The current live Bitcoin price stands at $29,864, reflecting a 24-hour trading volume of $11.2 billion and a less than 1% increase in the last 24 hours.

The current live Bitcoin price stands at $29,864, reflecting a 24-hour trading volume of $11.2 billion and a less than 1% increase in the last 24 hours.

As the top-ranked cryptocurrency with a market cap of $580.4 billion, Bitcoin is closely watched by investors and traders alike.

Meanwhile, in an interesting development, Global X ETFs, a renowned exchange-traded funds provider, has joined forces with CoinDesk to seek approval for a new Bitcoin ETF.

As Bitcoin continues its volatile journey, investors are keen to know where it is heading.

Global X ETFs Teams Up with CoinDesk to Pursue Approval for New Bitcoin ETF

The Global X Bitcoin Trend Strategy ETF, this fund will be designed to track BTC futures contracts and the CoinDesk BTC Trend Indicator Index. The index utilizes a proprietary signal that assesses the strength and direction of Bitcoin’s price movements.

According to Bloomberg ETF analyst James Seyffart, this application will likely be accepted since it is not a spot Bitcoin ETF application.

He expressed confidence that the ETF will go through the same approval process as the ones that have been previously approved.

Seyffart believes that the approval is almost certain, with the only potential obstacle being if the SEC compels all previously approved BTC futures ETFs to delist.

The introduction of the Global X Bitcoin Trend Strategy ETF, expected in October 2024, is contingent upon receiving regulatory approval.

The potential approval and launch of a Bitcoin ETF like the Global X Bitcoin Trend Strategy ETF can have significant implications for Bitcoin’s price.

Bitcoin Price Prediction

From a technical standpoint, Bitcoin is trading slightly above a significant support level of $29,550, which has been reinforced by a triple bottom pattern visible in the four-hour timeframe.

Moreover, the 50-day exponential moving average acts as a resistance level at approximately $29,995, a psychologically important mark just below $30,000.

Considering these factors, Bitcoin is likely to remain bearish below $30,000. If the cryptocurrency experiences a bearish breakthrough below $29,500, it may face further downward pressure, with the next potential support level at $28,900.

On the other hand, a failure to break below $29,500 could trigger a bullish bounce, potentially driving the price toward $30,000 initially and even surpassing $30,500 in a bullish crossover.

It’s crucial to closely monitor the $29,500 level as it may present a buying opportunity if the price moves above it.

Conversely, a break below this level could initiate selling positions. Additionally, an increase in demand for Bitcoin, resulting in a break above $30,450, could drive the price toward the next resistance level of $31,200.

Top 15 Cryptocurrencies to Watch in 2023

Keep yourself up-to-date with the most recent initial coin offering (ICO) ventures and alternative cryptocurrencies by regularly exploring our meticulously chosen assortment of the 15 most promising digital assets to monitor in 2023.

This thoughtfully curated compilation has been put together by industry professionals from Industry Talk and Cryptonews, guaranteeing that you receive expert advice and valuable insights.

Stay ahead in the industry and uncover the potential of these cryptocurrencies as you navigate through the constantly evolving landscape of digital assets.

