In the dynamic realm of cryptocurrency, Bitcoin (BTC) continues to capture attention as it showcases a rise of over 0.50%, reaching $26,133 on Sunday. Notably, the support at $26,000 appears to have effectively prevented further losses for the cryptocurrency.

Furthermore, the prominent entity MicroStrategy is contending with substantial unrealized losses amounting to $600 million due to the recent slumping of the Bitcoin price.

MicroStrategy Sees Significant Losses as Bitcoin’s Value Drops

MicroStrategy Inc, the main company holding Bitcoin, suffered a significant setback with over $600 million in unrealized losses due to the recent price drop to around $25,000.

The software company invested $4.5 billion to acquire over 150,000 Bitcoins, resulting in an average cost of around $29,970 per Bitcoin.

This price drop of 11% in three days from the August 16 peak of over $29,000 marks MicroStrategy’s first bout of red in Bitcoin holdings since June.

Despite these losses, the company, led by its ardent proponent of Bitcoin, Michael Saylor, remains steadfast in its conviction.

Saylor, who champions Bitcoin as “digital gold,” guides the firm’s acquisition strategy and reiterates the decision to retain their holdings.

MicroStrategy’s stock (MSTR) reflects a year-to-date gain of 132%, although it has faced a 14.49% dip in the past five days, according to Tradingview data.

Concurrently, the broader market trend shows a decline in Bitcoin holders’ profit by over 10%, accompanied by a drop in Bitcoin’s value, reducing the percentage of profitable supply from 73% to 60% in a week, as per Glassnode’s data.

MicroStrategy Inc’s sizable unrealized losses from the Bitcoin price decline could introduce a note of caution among investors, possibly amplifying market volatility and impacting Bitcoin’s valuation dynamics in the near term.

The US Dollar Index (DXY), which measures the value of the greenback against a basket of six major currencies, was down by 0.13% at the end of the week.

This bearish USD may have contributed to the improved movement of BTC/USD on the weekend.

Bitcoin Price Prediction

In recent times, Bitcoin’s technical landscape has been marked by significant activity following its drop below the $29,000 level on August 6th. Presently trading around $25,800, the cryptocurrency has experienced substantial decline.

Analyzing the four-hour timeframe, Bitcoin has shown patterns of “Three Black Crows” candlesticks, indicating a strong bearish sentiment in the market.

The Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) oscillators have entered the oversold region, highlighting the prevailing bearish dominance.

The 50-day Exponential Moving Average (EMA) around $27,300 has been influential, with recent candle closures confirming sustained bearish momentum.

The immediate resistance is at $26,200, but a bearish engulfing candlestick and two-day candle pattern below this level suggest ongoing bearish pressure. If this trend continues, Bitcoin may decline to $25,600, possibly even reaching $25,200.

However, surpassing the $26,200 level could lead to targeting the resistance at $26,800, and further gains might push BTC’s price toward $27,300 and eventually $27,600.

Conversely, a fall below $25,200 could indicate the potential for deeper losses, possibly reaching as low as $24,800.

Top 15 Cryptocurrencies to Watch in 2023

Discover the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly browsing our thoughtfully selected collection of the top 15 digital assets to keep an eye on in 2023.

This carefully curated list has been compiled by industry experts from Industry Talk and Cryptonews, providing you with professional recommendations and valuable insights.

Keep up with the rapidly evolving world of digital assets and stay ahead of the game by exploring the potential of these cryptocurrencies.

