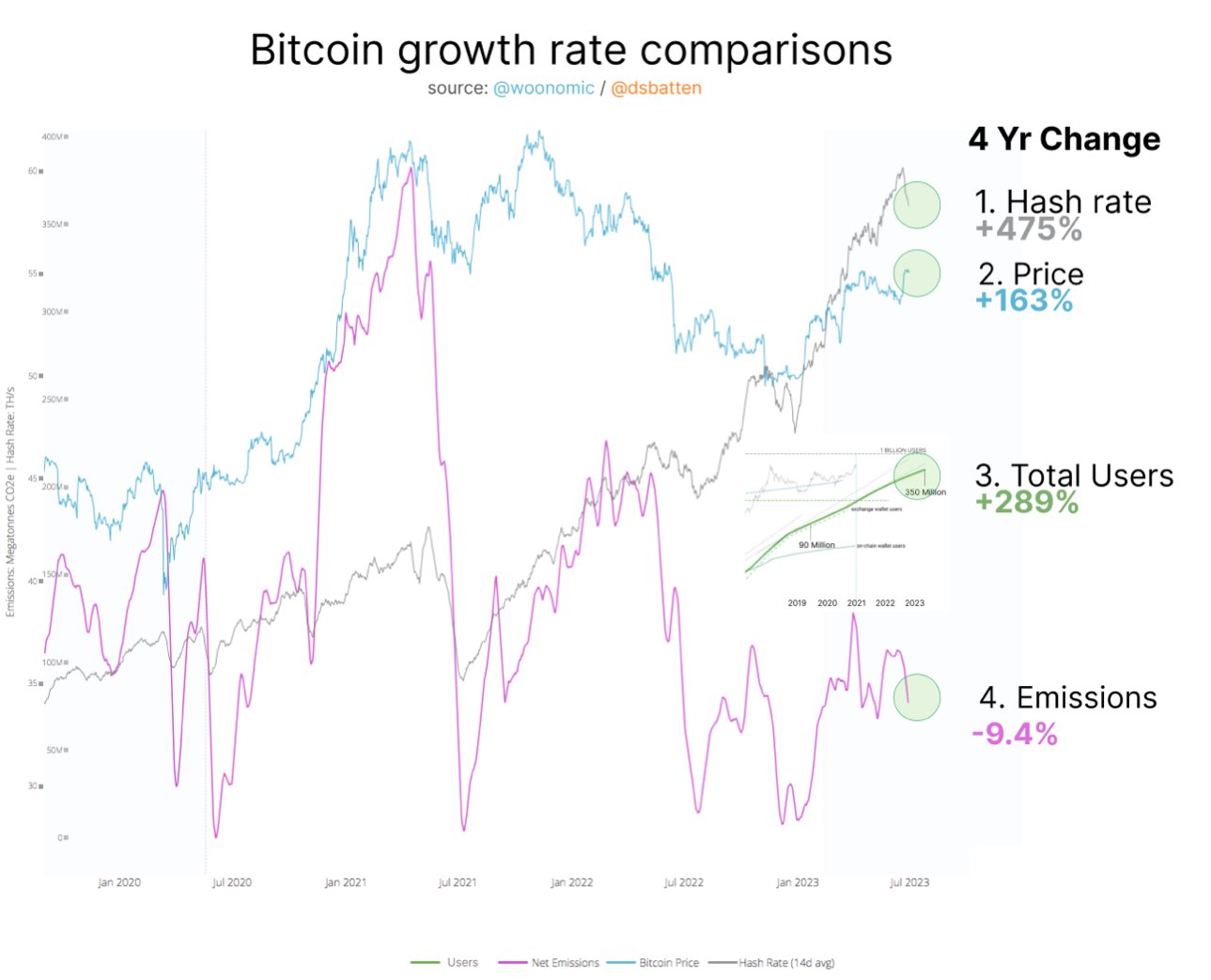

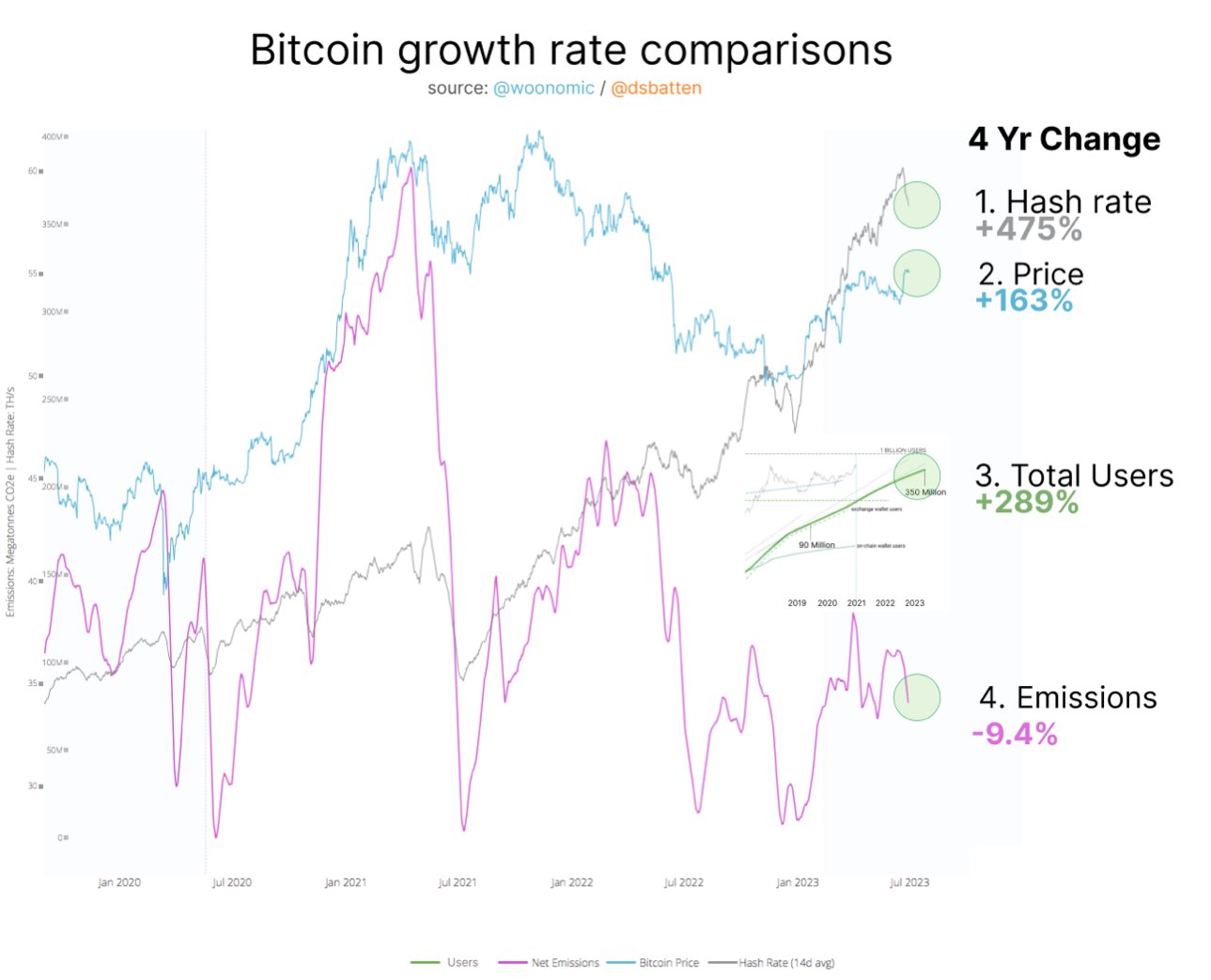

In addition to its green initiatives, the sector has also witnessed substantial growth in key performance metrics.