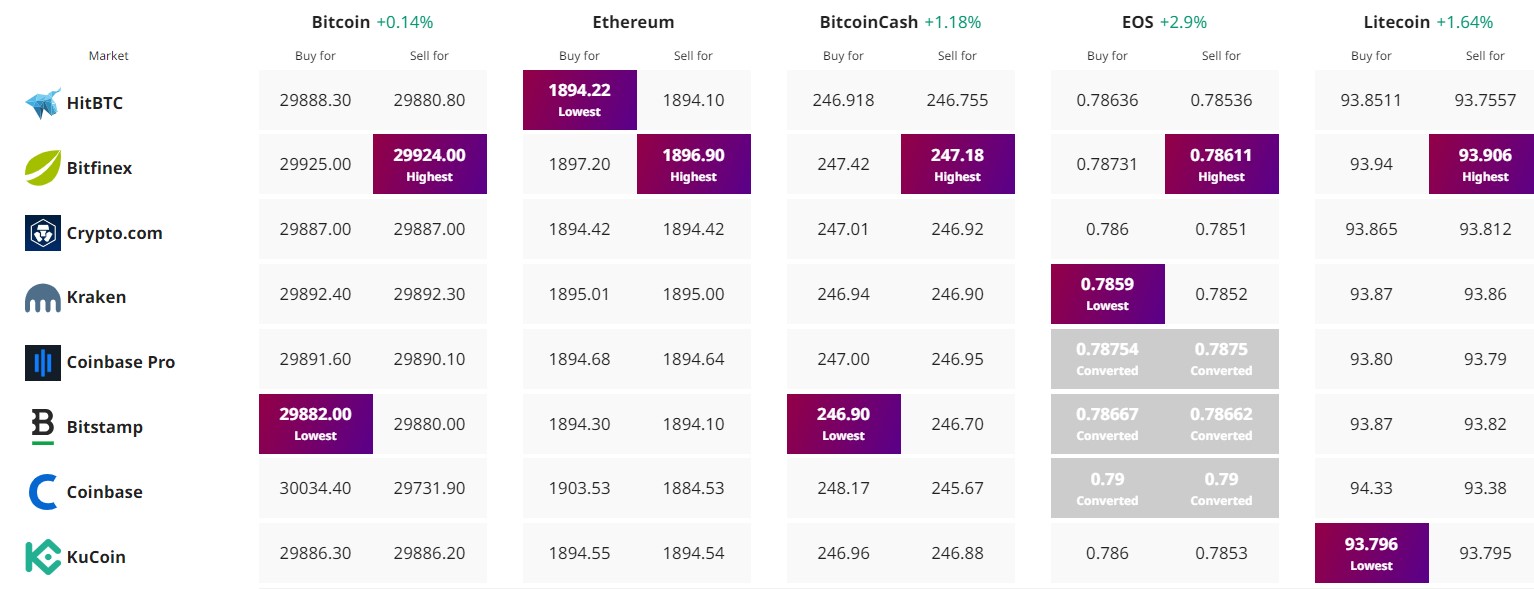

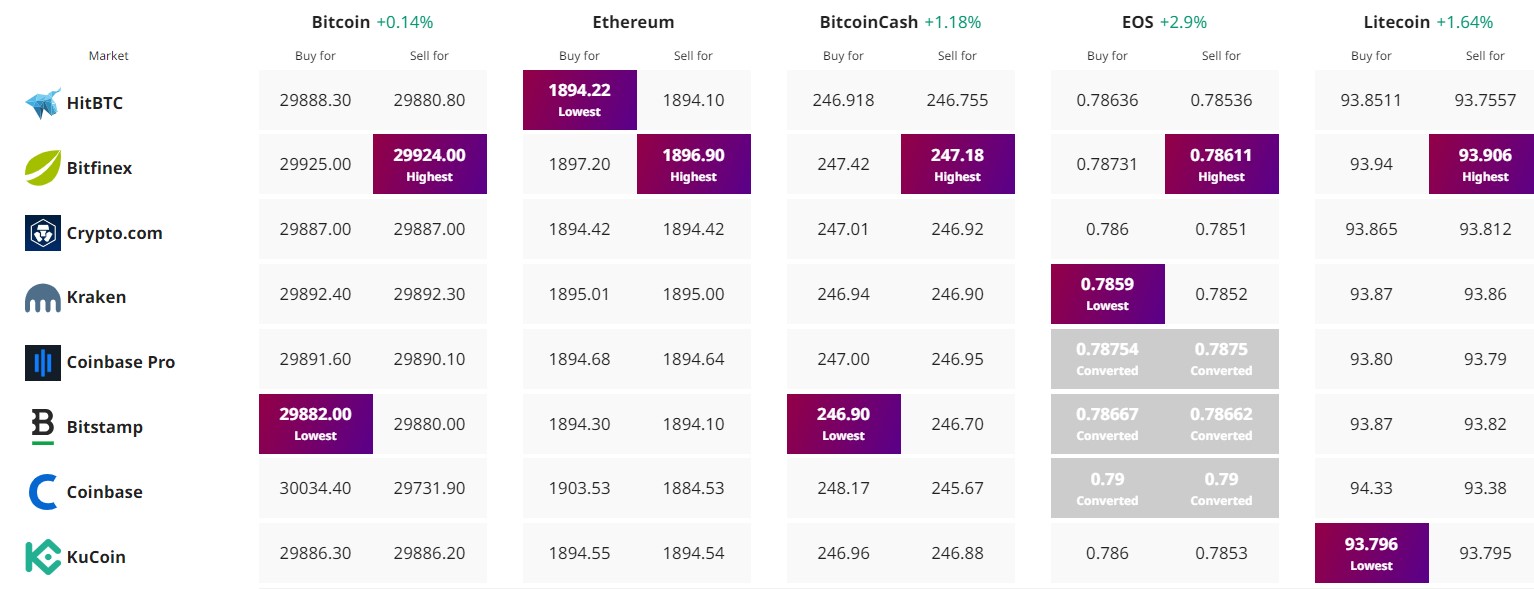

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

The current live Bitcoin price stands at $29,864, reflecting a 24-hour trading volume of $11.2 billion and a less than 1% increase in the last 24 hours.

The current live Bitcoin price stands at $29,864, reflecting a 24-hour trading volume of $11.2 billion and a less than 1% increase in the last 24 hours.

As the top-ranked cryptocurrency with a market cap of $580.4 billion, Bitcoin is closely watched by investors and traders alike.

Meanwhile, in an interesting development, Global X ETFs, a renowned exchange-traded funds provider, has joined forces with CoinDesk to seek approval for a new Bitcoin ETF.

As Bitcoin continues its volatile journey, investors are keen to know where it is heading.

Global X ETFs Teams Up with CoinDesk to Pursue Approval for New Bitcoin ETF

The Global X Bitcoin Trend Strategy ETF, this fund will be designed to track BTC futures contracts and the CoinDesk BTC Trend Indicator Index. The index utilizes a proprietary signal that assesses the strength and direction of Bitcoin’s price movements.

According to Bloomberg ETF analyst James Seyffart, this application will likely be accepted since it is not a spot Bitcoin ETF application.

He expressed confidence that the ETF will go through the same approval process as the ones that have been previously approved.

Seyffart believes that the approval is almost certain, with the only potential obstacle being if the SEC compels all previously approved BTC futures ETFs to delist.

The introduction of the Global X Bitcoin Trend Strategy ETF, expected in October 2024, is contingent upon receiving regulatory approval.

The potential approval and launch of a Bitcoin ETF like the Global X Bitcoin Trend Strategy ETF can have significant implications for Bitcoin’s price.

