In recent market movements, Bitcoin has shown resilience as it bounced back from the significant $25,000 support level, leading many to question if the recent sell-off is coming to a close.

As of now, Bitcoin’s live price stands at $26,000, marking a 3.36% increase over the last 24 hours. With an impressive 24-hour trading volume of $18.6 billion, Bitcoin maintains its dominant position at #1 on CoinMarketCap.

The cryptocurrency’s current market capitalization is a staggering $506.66 billion, and with a circulating supply of 19,483,481 BTC out of a maximum of 21,000,000 BTC coins, investors and traders are keeping a close eye on its next moves.

Bitcoin Price Prediction

Analyzing the technical facets of Bitcoin, it exhibits a pronounced bullish trend, breaking through a significant resistance at the $25,900 mark.

This resistance was previously reinforced by a downward trend line visible on the four-hour timeframe, which had consistently curbed Bitcoin’s upward momentum.

Nonetheless, during the early trading hours, Bitcoin successfully surged past this barrier, reaching highs of $26,500. This $26,500 level now presents itself as a double top pattern, thereby acting as a formidable resistance for BTC.

Despite its initial surge, Bitcoin struggled to maintain above the $26,500 threshold and has since retreated to just below the $26,000 mark.

It currently hovers slightly above its previously breached resistance at $25,900, which has now turned into a support level.

When considering primary technical indicators like the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD), both are poised in the buying zone.

Furthermore, the 50-day exponential moving average bolsters the potential for a continued bullish trajectory, as long as BTC sustains above the $25,600 level.

If BTC were to dip below this mark, the subsequent significant support levels to watch would be $25,400 and the crucial $24,950 mark.

Conversely, should BTC surpass the $26,500 resistance, potential targets would be the $27,000 and $27,500 levels.

In essence, the $26,500 mark serves as a pivotal point: values below might hint at bearishness, whereas figures above could signal bullish continuation.

Top 15 Cryptocurrencies to Watch in 2023

Get ahead of the game in the world of digital assets by checking out our carefully curated selection of the top 15 alternative cryptocurrencies and ICO projects to watch for in 2023.

Our list is compiled by industry experts from Industry Talk and Cryptonews, so you can expect professional recommendations and valuable insights for your cryptocurrency investments.

Stay updated and discover the potential of these digital assets.

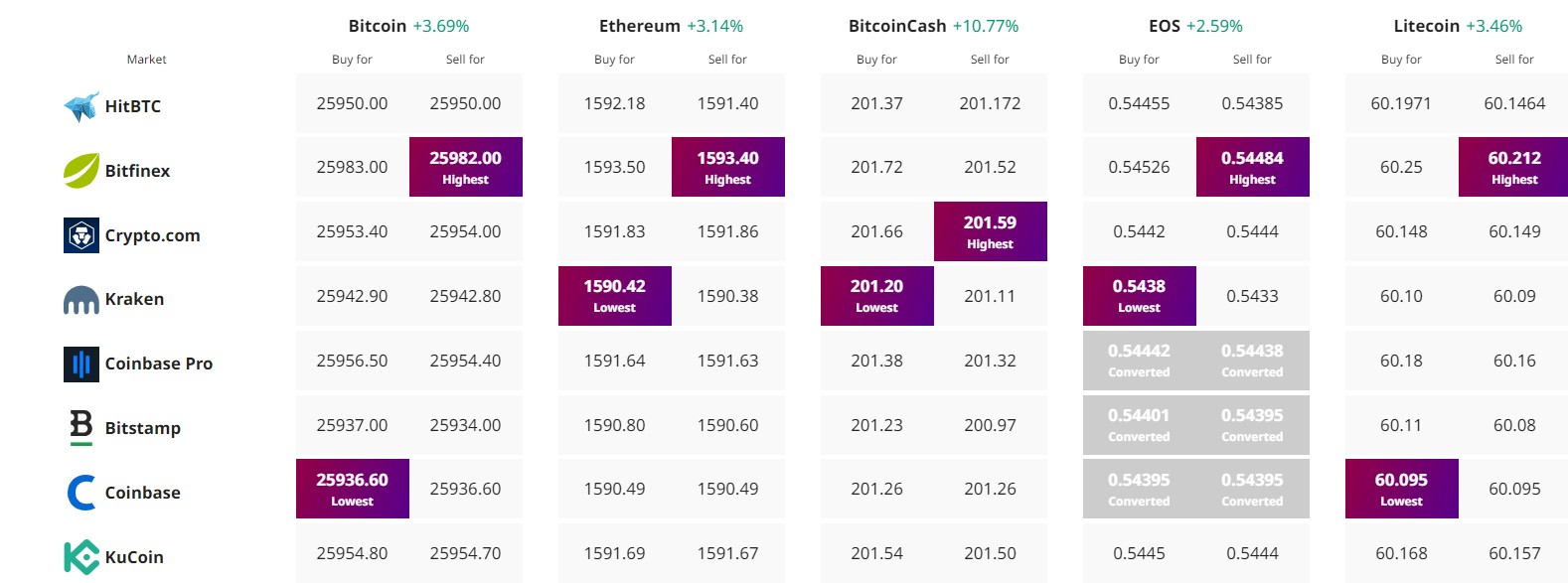

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

In recent market movements, Bitcoin has shown resilience as it bounced back from the significant $25,000 support level, leading many to question if the recent sell-off is coming to a close.

