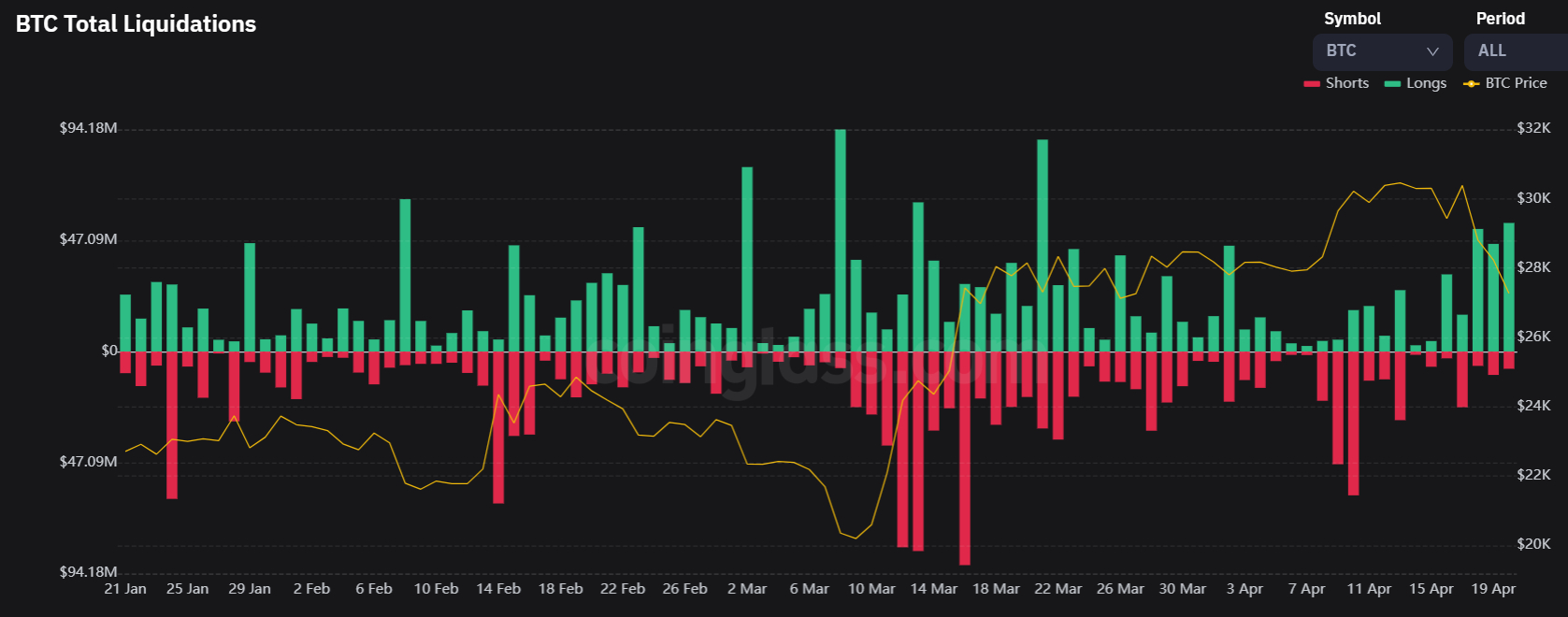

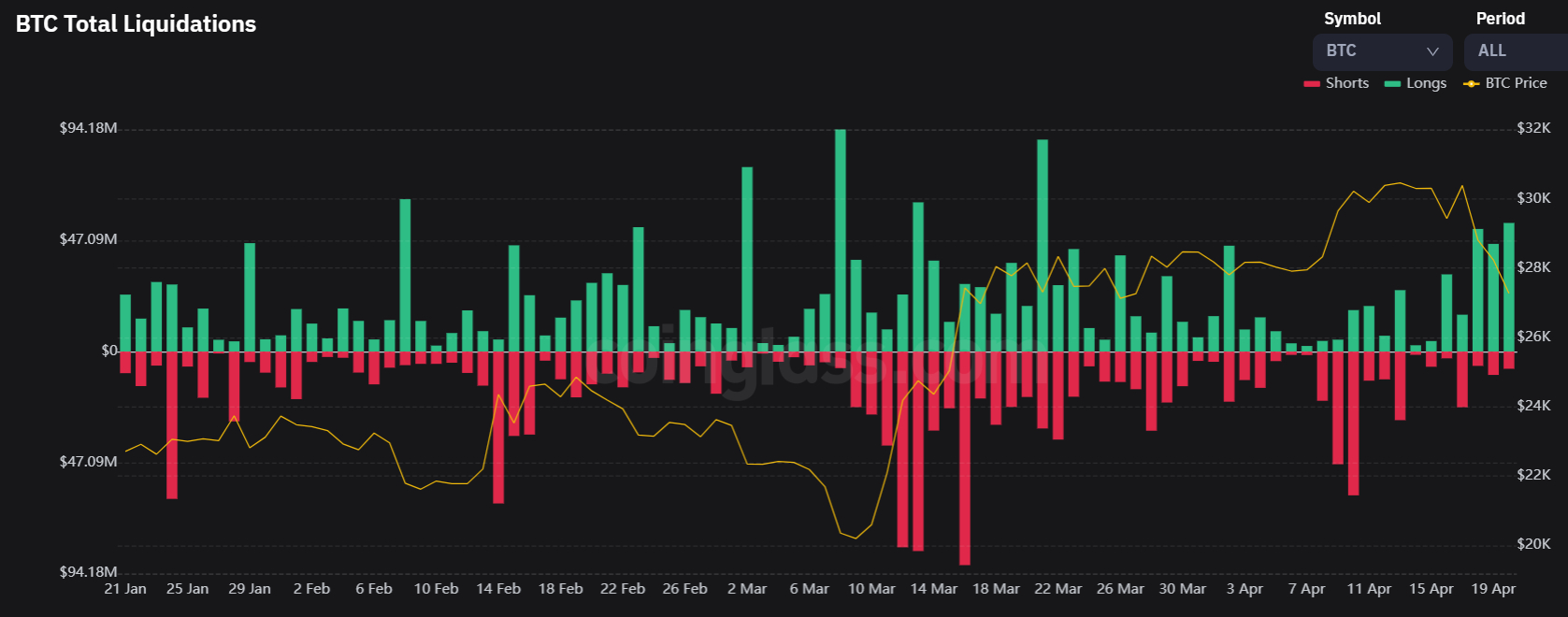

Leveraged long positions in the Bitcoin futures market have been getting “rekt” (i.e. stopped out in internet lingo) in the last few days.

According to data presented by crypto derivatives analytics website coinglass.com, long position liquidations have surpassed $150 million over the course of the last three days.

Indeed, Bitcoin’s 10% drop in the past three days from the mid-$30,000s to current levels in the low-$27,000s marks one of the most intense periods of long position liquidation since the start of the year.

Selling pressure accelerated earlier this week when the BTC price broke below key support in the $29,000 area in the form of 1) the 21DMA, 2) an uptrend from late March and 3) the late March highs.

Since this bearish break, technicians have been targeting a retest of support in the $26,500-800 area in the form of a support-turned-resistance level from March and the 50DMA.

Why is Bitcoin Down This Week?

Macro developments can partially explain Bitcoin’s drop on the week, which now stands at just shy of 10% (for reference, this would be Bitcoin’s worst weekly drop since the FTX debacle last November).

Survey data out of the US has painted a mixed picture about economic momentum in the US, muddying the water regarding expectations as to the economic outlook, as well as the outlook for further Fed tightening.

That, combined with much hotter-than-expected UK inflation data has pushed US yields higher on the week, typically a negative for non-yielding crypto assets like Bitcoin.