Bitcoin Price Prediction

From a technical standpoint, Bitcoin is trading slightly above a significant support level of $29,550, which has been reinforced by a triple bottom pattern visible in the four-hour timeframe.

Moreover, the 50-day exponential moving average acts as a resistance level at approximately $29,995, a psychologically important mark just below $30,000.

Considering these factors, Bitcoin is likely to remain bearish below $30,000. If the cryptocurrency experiences a bearish breakthrough below $29,500, it may face further downward pressure, with the next potential support level at $28,900.

On the other hand, a failure to break below $29,500 could trigger a bullish bounce, potentially driving the price toward $30,000 initially and even surpassing $30,500 in a bullish crossover.

It’s crucial to closely monitor the $29,500 level as it may present a buying opportunity if the price moves above it.

Conversely, a break below this level could initiate selling positions. Additionally, an increase in demand for Bitcoin, resulting in a break above $30,450, could drive the price toward the next resistance level of $31,200.

Top 15 Cryptocurrencies to Watch in 2023

Keep yourself up-to-date with the most recent initial coin offering (ICO) ventures and alternative cryptocurrencies by regularly exploring our meticulously chosen assortment of the 15 most promising digital assets to monitor in 2023.

This thoughtfully curated compilation has been put together by industry professionals from Industry Talk and Cryptonews, guaranteeing that you receive expert advice and valuable insights.

Stay ahead in the industry and uncover the potential of these cryptocurrencies as you navigate through the constantly evolving landscape of digital assets.

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.