Stablecoin issuer Tether has established a banking relationship with Britannia Bank & Trust, a privately-held bank located in the Bahamas, to facilitate dollar transfers, according to unnamed sources cited by Bloomberg.

Although it remains unclear exactly when the new banking relationship started, Tether has allegedly instructed clients to send funds to Britannia’s bank account in recent months.

Tether, which issues the world’s most popular stablecoin USDT, has not commented on the matter. Britannia Financial Group, the parent of Britannia Bank & Trust, has also refrained from making a statement.

It is well-known that Tether historically has faced challenges accessing the traditional financial system, and in particular US-based banks.

Tether’s chief technology officer, Paolo Ardoino, has previously disclosed some of the company’s banking partners, including Bahamian lenders Deltec Bank & Trust Ltd. and Capital Union Bank, as well as Cantor Fitzgerald, which serves as a custodian for Tether’s Treasury bill holdings.

Tether’s banking relationships have been the subject of speculation, with the company having reached a settlement with the New York Attorney General in 2021 over allegations of misrepresenting its reserves and losses.

Tether secrecy a ‘major impediment’ for industry

Commenting to Bloomberg, Patrick Tan, general counsel for blockchain analytics firm ChainArgos, said that Tether’s complicated relationship with banks and regulators has become a problem for the crypto industry.

“The secrecy surrounding Tether’s banking relationships continues to be a major impediment for developing the cryptocurrency industry, deterring regulatory approvals on other matters, and discouraging traditional asset managers with little tolerance for regulatory risk from more active participation in the space,” Tan said.

Britannia Financial Group has expanded its presence through acquisitions in recent years, including a proprietary crypto trading firm in April last year.

At the time of the acquisition, Britannia’s CEO called crypto as “increasingly important asset class” for many of its clients.

The London-based firm’s CEO, Mark Bruce, joined from Jump Trading in 2022.

