Per Nansen’s Arbitrum Quarterly Report for Q2 2023, the Arbitrum (ARB) airdrop on March 23, 2023, led to a peak in users and transactions. Following the ARB airdrop, daily transactions and user numbers have consistently exceeded the chain’s past averages.

Arbitrum, an Ethereum rollup hosting asset valued at $5.77 billion, sustained robust growth in the previous quarter. Throughout Q2, Arbitrum maintained its momentum by enhancing its infrastructure and advancing its ecosystem.

After the ARB airdrop incentives concluded and the airdrop resulted in a “sell-the-news” reaction for the native token and its associated ecosystem projects, noteworthy activity levels persisted, evident in transaction and user counts surpassing pre-airdrop figures.

The influx of new users underscores Arbitrum’s enduring strength and flourishing ecosystem.

A group of “super airdrop hunters” who amassed ARB tokens using multiple Ethereum addresses contributed significantly to the selling pressure.

The ARB token experienced significant selling during the airdrop, causing its price to plummet from $10.29 to $1 in just a few hours.

Nansen’s report stated that the stability of Arbitrum after its Airdrop “points towards more organic activity” as new users have been increasing, even “surpassing Ethereum on certain days in Q2.”

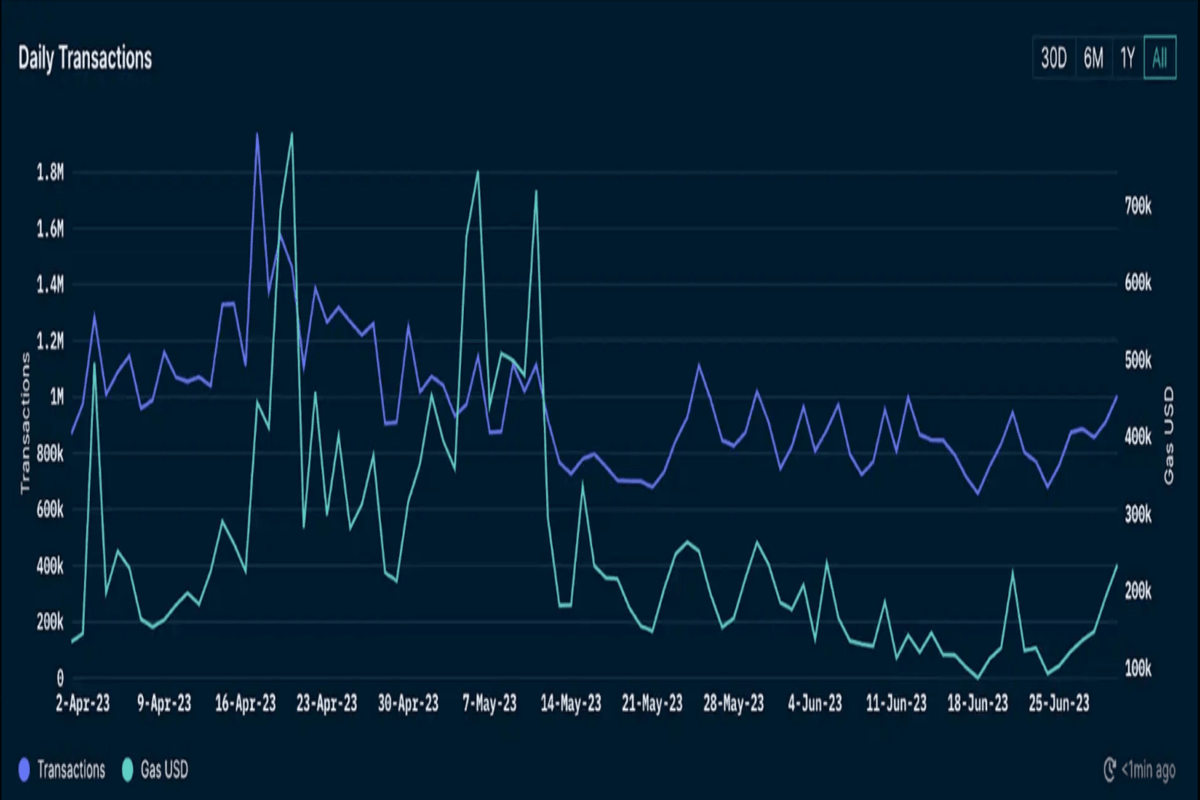

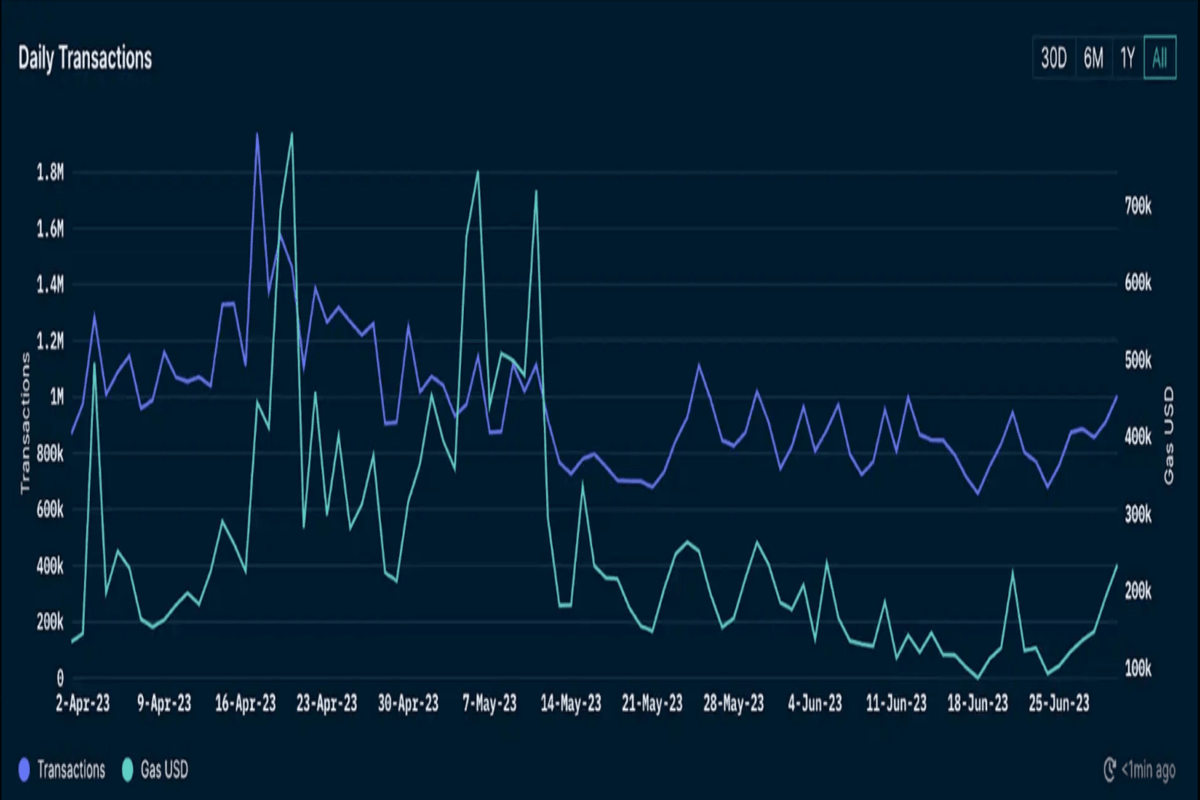

In the second quarter of 2023, daily transactions and gas prices on Arbitrum One, one of the critical components of Arbitrum utilizing Arbitrum Rollup technology to enhance transaction throughput while maintaining security, remained steady, averaging 800k transactions.

The quarter saw a consistent rise in transaction count compared to the previous quarter, indicating heightened activity since the airdrop. Daily active addresses on Arbitrum remained stable at approximately 200k throughout the quarter.

Conversely, there has been a gradual increase in the number of new wallets initiating transactions on Arbitrum since the beginning of the year. On specific days in Q2, this count surpassed Ethereum’s new wallet activity.

Arbitrum (ARB) Airdrop Spurs Price Surge and Ecosystem Growth Since March

The announcement of the Arbitrum (ARB) airdrop on March 16 led to a significant price increase in native tokens of projects within the Arbitrum ecosystem, including GMX (GMX), Magic (MAGIC), Gains Network (GNS), and Radiant Network (RDNT).

This surge was directly tied to the ARB airdrop, fueling growth in the Arbitrum ecosystem.

The price surge occurred mainly between the airdrop announcement and its execution on March 23.