Some analysts have pointed to ongoing uncertainty regarding the regulatory situation in the US another factor weighing on crypto, with SEC Chair Gary Gensler’s appearance before Congress earlier this week adding little certainty to the outlook.

Meanwhile, the passing of landmark crypto regulations in the EU did little to boost the mood.

Indeed, this week seems to have been dominated by 1) profit-taking after a very strong start to the year which has led to 2) liquidation of a large number of overly optimistic/greedy bulls who expected Bitcoin to plough on above $30,000.

Bitcoin Market Cooling Off

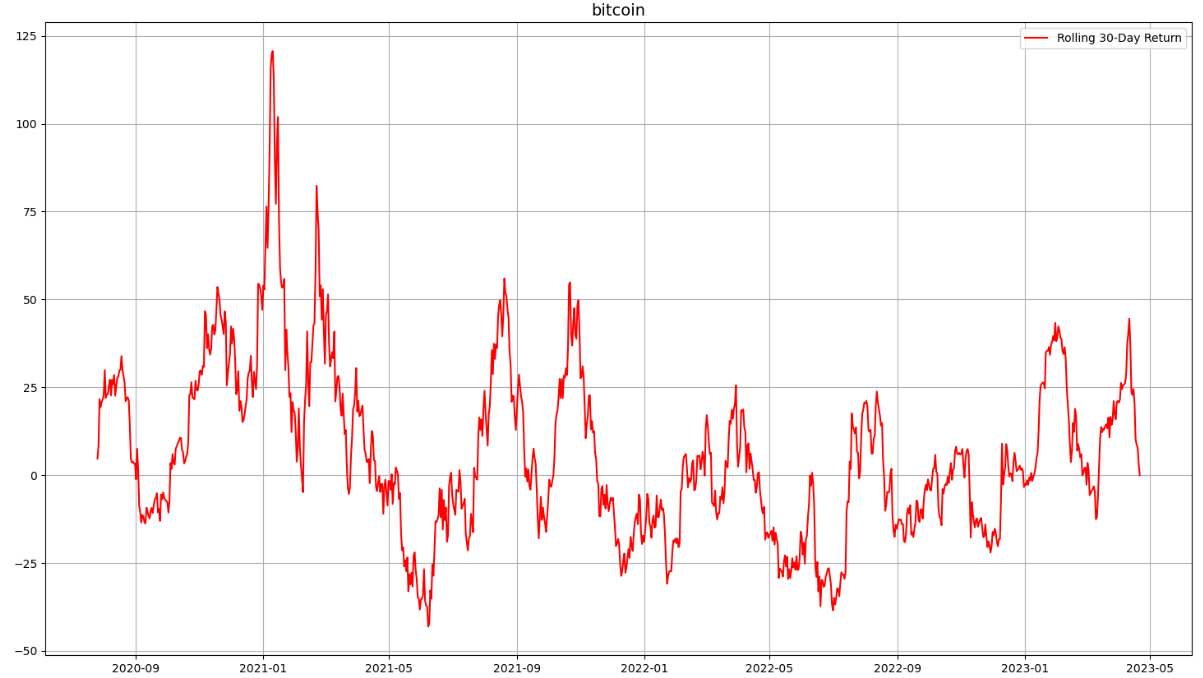

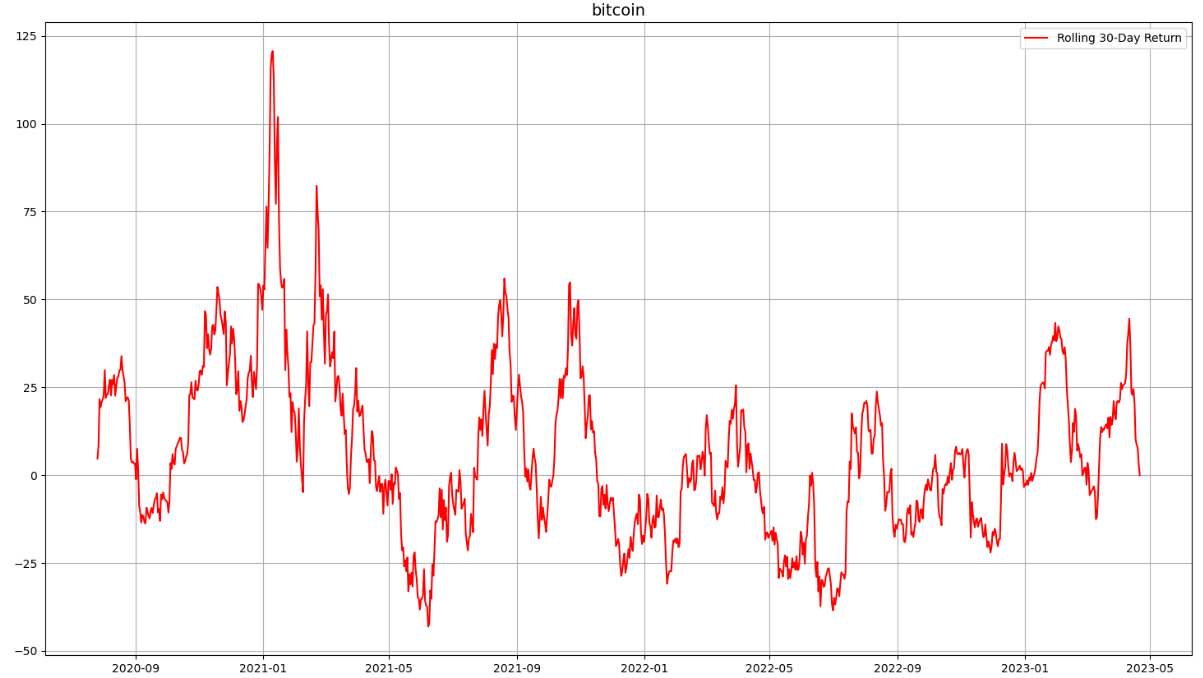

Indeed, a number of metrics last week were flashing that the Bitcoin market may have been overheating in the short-term when the BTC price hit fresh 10-month highs above $30,000 last week.

The 14-Day Relative Strength Index had risen above 70, signaling an overbought market. It’s now fallen to around 42 and if the Bitcoin drop extends to the $25/26,000s, may soon signal an oversold market.

Meanwhile, BTC’s rolling 30-day return had also spiked to its highest level since late November.

The prospect for a continued to drop back towards support in the $25,200-400 region as further optimism is unwound is certainly on the table for the coming days/weeks.

But that shouldn’t do too much damage to the longer-term bull market thesis, and may present an excellent entry point for the longer-term bulls to get back into the market.

As noted in an article on Thursday, the 25% delta skew of short-term Bitcoin options has turned negative, but the skew of longer-term options continues to lean positive.

confidence in Bitcoin’s longer-term price outlook makes sense when you consider macro factors, on-chain trends and medium to long-term technical indicators.

While significant uncertainty remains about how many more times the US Federal Reserve will lift interest rates and when it will start cutting them, one thing seems certain – the end of the Fed’s tightening cycle looks to be close as US inflation and economic growth decelerate.

That implies that unfavorable changes to financial conditions are unlikely to return as a major headwind to crypto markets in 2023, as was the case in 2022.

Meanwhile, Bitcoin is likely to continue to derive tailwinds from key recent technical developments including 1) Bitcoin’s spectacular bounce from its 200DMA and Realized Price in mid-March and 2) Bitcoin’s “golden cross” (when the 50DMA went above the 200DMA) in early February.

Elsewhere, a litany of on-chain and market cycle indicators are screaming that last year’s lows marked the end of the crypto bear market. Many investors will remain confident that Bitcoin’s 2023 bull market will stay alive and well.