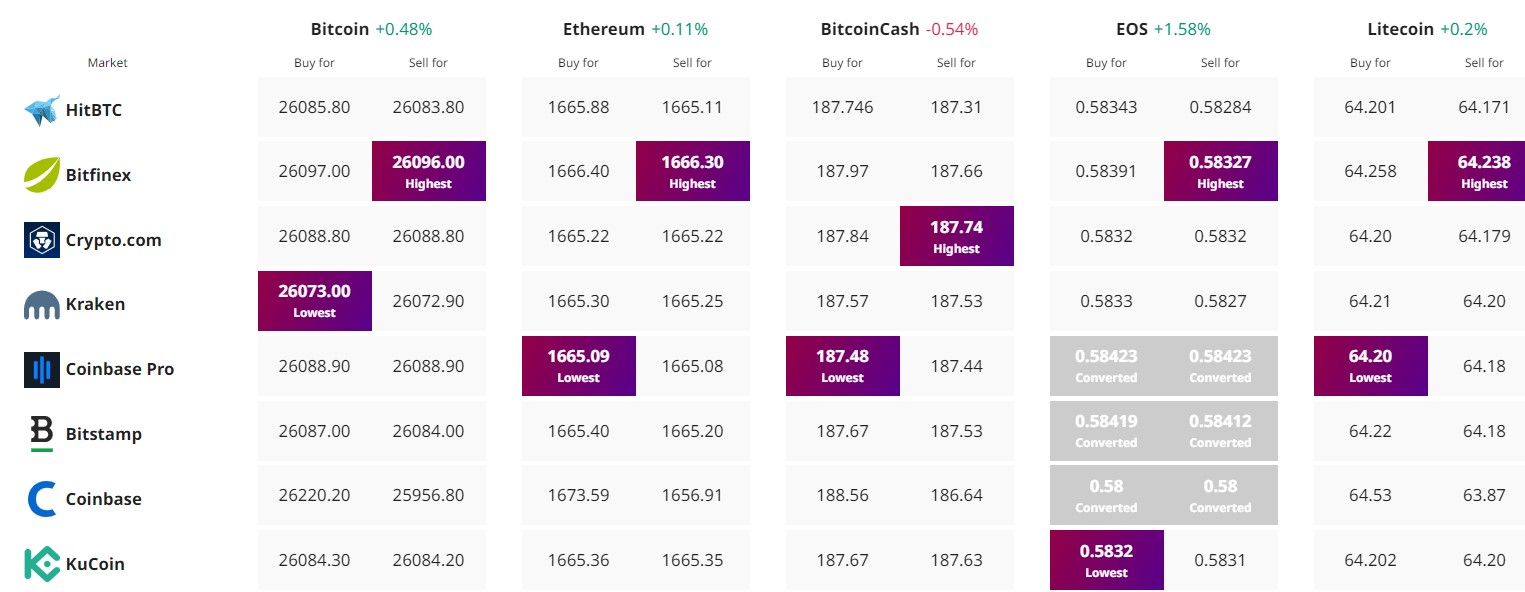

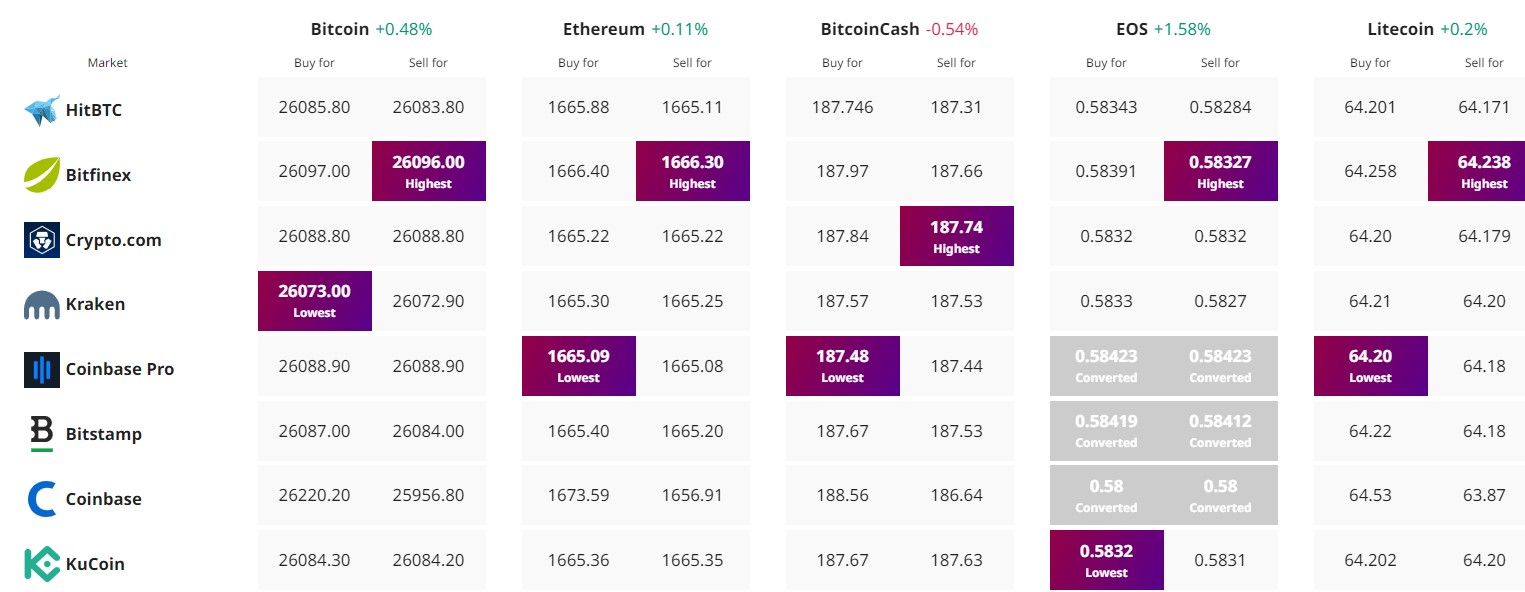

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

In the dynamic realm of cryptocurrency, Bitcoin (BTC) continues to capture attention as it showcases a rise of over 0.50%, reaching $26,133 on Sunday. Notably, the support at $26,000 appears to have effectively prevented further losses for the cryptocurrency.

Furthermore, the prominent entity MicroStrategy is contending with substantial unrealized losses amounting to $600 million due to the recent slumping of the Bitcoin price.

MicroStrategy Sees Significant Losses as Bitcoin’s Value Drops

MicroStrategy Inc, the main company holding Bitcoin, suffered a significant setback with over $600 million in unrealized losses due to the recent price drop to around $25,000.

The software company invested $4.5 billion to acquire over 150,000 Bitcoins, resulting in an average cost of around $29,970 per Bitcoin.

This price drop of 11% in three days from the August 16 peak of over $29,000 marks MicroStrategy’s first bout of red in Bitcoin holdings since June.

Despite these losses, the company, led by its ardent proponent of Bitcoin, Michael Saylor, remains steadfast in its conviction.

Saylor, who champions Bitcoin as “digital gold,” guides the firm’s acquisition strategy and reiterates the decision to retain their holdings.

MicroStrategy’s stock (MSTR) reflects a year-to-date gain of 132%, although it has faced a 14.49% dip in the past five days, according to Tradingview data.

Concurrently, the broader market trend shows a decline in Bitcoin holders’ profit by over 10%, accompanied by a drop in Bitcoin’s value, reducing the percentage of profitable supply from 73% to 60% in a week, as per Glassnode’s data.

MicroStrategy Inc’s sizable unrealized losses from the Bitcoin price decline could introduce a note of caution among investors, possibly amplifying market volatility and impacting Bitcoin’s valuation dynamics in the near term.