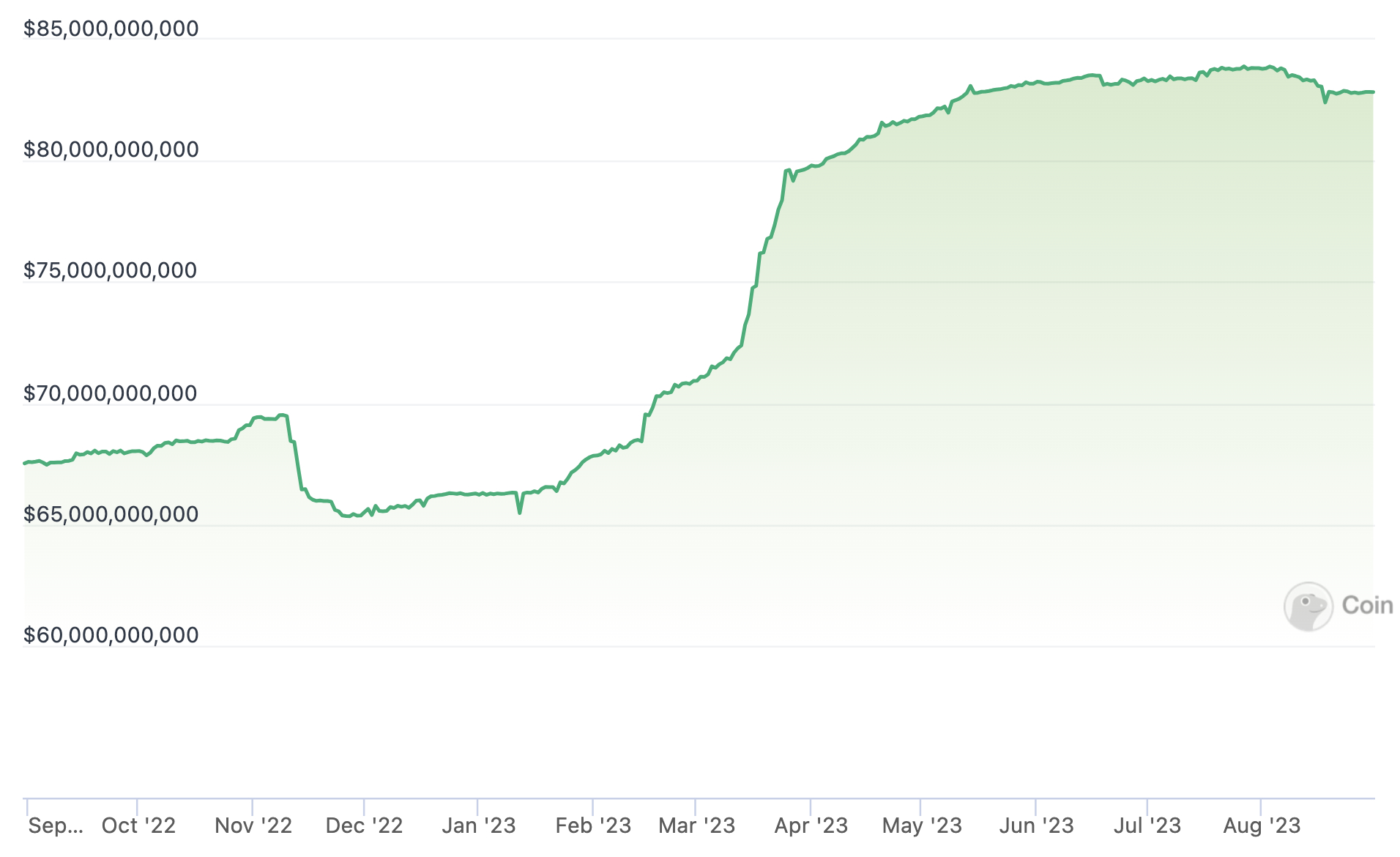

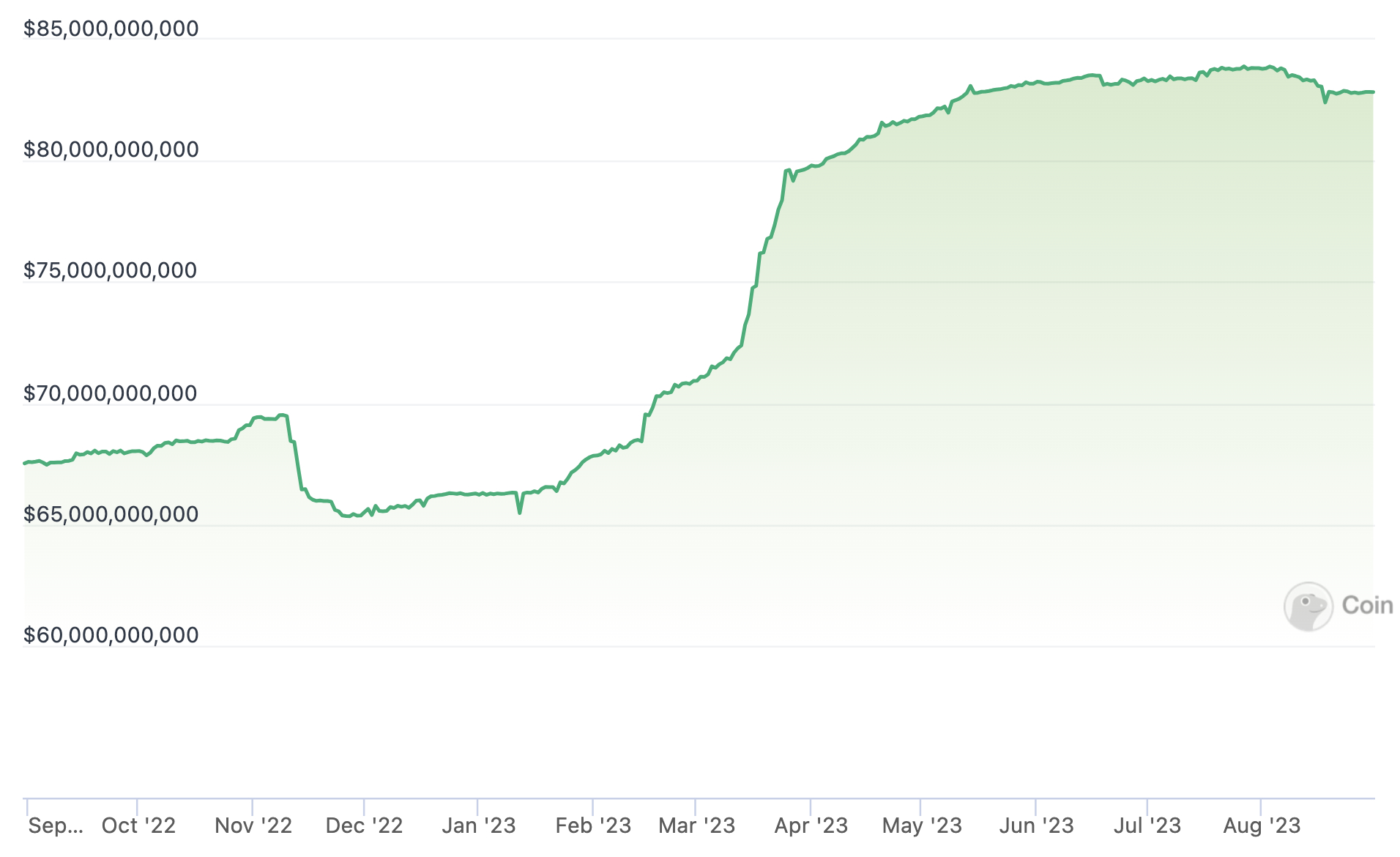

The market capitalization of USDT tokens in circulation has grown significantly this year, from around $66 billion at the beginning of the year to almost $83 billion as of today, per data from CoinGecko.

Stablecoin issuer Tether has established a banking relationship with Britannia Bank & Trust, a privately-held bank located in the Bahamas, to facilitate dollar transfers, according to unnamed sources cited by Bloomberg.

Although it remains unclear exactly when the new banking relationship started, Tether has allegedly instructed clients to send funds to Britannia’s bank account in recent months.

Tether, which issues the world’s most popular stablecoin USDT, has not commented on the matter. Britannia Financial Group, the parent of Britannia Bank & Trust, has also refrained from making a statement.

It is well-known that Tether historically has faced challenges accessing the traditional financial system, and in particular US-based banks.

Tether’s chief technology officer, Paolo Ardoino, has previously disclosed some of the company’s banking partners, including Bahamian lenders Deltec Bank & Trust Ltd. and Capital Union Bank, as well as Cantor Fitzgerald, which serves as a custodian for Tether’s Treasury bill holdings.

Tether’s banking relationships have been the subject of speculation, with the company having reached a settlement with the New York Attorney General in 2021 over allegations of misrepresenting its reserves and losses.

Tether secrecy a ‘major impediment’ for industry

Commenting to Bloomberg, Patrick Tan, general counsel for blockchain analytics firm ChainArgos, said that Tether’s complicated relationship with banks and regulators has become a problem for the crypto industry.

“The secrecy surrounding Tether’s banking relationships continues to be a major impediment for developing the cryptocurrency industry, deterring regulatory approvals on other matters, and discouraging traditional asset managers with little tolerance for regulatory risk from more active participation in the space,” Tan said.

Britannia Financial Group has expanded its presence through acquisitions in recent years, including a proprietary crypto trading firm in April last year.

At the time of the acquisition, Britannia’s CEO called crypto as “increasingly important asset class” for many of its clients.

The London-based firm’s CEO, Mark Bruce, joined from Jump Trading in 2022.

The market capitalization of USDT tokens in circulation has grown significantly this year, from around $66 billion at the beginning of the year to almost $83 billion as of today, per data from CoinGecko.