Bitcoin, the pioneering cryptocurrency, currently trades at $26,111, marking a modest increase of nearly 0.25% as of Tuesday.

This price movement unfolds against a backdrop of mounting challenges in the Bitcoin mining sector, where miners grapple with soaring difficulty levels and hash rates that have touched unprecedented highs.

Additionally, trading activity appears to be waning, with the volume of Bitcoin transactions plummeting to its lowest ebb in over four years.

Compounding these dynamics, the cryptocurrency market, and Bitcoin in particular, braces itself for potentially significant fluctuations influenced by a crucial economic data set to be unveiled next week.

Bitcoin Mining Becomes More Challenging as Difficulty and Hash Rate Reach Record Highs

On August 17, the hash rate of the Bitcoin network hit an all-time high of over 414 (EH/s), accompanied by an unprecedented level of difficulty.

Even though the price of Bitcoin has remained stable at around $26,000, institutional interest in mining has boosted the network’s expansion.

Nevertheless, mining operations are finding it difficult to maintain profitability due to increasing operational costs.

On August 27, the cost of mining one BTC was $45,877, whereas its spot price was $26,089, resulting in a loss of $19,588 for every mined BTC.

This struggle has negatively impacted publicly traded mining companies, causing losses and prompting them to rely on stock sales.

It is worth noting that BlackRock Fund Advisors is a significant shareholder in several underperforming mining firms. Today, the BTC/USD has risen, potentially easing some of the pressure on miners.

Bitcoin Trading Hits 4-Year Low Amid Market Slowdown

A recent report from CNBC reveals that Bitcoin’s trading volume has reached its lowest point in over four years. The amount of Bitcoin traded on all exchanges has dropped to levels last seen in 2019, with an average of 129,307 BTC being traded.

This represents a significant decrease from the March high of 3.5 million BTC, which is down by approximately 94%.

The drop in trading volume is due to decreased investor participation. Despite a recent increase in the BTC/USD price to around $26,100, the crypto market has had a lackluster summer marked by regulatory pressures and a waning banking crisis, leading to reduced market activity.

However, long-term investors seem unaffected by the recent market weakness and are waiting for catalysts, such as spot Bitcoin ETF decisions.

Upcoming Economic Data May Affect Bitcoin Prices

Bitcoin’s market consolidation continues, but there may be increased volatility in the coming week. The US market is anticipating important macroeconomic data, such as consumer confidence, the Core PCE Price Index, and Nonfarm Payrolls.

Furthermore, there is interest in possible decisions by the SEC regarding spot Bitcoin Exchange-Traded Funds (ETFs) for multiple organizations.

Given recent market dynamics and historical SEC delays, the impact of these factors might be short-lived. It’s worth noting that BTC/USD is presently on the rise before the release of these critical economic figures.

Bitcoin Price Prediction

Analyzing the technical aspects of Bitcoin on the daily timeframe reveals that Bitcoin is currently consolidating within a sideways trading band.

This range has a lower boundary at 25,400 and an upper resistance near 26,800, which seems to be a pivotal point for BTC.

When evaluating leading oscillator indicators such as the Moving Average (MA) and Moving Average Convergence Divergence (MACD) in conjunction with the Relative Strength Index (RSI), both suggest a continued bearish momentum.

The 50-day Exponential Moving Average (EMA) further reinforces this sentiment, positioned around the 27,285 mark, suggesting that the bearish momentum remains robust.

Should Bitcoin breach the 25,400 support level, there’s potential for a drop towards 23,900, possibly even as low as 21,900.

Conversely, a bullish breakout above 26,800 could pave the way for Bitcoin to approach the 28,600 level.