Over the last four years, the mining hashrate, which measures the total computational power connected to the blockchain, has increased by 475%. Similarly, the price of Bitcoin has surged by 164%, while the total number of users has grown by 289%.

Despite these surges, the carbon emissions from Bitcoin mining have actually decreased by almost 10%.

Batten pointed out that even if these metrics were to double in any four-year cycle, the emissions would remain at the starting level—a feat unmatched by any other industry. The emission intensity, or emissions per kilowatt-hour of power used, has also reduced by over 50% in the past four years.

Green Crypto: The Energy Composition of Bitcoin Mining

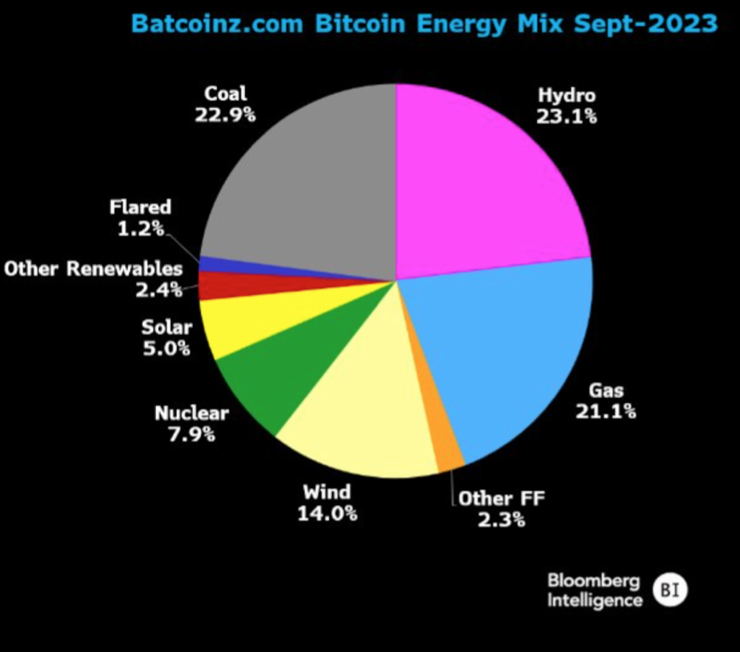

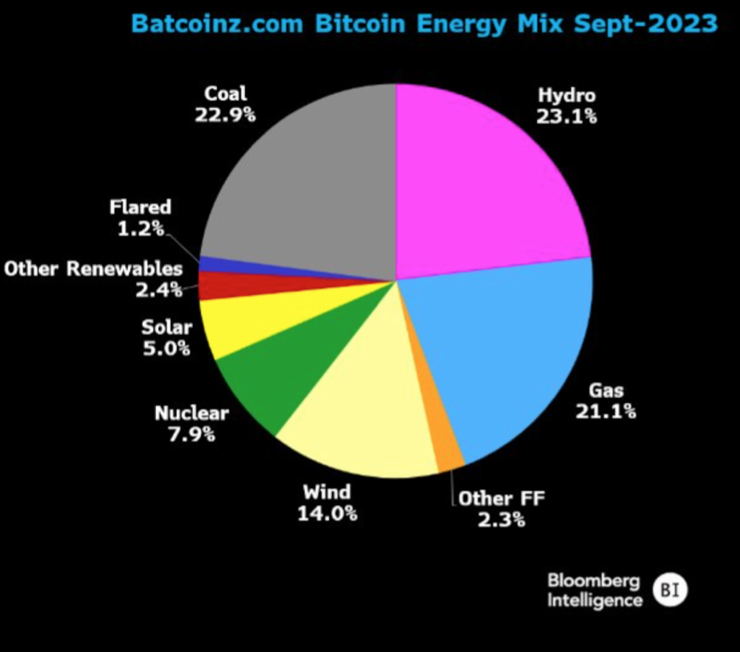

Batten’s report also focuses on the energy composition within the Bitcoin mining industry, highlighting that hydroelectric power serves as the dominant energy source. This aspect differentiates Bitcoin mining from other industries, most of which still rely on coal as their primary source of energy.

