The volatile nature of the cryptocurrency market is once again underscored as Bitcoin, the foremost digital currency, witnesses a significant drop, plummeting to levels around $29,000.

Amidst an overall tumble in crypto prices, the immediate trajectory and stability of Bitcoin remain the subjects of fervent debate.

With a current price lingering just below the $29,000 mark, investors and traders are keenly observing potential shifts and key levels that could dictate the next phase of movement.

CoinMarketCap positions Bitcoin firmly at the top, despite its recent 0.92% dip over the past day.

But as this digital giant approaches its maximum supply limit, market dynamics might be poised for further twists. Here’s a closer look at the current situation and what to anticipate.

Bitcoin Price Prediction

The dominant cryptocurrency, Bitcoin, seems to be on a descending trajectory, recently bypassing the significant $29,000 marker.

Indications of a bearish stance are evident as Bitcoin trends below the 50-day exponential moving average, suggesting that a breach of the $29,250 mark might exacerbate today’s negative momentum.

Current technical indicators, including the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD), echo this bearish sentiment.

Bitcoin’s immediate resistance hovers around the $29,050 mark, and a conclusion beneath this could signal lucrative short-selling opportunities.

On the decline front, the foremost support for Bitcoin stands near the $29,000 bracket.

Any slide beneath might push its valuation toward the $28,750 territory.

Alternatively, if Bitcoin surmounts the $29,250 resistance, it’s poised to meet the subsequent resistance set at $29,400.

A further ascent would likely find stiff resistance around the $29,600 zone.

To sum up, it’s imperative for investors to keep a vigilant watch over the $29,250 landmark.

Signs to be wary of include bearish patterns like a descending engulfing candlestick, settlements below the 50-day moving average, and other bearish indicators such as the RSI and MACD, all of which could signify a downtrend in the day’s trading session.

Top 15 Cryptocurrencies to Watch in 2023

Explore our meticulously chosen collection of the top 15 digital assets to stay up to date on the latest initial coin offering (ICO) projects and alternative cryptocurrencies in 2023.

This expertly curated list is brought to you by Industry Talk and Cryptonews, providing you with professional recommendations and valuable insights.

Keep pace with the constantly evolving world of digital assets by discovering the potential of these cryptocurrencies.