The US Dollar Index (DXY), which measures the value of the greenback against a basket of six major currencies, was down by 0.13% at the end of the week.

This bearish USD may have contributed to the improved movement of BTC/USD on the weekend.

Bitcoin Price Prediction

In recent times, Bitcoin’s technical landscape has been marked by significant activity following its drop below the $29,000 level on August 6th. Presently trading around $25,800, the cryptocurrency has experienced substantial decline.

Analyzing the four-hour timeframe, Bitcoin has shown patterns of “Three Black Crows” candlesticks, indicating a strong bearish sentiment in the market.

The Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) oscillators have entered the oversold region, highlighting the prevailing bearish dominance.

The 50-day Exponential Moving Average (EMA) around $27,300 has been influential, with recent candle closures confirming sustained bearish momentum.

The immediate resistance is at $26,200, but a bearish engulfing candlestick and two-day candle pattern below this level suggest ongoing bearish pressure. If this trend continues, Bitcoin may decline to $25,600, possibly even reaching $25,200.

However, surpassing the $26,200 level could lead to targeting the resistance at $26,800, and further gains might push BTC’s price toward $27,300 and eventually $27,600.

Conversely, a fall below $25,200 could indicate the potential for deeper losses, possibly reaching as low as $24,800.

Top 15 Cryptocurrencies to Watch in 2023

Discover the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly browsing our thoughtfully selected collection of the top 15 digital assets to keep an eye on in 2023.

This carefully curated list has been compiled by industry experts from Industry Talk and Cryptonews, providing you with professional recommendations and valuable insights.

Keep up with the rapidly evolving world of digital assets and stay ahead of the game by exploring the potential of these cryptocurrencies.

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.