This marked shift towards green Bitcoin and sustainable crypto practices is not just a milestone for the industry but also sets a precedent for other sectors.

As the world grapples with the urgent need for environmental sustainability, the Bitcoin mining sector provides a viable template for balancing industrial growth with ecological responsibility.

The Financial Viability of Going Green in Bitcoin Mining

The data indicating a shift towards sustainable energy use in Bitcoin mining could potentially impact investor sentiment and regulatory stances as well.

As governments worldwide scrutinize the environmental effects of digital assets, the Bitcoin mining industry’s move towards more eco-friendly practices may serve as a buffer against stringent regulations that could otherwise stifle growth.

Additionally, with ESG (Environmental, Social, Governance) criteria becoming increasingly relevant in investment decisions, this transition might make Bitcoin, and by extension, the broader crypto market, more appealing to a class of investors focused on sustainability.

Alternative Views: The Debate Over Bitcoin Mining’s Environmental Impact

While Batten’s data suggests that Bitcoin mining is becoming more sustainable, not everyone agrees with this optimistic view. Critics argue that the industry’s energy consumption is both unnecessary and wasteful, given the existence of alternative cryptocurrencies that require less energy.

Skeptics also dispute the notion that Bitcoin mining’s high energy use is an “emergent benefit for humanity.” They label such arguments as greenwashing, with the goal of painting an environmentally unfriendly practice in a positive light.

The real-world energy sources used for Bitcoin mining further complicate the picture. Despite anecdotal examples of mining operations powered by renewable energy, a big part still relies on whatever energy is most readily and cheaply available. Often, this means using less environmentally friendly forms of energy.

These critics also point out the “broken window fallacy,” an economic theory suggesting it’s not beneficial to create unnecessary demand for resources and labor. In this context, the criticism is that Bitcoin mining creates unnecessary competition for renewable energy resources, which could be better used elsewhere.

The Complex Interplay of Economics and Sustainability in Bitcoin Mining

As the debate over Bitcoin mining’s environmental impact heats up, the industry finds itself at the intersection of economics and sustainability. While Batten’s data shows a shift toward greener practices, critics maintain that the industry’s resource consumption is neither justified nor sustainable in the long term.

One aspect that merits consideration but hasn’t been discussed is how these shifts in energy sourcing could influence the geopolitical landscape of energy production.

As Bitcoin mining operations seek cheaper, renewable energy, they might indirectly accelerate investment in green energy infrastructure in various regions. This could lead to shifts in energy politics, including possible decentralization of energy production away from historically dominant producers of fossil fuels.

Additionally, as digital assets become increasingly mainstream, their environmental impact is likely to become a more significant factor in regulatory decisions. Whether the strides the Bitcoin mining industry has made in sustainability will be enough to appease regulators and attract sustainability-focused investors remains an open question, however.

New data released today by Daniel Batten, the co-founder of CH4Capital, revealed that Bitcoin mining is now leading as the most sustainably-powered global industry, with over half of its energy consumption coming from renewable sources.

This development is contrary to widespread criticism that has often labeled the sector as energy-intensive and environmentally damaging. However, the real picture is more nuanced and critics bring up some good points that Bitcoin advocates should not dismiss–which we’ll explore more later in the article.

Transitioning to Green: Bitcoin Mining’s Sustainability Metrics

Batten’s post on social media platform X shows that the Bitcoin mining industry has rapidly incorporated sustainable energy solutions into its operations.

Charts shared by Batten illustrate the growth in the use of renewable energy sources in the Bitcoin mining sector over the past four years. In contrast, other major industries have shown only minimal increases in the use of clean energy.

The banking sector, which ranks second in adopting clean energy, has seen only a 2.6% rise.