The direction ultimately depends on which boundary the market challenges, so it’s essential to monitor the specified range closely.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

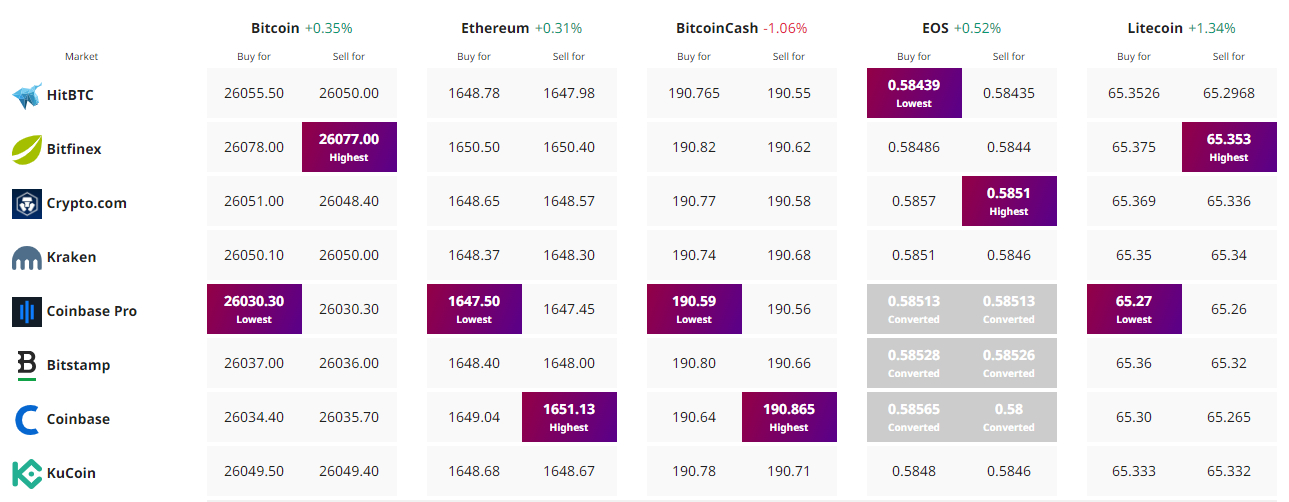

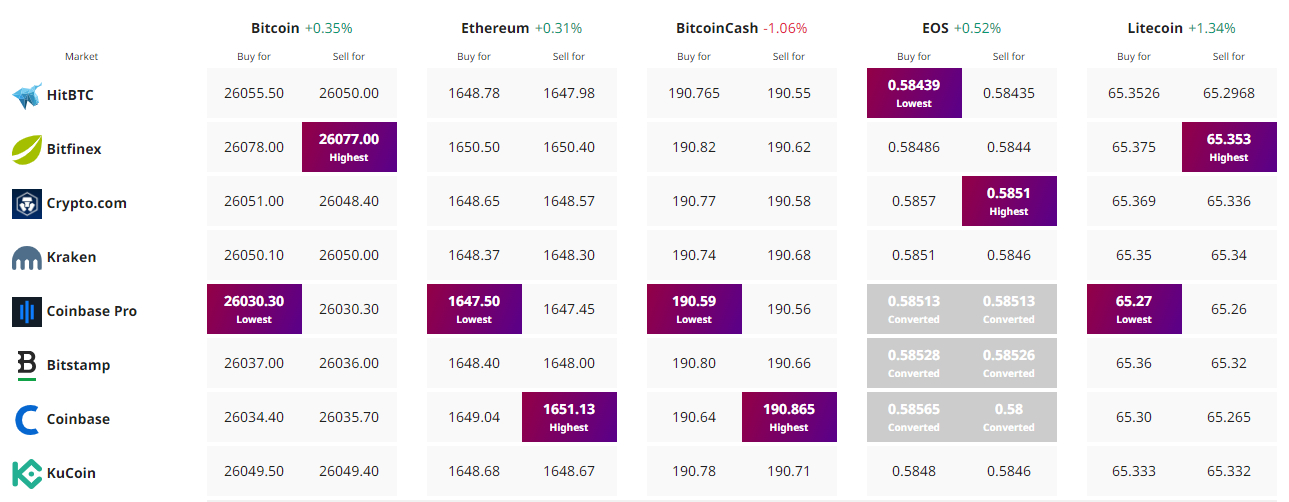

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

Bitcoin, the pioneering cryptocurrency, currently trades at $26,111, marking a modest increase of nearly 0.25% as of Tuesday.