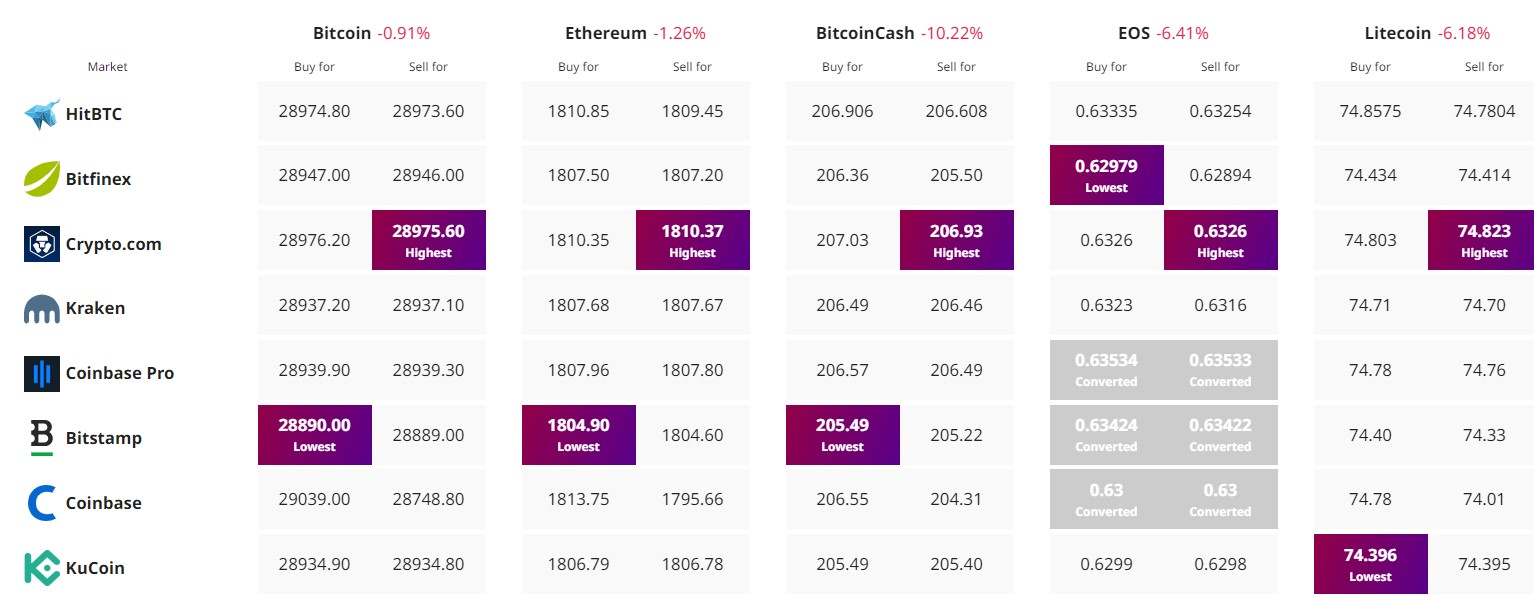

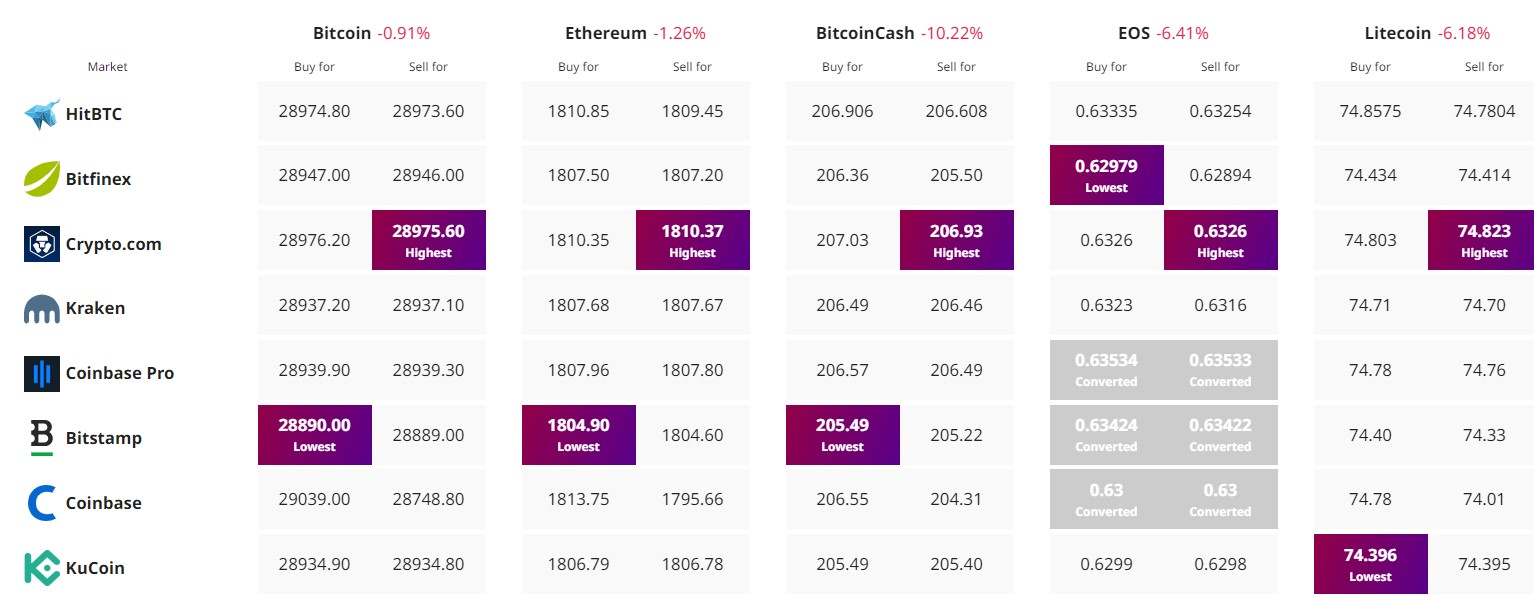

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

The volatile nature of the cryptocurrency market is once again underscored as Bitcoin, the foremost digital currency, witnesses a significant drop, plummeting to levels around $29,000.

Amidst an overall tumble in crypto prices, the immediate trajectory and stability of Bitcoin remain the subjects of fervent debate.

With a current price lingering just below the $29,000 mark, investors and traders are keenly observing potential shifts and key levels that could dictate the next phase of movement.

CoinMarketCap positions Bitcoin firmly at the top, despite its recent 0.92% dip over the past day.

But as this digital giant approaches its maximum supply limit, market dynamics might be poised for further twists. Here’s a closer look at the current situation and what to anticipate.

Bitcoin Price Prediction

The dominant cryptocurrency, Bitcoin, seems to be on a descending trajectory, recently bypassing the significant $29,000 marker.

Indications of a bearish stance are evident as Bitcoin trends below the 50-day exponential moving average, suggesting that a breach of the $29,250 mark might exacerbate today’s negative momentum.

Current technical indicators, including the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD), echo this bearish sentiment.

Bitcoin’s immediate resistance hovers around the $29,050 mark, and a conclusion beneath this could signal lucrative short-selling opportunities.

On the decline front, the foremost support for Bitcoin stands near the $29,000 bracket.

Any slide beneath might push its valuation toward the $28,750 territory.

Alternatively, if Bitcoin surmounts the $29,250 resistance, it’s poised to meet the subsequent resistance set at $29,400.

A further ascent would likely find stiff resistance around the $29,600 zone.

To sum up, it’s imperative for investors to keep a vigilant watch over the $29,250 landmark.

Signs to be wary of include bearish patterns like a descending engulfing candlestick, settlements below the 50-day moving average, and other bearish indicators such as the RSI and MACD, all of which could signify a downtrend in the day’s trading session.

Top 15 Cryptocurrencies to Watch in 2023

Explore our meticulously chosen collection of the top 15 digital assets to stay up to date on the latest initial coin offering (ICO) projects and alternative cryptocurrencies in 2023.

This expertly curated list is brought to you by Industry Talk and Cryptonews, providing you with professional recommendations and valuable insights.

Keep pace with the constantly evolving world of digital assets by discovering the potential of these cryptocurrencies.

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.