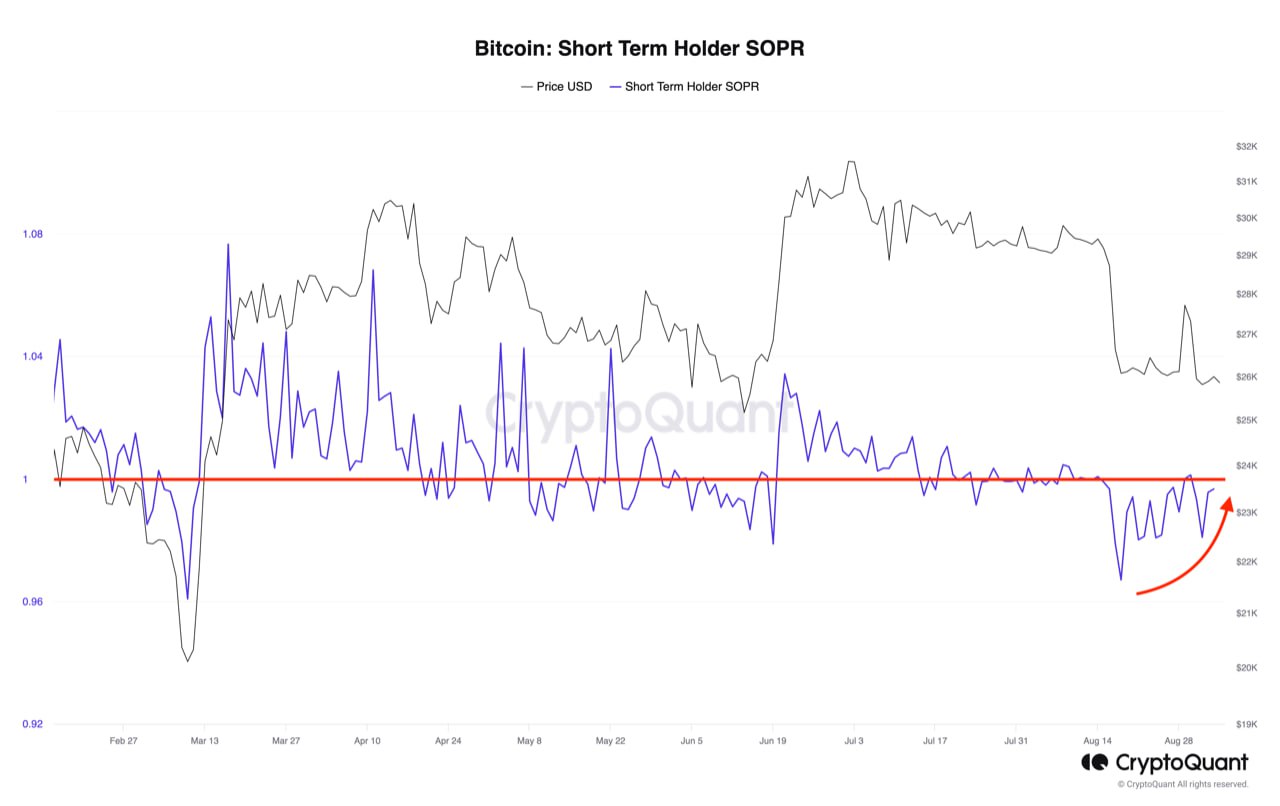

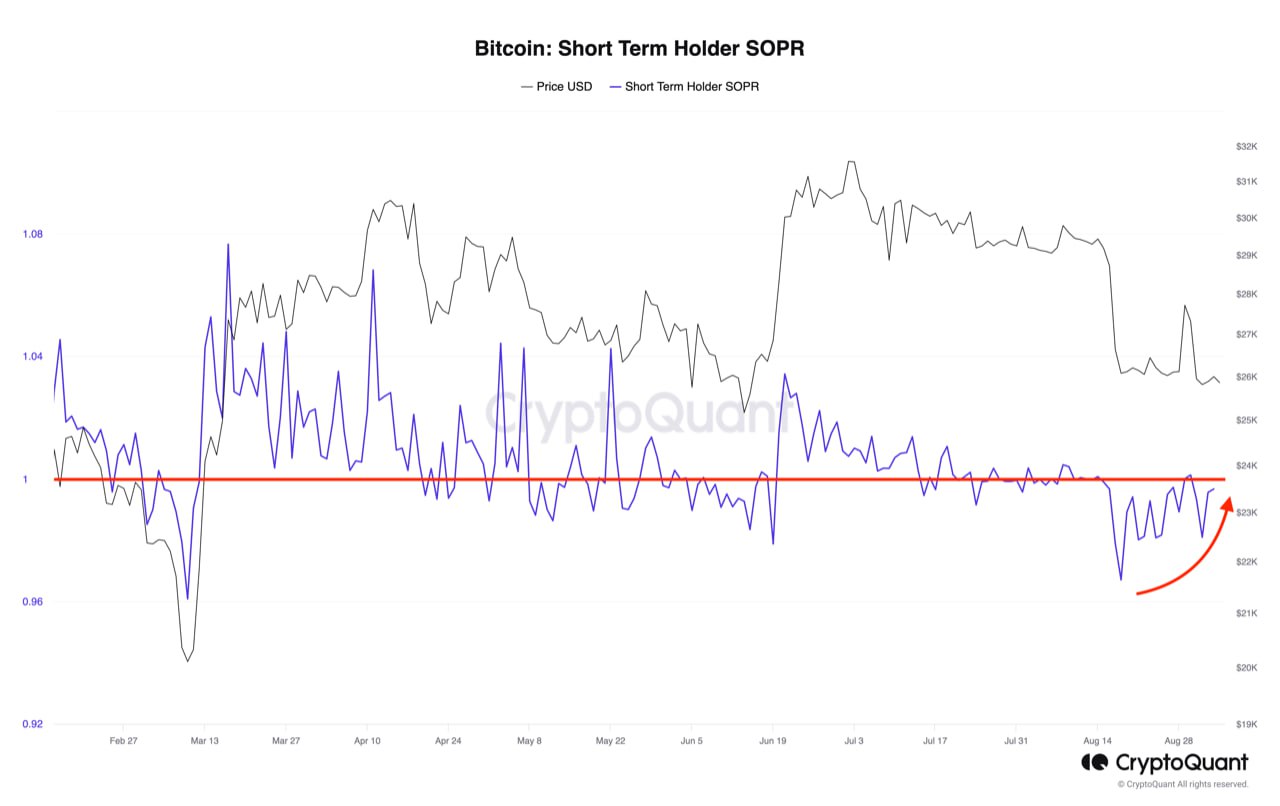

The Short-Term Holder Spent Output Profit Ratio (STH-SOPR) for Bitcoin (BTC) has decreased from 1 to 0.9809, indicating less favorable conditions for short-term Bitcoin holders due to recent price declines.

The STH-SOPR measures the profitability of Bitcoin trades involving coins held for less than 155 days.

A declining STH-SOPR during a price correction suggests that many short-term holders may be about to sell their Bitcoin, contributing to an overall drop in prices, and potentially leading to a self-reinforcing cycle of declining prices, on-chain analysis platform CryptoQuant explained in a Telegram post on Tuesday.

The development indicates that short-term holders sold their Bitcoin at a price that allowed them to exit without making a profit or incurring a loss, essentially breaking even.

Slow progress on ETFs

One reason for the lack of excitement among Bitcoin investors is a perceived lack of progress for the many spot Bitcoin exchange-traded fund (ETF) applications that are on the Securities and Exchange Commission’s (SEC) table.

Just last week, the SEC decided to delay its decision on seven ETF applications, saying it would need at least 45 more days to review these applications.

The new decision deadline for the ETF applications is now in mid-October.

The delays came despite a recent court ruling involving digital asset manager Grayscale that most experts believe will make it difficult for the regulator to deny any of the applications.

The win means that the SEC now cannot legally stop Grayscale from converting its Bitcoin Trust to a spot ETF, something the firm for a long time has wanted to do.