This price movement unfolds against a backdrop of mounting challenges in the Bitcoin mining sector, where miners grapple with soaring difficulty levels and hash rates that have touched unprecedented highs.

Additionally, trading activity appears to be waning, with the volume of Bitcoin transactions plummeting to its lowest ebb in over four years.

Compounding these dynamics, the cryptocurrency market, and Bitcoin in particular, braces itself for potentially significant fluctuations influenced by a crucial economic data set to be unveiled next week.

Bitcoin Mining Becomes More Challenging as Difficulty and Hash Rate Reach Record Highs

On August 17, the hash rate of the Bitcoin network hit an all-time high of over 414 (EH/s), accompanied by an unprecedented level of difficulty.

Even though the price of Bitcoin has remained stable at around $26,000, institutional interest in mining has boosted the network’s expansion.

Nevertheless, mining operations are finding it difficult to maintain profitability due to increasing operational costs.

On August 27, the cost of mining one BTC was $45,877, whereas its spot price was $26,089, resulting in a loss of $19,588 for every mined BTC.

This struggle has negatively impacted publicly traded mining companies, causing losses and prompting them to rely on stock sales.

It is worth noting that BlackRock Fund Advisors is a significant shareholder in several underperforming mining firms. Today, the BTC/USD has risen, potentially easing some of the pressure on miners.

Bitcoin Trading Hits 4-Year Low Amid Market Slowdown

A recent report from CNBC reveals that Bitcoin’s trading volume has reached its lowest point in over four years. The amount of Bitcoin traded on all exchanges has dropped to levels last seen in 2019, with an average of 129,307 BTC being traded.

This represents a significant decrease from the March high of 3.5 million BTC, which is down by approximately 94%.

The drop in trading volume is due to decreased investor participation. Despite a recent increase in the BTC/USD price to around $26,100, the crypto market has had a lackluster summer marked by regulatory pressures and a waning banking crisis, leading to reduced market activity.

However, long-term investors seem unaffected by the recent market weakness and are waiting for catalysts, such as spot Bitcoin ETF decisions.

Upcoming Economic Data May Affect Bitcoin Prices

Bitcoin’s market consolidation continues, but there may be increased volatility in the coming week. The US market is anticipating important macroeconomic data, such as consumer confidence, the Core PCE Price Index, and Nonfarm Payrolls.

Furthermore, there is interest in possible decisions by the SEC regarding spot Bitcoin Exchange-Traded Funds (ETFs) for multiple organizations.

Given recent market dynamics and historical SEC delays, the impact of these factors might be short-lived. It’s worth noting that BTC/USD is presently on the rise before the release of these critical economic figures.

Bitcoin Price Prediction

Analyzing the technical aspects of Bitcoin on the daily timeframe reveals that Bitcoin is currently consolidating within a sideways trading band.

This range has a lower boundary at 25,400 and an upper resistance near 26,800, which seems to be a pivotal point for BTC.

When evaluating leading oscillator indicators such as the Moving Average (MA) and Moving Average Convergence Divergence (MACD) in conjunction with the Relative Strength Index (RSI), both suggest a continued bearish momentum.

The 50-day Exponential Moving Average (EMA) further reinforces this sentiment, positioned around the 27,285 mark, suggesting that the bearish momentum remains robust.

Should Bitcoin breach the 25,400 support level, there’s potential for a drop towards 23,900, possibly even as low as 21,900.

Conversely, a bullish breakout above 26,800 could pave the way for Bitcoin to approach the 28,600 level.

The direction ultimately depends on which boundary the market challenges, so it’s essential to monitor the specified range closely.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.