South Korean regulators look set to turn their attention to the over-the-counter (OTC) crypto market, with indications regulation could be on its way.

The nation has moved to shore up its regulatory system this year in the wake of the so-called “Terra-Luna scandal,” which left thousands of domestic LUNC investors out of pocket.

The news has also been dominated by a high-profile political scandal involving token-owning lawmakers.

Multiple (similarly high-profile) allegations of the market manipulation of so-called “kimchi coins” have also rocked the nation.

But thus far, regulation has focused on centralized crypto exchanges.

Per Asia Kyungjae, “prosecutors and financial authority officials” are now “directly mentioning” the “problems of” the OTC market.

OTC traders have been implicated with smuggling and tax evasion charges pertaining to “kimchi premium” trading.

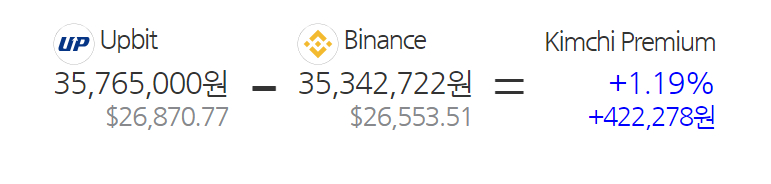

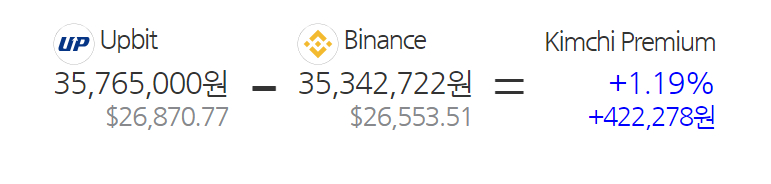

The kimchi premium is a bull market phenomenon whereby retail BTC prices rise much faster in South Korea than elsewhere in the world.

During these periods, South Korean exchanges’ BTC prices can climb to over 30% of the global average.

In the past, this has seen South Korean traders buying Bitcoin (BTC) from OTC traders based in countries such as China.

Kimchi premium traders then swap these BTC tokens for fiat on domestic crypto exchanges.

The police and prosecution officials have clamped down hard on kimchi trading rings, unearthing associated shell companies, illegal semiconductor trading, and precious metal smugglers in the process.

But the South Korean OTC market remains largely unregulated.

OTC Crypto Traders: In South Korean Regulators’ Crosshairs?

An event held earlier this month at the Supreme Prosecutors’ Office indicates that law enforcers want to change that.

The event was titled “Legal Challenges in the Virtual Assets Field” (literal translation), and saw participation from the prosecution service.

Representatives from the Financial Services Commission and the Seoul Southern District Prosecutors’ Office Virtual Asset Crime Joint Investigation Team also attended.

Speakers at the event claimed “more” and “stronger” crypto regulation was required.

And they claimed that OTC markets were becoming “the epicenter of virtual currency-related crimes,” such as “fraud and money laundering.”

Deputy Chief Prosecutor Ki No-seong called for regulation for “OTC companies,” explaining:

“Illegal OTC [crypto] companies have overseas arms and are engaged in the business of converting illegally obtained virtual currency into Korean won or foreign currency. We must regulate these companies.”

Attendees called the OTC market the “top 1% market,” claiming that it was “mainly used by high-value investors.”

Some OTC marketplaces active in South Korea, they claimed, provide “trading services for over 700 coins.”

Hong Ki-hoon, a professor of Business Administration at Hongik University, said,

“The investigative and financial authorities are now continuously sending strong messages about the virtual currency market. In the future, I expect stronger [regulations] to be imposed on virtual currency market manipulation and money laundering.”

In February this year, police said they had closed down a suspected international OTC-kimchi premium trading ring operating in South Korea.

A group of individuals, including a Libyan and three North Korean defectors, were charged with violations of the Specific Financial Information Act and the Foreign Exchange Transactions Act.

Prosecutors said the ring had bought “over $76 million” worth of cryptoassets from OTC vendors and overseas exchanges.

These coins were then sold “on behalf of overseas clients” on domestic exchanges, prosecutors alleged.

South Korean regulators look set to turn their attention to the over-the-counter (OTC) crypto market, with indications regulation could be on its way.

The nation has moved to shore up its regulatory system this year in the wake of the so-called “Terra-Luna scandal,” which left thousands of domestic LUNC investors out of pocket.

The news has also been dominated by a high-profile political scandal involving token-owning lawmakers.

Multiple (similarly high-profile) allegations of the market manipulation of so-called “kimchi coins” have also rocked the nation.

But thus far, regulation has focused on centralized crypto exchanges.

Per Asia Kyungjae, “prosecutors and financial authority officials” are now “directly mentioning” the “problems of” the OTC market.

OTC traders have been implicated with smuggling and tax evasion charges pertaining to “kimchi premium” trading.

The kimchi premium is a bull market phenomenon whereby retail BTC prices rise much faster in South Korea than elsewhere in the world.

During these periods, South Korean exchanges’ BTC prices can climb to over 30% of the global average.

In the past, this has seen South Korean traders buying Bitcoin (BTC) from OTC traders based in countries such as China.

Kimchi premium traders then swap these BTC tokens for fiat on domestic crypto exchanges.

The police and prosecution officials have clamped down hard on kimchi trading rings, unearthing associated shell companies, illegal semiconductor trading, and precious metal smugglers in the process.

But the South Korean OTC market remains largely unregulated.

OTC Crypto Traders: In South Korean Regulators’ Crosshairs?

An event held earlier this month at the Supreme Prosecutors’ Office indicates that law enforcers want to change that.

The event was titled “Legal Challenges in the Virtual Assets Field” (literal translation), and saw participation from the prosecution service.

Representatives from the Financial Services Commission and the Seoul Southern District Prosecutors’ Office Virtual Asset Crime Joint Investigation Team also attended.

Speakers at the event claimed “more” and “stronger” crypto regulation was required.

And they claimed that OTC markets were becoming “the epicenter of virtual currency-related crimes,” such as “fraud and money laundering.”

Deputy Chief Prosecutor Ki No-seong called for regulation for “OTC companies,” explaining:

“Illegal OTC [crypto] companies have overseas arms and are engaged in the business of converting illegally obtained virtual currency into Korean won or foreign currency. We must regulate these companies.”

Attendees called the OTC market the “top 1% market,” claiming that it was “mainly used by high-value investors.”

Some OTC marketplaces active in South Korea, they claimed, provide “trading services for over 700 coins.”

Hong Ki-hoon, a professor of Business Administration at Hongik University, said,

“The investigative and financial authorities are now continuously sending strong messages about the virtual currency market. In the future, I expect stronger [regulations] to be imposed on virtual currency market manipulation and money laundering.”

In February this year, police said they had closed down a suspected international OTC-kimchi premium trading ring operating in South Korea.

A group of individuals, including a Libyan and three North Korean defectors, were charged with violations of the Specific Financial Information Act and the Foreign Exchange Transactions Act.

Prosecutors said the ring had bought “over $76 million” worth of cryptoassets from OTC vendors and overseas exchanges.

These coins were then sold “on behalf of overseas clients” on domestic exchanges, prosecutors alleged.