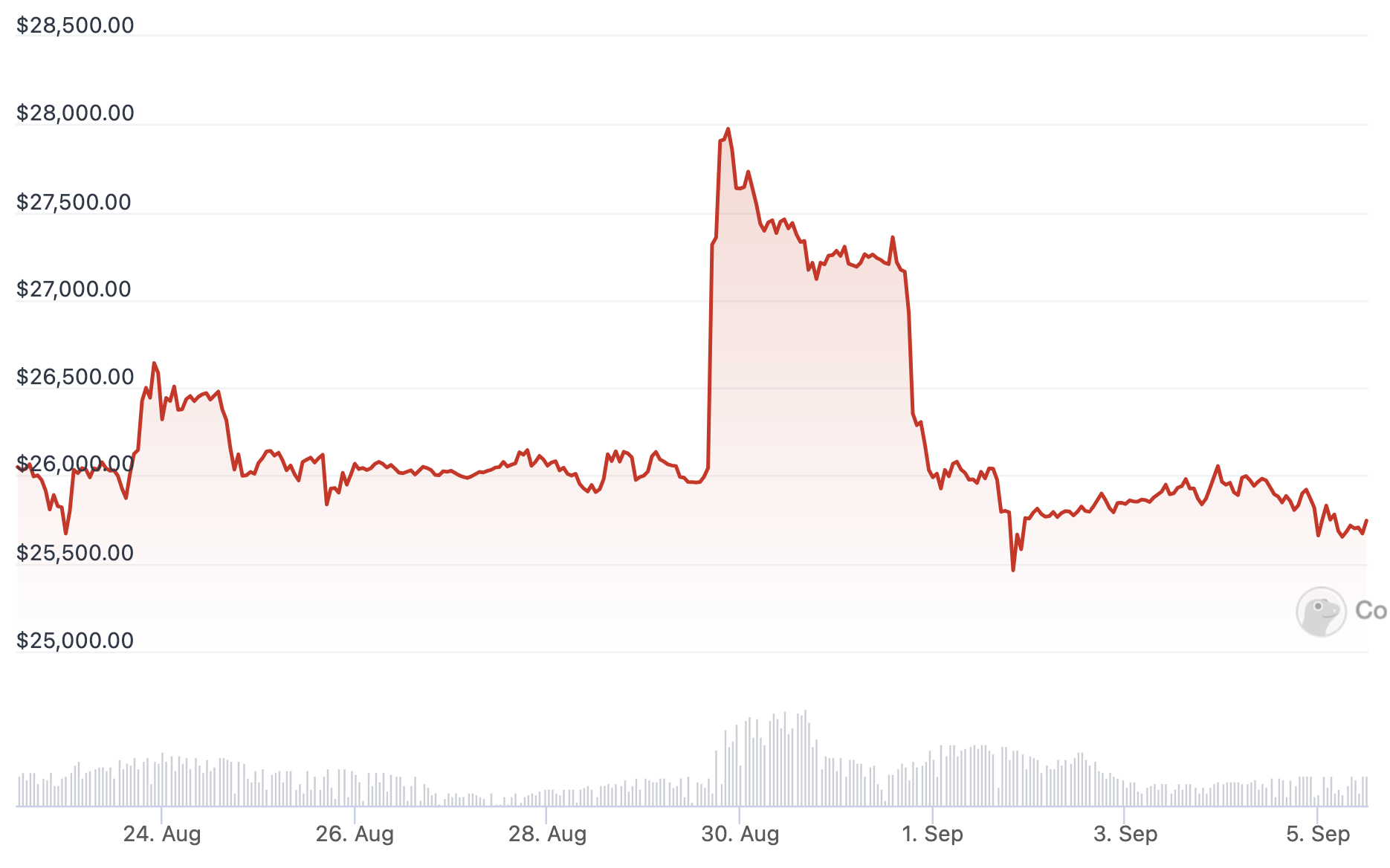

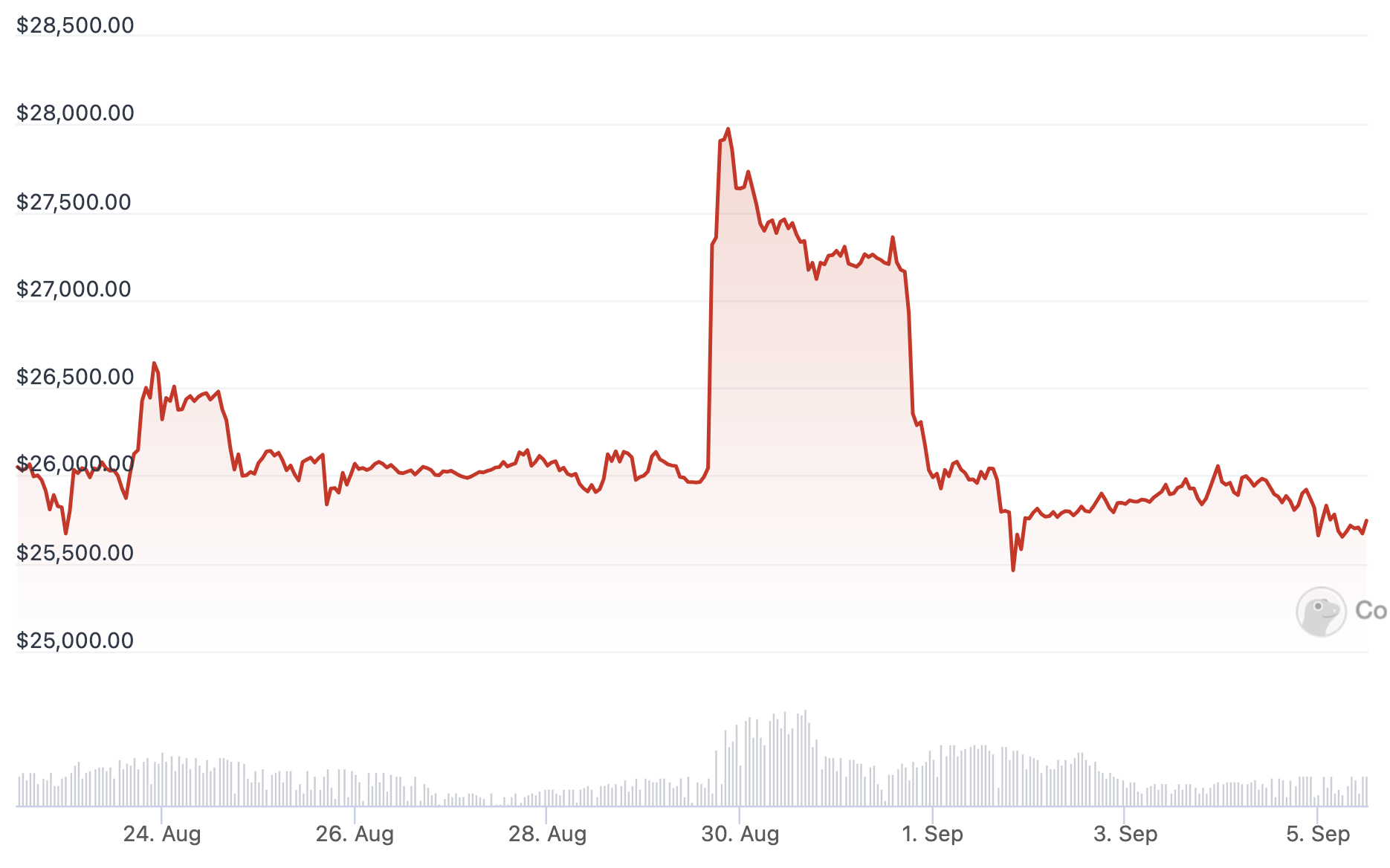

At press time on Tuesday, Bitcoin traded at $25,727, down 0.8% for the past 24 hours and down close to 1% for the past seven days.

The Short-Term Holder Spent Output Profit Ratio (STH-SOPR) for Bitcoin (BTC) has decreased from 1 to 0.9809, indicating less favorable conditions for short-term Bitcoin holders due to recent price declines.

The STH-SOPR measures the profitability of Bitcoin trades involving coins held for less than 155 days.

A declining STH-SOPR during a price correction suggests that many short-term holders may be about to sell their Bitcoin, contributing to an overall drop in prices, and potentially leading to a self-reinforcing cycle of declining prices, on-chain analysis platform CryptoQuant explained in a Telegram post on Tuesday.

The development indicates that short-term holders sold their Bitcoin at a price that allowed them to exit without making a profit or incurring a loss, essentially breaking even.

Slow progress on ETFs

One reason for the lack of excitement among Bitcoin investors is a perceived lack of progress for the many spot Bitcoin exchange-traded fund (ETF) applications that are on the Securities and Exchange Commission’s (SEC) table.

Just last week, the SEC decided to delay its decision on seven ETF applications, saying it would need at least 45 more days to review these applications.

The new decision deadline for the ETF applications is now in mid-October.

The delays came despite a recent court ruling involving digital asset manager Grayscale that most experts believe will make it difficult for the regulator to deny any of the applications.

The win means that the SEC now cannot legally stop Grayscale from converting its Bitcoin Trust to a spot ETF, something the firm for a long time has wanted to do.

At press time on Tuesday, Bitcoin traded at $25,727, down 0.8% for the past 24 hours and down close to 1% for the past seven days.