Meanwhile, Bitcoin mining has recorded an impressive 38% increase in the use of sustainable energy, pushing the total share to 52.6%. The data clearly establishes Bitcoin mining as the most eco-friendly among global industries.

Bitcoin Metrics and Emission Intensity

In addition to its green initiatives, the sector has also witnessed substantial growth in key performance metrics.

Over the last four years, the mining hashrate, which measures the total computational power connected to the blockchain, has increased by 475%. Similarly, the price of Bitcoin has surged by 164%, while the total number of users has grown by 289%.

Despite these surges, the carbon emissions from Bitcoin mining have actually decreased by almost 10%.

Batten pointed out that even if these metrics were to double in any four-year cycle, the emissions would remain at the starting level—a feat unmatched by any other industry. The emission intensity, or emissions per kilowatt-hour of power used, has also reduced by over 50% in the past four years.

Green Crypto: The Energy Composition of Bitcoin Mining

Batten’s report also focuses on the energy composition within the Bitcoin mining industry, highlighting that hydroelectric power serves as the dominant energy source. This aspect differentiates Bitcoin mining from other industries, most of which still rely on coal as their primary source of energy.

This marked shift towards green Bitcoin and sustainable crypto practices is not just a milestone for the industry but also sets a precedent for other sectors.

As the world grapples with the urgent need for environmental sustainability, the Bitcoin mining sector provides a viable template for balancing industrial growth with ecological responsibility.

The Financial Viability of Going Green in Bitcoin Mining

The data indicating a shift towards sustainable energy use in Bitcoin mining could potentially impact investor sentiment and regulatory stances as well.

As governments worldwide scrutinize the environmental effects of digital assets, the Bitcoin mining industry’s move towards more eco-friendly practices may serve as a buffer against stringent regulations that could otherwise stifle growth.

Additionally, with ESG (Environmental, Social, Governance) criteria becoming increasingly relevant in investment decisions, this transition might make Bitcoin, and by extension, the broader crypto market, more appealing to a class of investors focused on sustainability.

Alternative Views: The Debate Over Bitcoin Mining’s Environmental Impact

While Batten’s data suggests that Bitcoin mining is becoming more sustainable, not everyone agrees with this optimistic view. Critics argue that the industry’s energy consumption is both unnecessary and wasteful, given the existence of alternative cryptocurrencies that require less energy.

Skeptics also dispute the notion that Bitcoin mining’s high energy use is an “emergent benefit for humanity.” They label such arguments as greenwashing, with the goal of painting an environmentally unfriendly practice in a positive light.

The real-world energy sources used for Bitcoin mining further complicate the picture. Despite anecdotal examples of mining operations powered by renewable energy, a big part still relies on whatever energy is most readily and cheaply available. Often, this means using less environmentally friendly forms of energy.

These critics also point out the “broken window fallacy,” an economic theory suggesting it’s not beneficial to create unnecessary demand for resources and labor. In this context, the criticism is that Bitcoin mining creates unnecessary competition for renewable energy resources, which could be better used elsewhere.

The Complex Interplay of Economics and Sustainability in Bitcoin Mining

As the debate over Bitcoin mining’s environmental impact heats up, the industry finds itself at the intersection of economics and sustainability. While Batten’s data shows a shift toward greener practices, critics maintain that the industry’s resource consumption is neither justified nor sustainable in the long term.

One aspect that merits consideration but hasn’t been discussed is how these shifts in energy sourcing could influence the geopolitical landscape of energy production.

As Bitcoin mining operations seek cheaper, renewable energy, they might indirectly accelerate investment in green energy infrastructure in various regions. This could lead to shifts in energy politics, including possible decentralization of energy production away from historically dominant producers of fossil fuels.

Additionally, as digital assets become increasingly mainstream, their environmental impact is likely to become a more significant factor in regulatory decisions. Whether the strides the Bitcoin mining industry has made in sustainability will be enough to appease regulators and attract sustainability-focused investors remains an open question, however.