As noted in a report, “Once the airdrop launched alongside the $ARB token introduction, ecosystem token prices began to decrease, following a typical ‘sell the news’ pattern.”

The Arbitrum airdrop allocated 1.1% of the total 12.75 billion ARB supply to the ecosystem’s DAOs. This allocation was crucial for a positive outlook on the Arbitrum ecosystem, as DAOs could leverage ARB incentives to encourage usage.

However, the airdrop amounts for individual projects in the Arbitrum ecosystem were relatively smaller. Only GMX and MAGIC received allocations exceeding $10 million.

Most projects received less than $500,000 worth of ARB tokens, which needed to be improved to incentivize liquidity across a large user base.

With the speculation surrounding the ARB airdrop subsiding, the growing number of new wallets implies increased organic engagement.

Daily active users, transaction count, and on-chain value have all settled at levels higher than pre-airdrop figures.

The upward trends in gas fee expenditure and the establishment of new wallets further signify the growing utilization of the network.

Per Nansen’s Arbitrum Quarterly Report for Q2 2023, the Arbitrum (ARB) airdrop on March 23, 2023, led to a peak in users and transactions. Following the ARB airdrop, daily transactions and user numbers have consistently exceeded the chain’s past averages.

Arbitrum, an Ethereum rollup hosting asset valued at $5.77 billion, sustained robust growth in the previous quarter. Throughout Q2, Arbitrum maintained its momentum by enhancing its infrastructure and advancing its ecosystem.

After the ARB airdrop incentives concluded and the airdrop resulted in a “sell-the-news” reaction for the native token and its associated ecosystem projects, noteworthy activity levels persisted, evident in transaction and user counts surpassing pre-airdrop figures.

The influx of new users underscores Arbitrum’s enduring strength and flourishing ecosystem.

A group of “super airdrop hunters” who amassed ARB tokens using multiple Ethereum addresses contributed significantly to the selling pressure.

The ARB token experienced significant selling during the airdrop, causing its price to plummet from $10.29 to $1 in just a few hours.

Nansen’s report stated that the stability of Arbitrum after its Airdrop “points towards more organic activity” as new users have been increasing, even “surpassing Ethereum on certain days in Q2.”

In the second quarter of 2023, daily transactions and gas prices on Arbitrum One, one of the critical components of Arbitrum utilizing Arbitrum Rollup technology to enhance transaction throughput while maintaining security, remained steady, averaging 800k transactions.

The quarter saw a consistent rise in transaction count compared to the previous quarter, indicating heightened activity since the airdrop. Daily active addresses on Arbitrum remained stable at approximately 200k throughout the quarter.

Conversely, there has been a gradual increase in the number of new wallets initiating transactions on Arbitrum since the beginning of the year. On specific days in Q2, this count surpassed Ethereum’s new wallet activity.

Arbitrum (ARB) Airdrop Spurs Price Surge and Ecosystem Growth Since March

The announcement of the Arbitrum (ARB) airdrop on March 16 led to a significant price increase in native tokens of projects within the Arbitrum ecosystem, including GMX (GMX), Magic (MAGIC), Gains Network (GNS), and Radiant Network (RDNT).

This surge was directly tied to the ARB airdrop, fueling growth in the Arbitrum ecosystem.

The price surge occurred mainly between the airdrop announcement and its execution on March 23.

As noted in a report, “Once the airdrop launched alongside the $ARB token introduction, ecosystem token prices began to decrease, following a typical ‘sell the news’ pattern.”

The Arbitrum airdrop allocated 1.1% of the total 12.75 billion ARB supply to the ecosystem’s DAOs. This allocation was crucial for a positive outlook on the Arbitrum ecosystem, as DAOs could leverage ARB incentives to encourage usage.

However, the airdrop amounts for individual projects in the Arbitrum ecosystem were relatively smaller. Only GMX and MAGIC received allocations exceeding $10 million.

Most projects received less than $500,000 worth of ARB tokens, which needed to be improved to incentivize liquidity across a large user base.

With the speculation surrounding the ARB airdrop subsiding, the growing number of new wallets implies increased organic engagement.

Daily active users, transaction count, and on-chain value have all settled at levels higher than pre-airdrop figures.

The upward trends in gas fee expenditure and the establishment of new wallets further signify the growing utilization of the network.