As of now, Bitcoin’s live price stands at $26,000, marking a 3.36% increase over the last 24 hours. With an impressive 24-hour trading volume of $18.6 billion, Bitcoin maintains its dominant position at #1 on CoinMarketCap.

The cryptocurrency’s current market capitalization is a staggering $506.66 billion, and with a circulating supply of 19,483,481 BTC out of a maximum of 21,000,000 BTC coins, investors and traders are keeping a close eye on its next moves.

Bitcoin Price Prediction

Analyzing the technical facets of Bitcoin, it exhibits a pronounced bullish trend, breaking through a significant resistance at the $25,900 mark.

This resistance was previously reinforced by a downward trend line visible on the four-hour timeframe, which had consistently curbed Bitcoin’s upward momentum.

Nonetheless, during the early trading hours, Bitcoin successfully surged past this barrier, reaching highs of $26,500. This $26,500 level now presents itself as a double top pattern, thereby acting as a formidable resistance for BTC.

Despite its initial surge, Bitcoin struggled to maintain above the $26,500 threshold and has since retreated to just below the $26,000 mark.

It currently hovers slightly above its previously breached resistance at $25,900, which has now turned into a support level.

When considering primary technical indicators like the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD), both are poised in the buying zone.

Furthermore, the 50-day exponential moving average bolsters the potential for a continued bullish trajectory, as long as BTC sustains above the $25,600 level.

If BTC were to dip below this mark, the subsequent significant support levels to watch would be $25,400 and the crucial $24,950 mark.

Conversely, should BTC surpass the $26,500 resistance, potential targets would be the $27,000 and $27,500 levels.

In essence, the $26,500 mark serves as a pivotal point: values below might hint at bearishness, whereas figures above could signal bullish continuation.

Top 15 Cryptocurrencies to Watch in 2023

Get ahead of the game in the world of digital assets by checking out our carefully curated selection of the top 15 alternative cryptocurrencies and ICO projects to watch for in 2023.

Our list is compiled by industry experts from Industry Talk and Cryptonews, so you can expect professional recommendations and valuable insights for your cryptocurrency investments.

Stay updated and discover the potential of these digital assets.

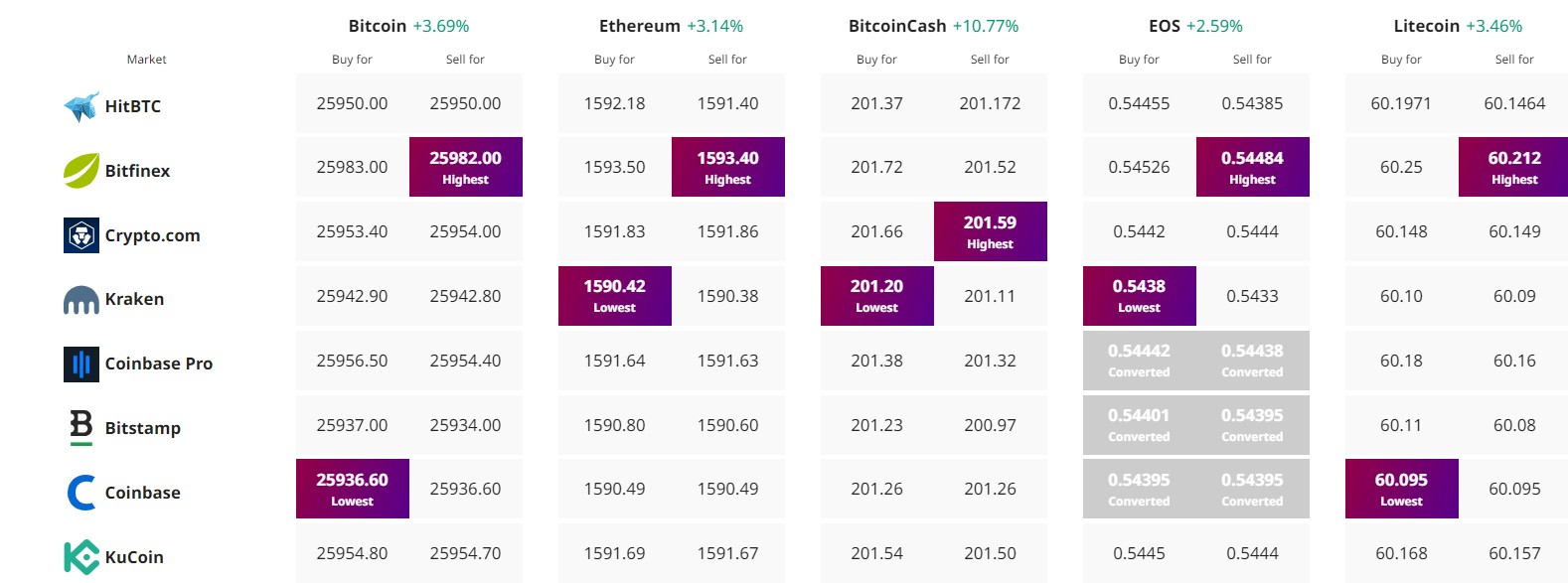

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.