As such, expect bargain hunters and dip-buyers to be waiting eagerly on the sidelines to jump in each time Bitcoin posts significant price dips, just as was the case during mid-March.

Leveraged long positions in the Bitcoin futures market have been getting “rekt” (i.e. stopped out in internet lingo) in the last few days.

According to data presented by crypto derivatives analytics website coinglass.com, long position liquidations have surpassed $150 million over the course of the last three days.

Indeed, Bitcoin’s 10% drop in the past three days from the mid-$30,000s to current levels in the low-$27,000s marks one of the most intense periods of long position liquidation since the start of the year.

Selling pressure accelerated earlier this week when the BTC price broke below key support in the $29,000 area in the form of 1) the 21DMA, 2) an uptrend from late March and 3) the late March highs.

Since this bearish break, technicians have been targeting a retest of support in the $26,500-800 area in the form of a support-turned-resistance level from March and the 50DMA.

Why is Bitcoin Down This Week?

Macro developments can partially explain Bitcoin’s drop on the week, which now stands at just shy of 10% (for reference, this would be Bitcoin’s worst weekly drop since the FTX debacle last November).

Survey data out of the US has painted a mixed picture about economic momentum in the US, muddying the water regarding expectations as to the economic outlook, as well as the outlook for further Fed tightening.

That, combined with much hotter-than-expected UK inflation data has pushed US yields higher on the week, typically a negative for non-yielding crypto assets like Bitcoin.

Some analysts have pointed to ongoing uncertainty regarding the regulatory situation in the US another factor weighing on crypto, with SEC Chair Gary Gensler’s appearance before Congress earlier this week adding little certainty to the outlook.

Meanwhile, the passing of landmark crypto regulations in the EU did little to boost the mood.

Indeed, this week seems to have been dominated by 1) profit-taking after a very strong start to the year which has led to 2) liquidation of a large number of overly optimistic/greedy bulls who expected Bitcoin to plough on above $30,000.

Bitcoin Market Cooling Off

Indeed, a number of metrics last week were flashing that the Bitcoin market may have been overheating in the short-term when the BTC price hit fresh 10-month highs above $30,000 last week.

The 14-Day Relative Strength Index had risen above 70, signaling an overbought market. It’s now fallen to around 42 and if the Bitcoin drop extends to the $25/26,000s, may soon signal an oversold market.

Meanwhile, BTC’s rolling 30-day return had also spiked to its highest level since late November.

The prospect for a continued to drop back towards support in the $25,200-400 region as further optimism is unwound is certainly on the table for the coming days/weeks.

But that shouldn’t do too much damage to the longer-term bull market thesis, and may present an excellent entry point for the longer-term bulls to get back into the market.

As noted in an article on Thursday, the 25% delta skew of short-term Bitcoin options has turned negative, but the skew of longer-term options continues to lean positive.

confidence in Bitcoin’s longer-term price outlook makes sense when you consider macro factors, on-chain trends and medium to long-term technical indicators.

While significant uncertainty remains about how many more times the US Federal Reserve will lift interest rates and when it will start cutting them, one thing seems certain – the end of the Fed’s tightening cycle looks to be close as US inflation and economic growth decelerate.

That implies that unfavorable changes to financial conditions are unlikely to return as a major headwind to crypto markets in 2023, as was the case in 2022.

Meanwhile, Bitcoin is likely to continue to derive tailwinds from key recent technical developments including 1) Bitcoin’s spectacular bounce from its 200DMA and Realized Price in mid-March and 2) Bitcoin’s “golden cross” (when the 50DMA went above the 200DMA) in early February.

Elsewhere, a litany of on-chain and market cycle indicators are screaming that last year’s lows marked the end of the crypto bear market. Many investors will remain confident that Bitcoin’s 2023 bull market will stay alive and well.

As such, expect bargain hunters and dip-buyers to be waiting eagerly on the sidelines to jump in each time Bitcoin posts significant price dips, just as was the case during mid-March.