In a surprising turn of events, the cryptocurrency market witnessed a sudden sell-off, causing Bitcoin price to plummet by more than 3% from its previous level of $31,750 to $30,290.

The rapid decline has caught many investors off guard and left them wondering about the next target for Bitcoin’s price.

While the exact reasons behind this sudden sell-off remain unclear, one possible factor could be the influence of stronger-than-expected Preliminary University of Michigan (UoM) Consumer Sentiment figures on BTC.

The preliminary data from the University of Michigan’s consumer sentiment index reveals a reading of 72.6, surpassing expectations of 65.5 and June’s figure of 64.4.

Positive consumer sentiment often indicates a healthier economy and can result in increased investor confidence in traditional markets, potentially diverting funds away from cryptocurrencies like Bitcoin.

Following this sell-off, traders and investors are closely monitoring the price levels and market indicators in order to identify the next potential Bitcoin price target.

Bitcoin Price Prediction

Taking a closer look at the technical analysis of Bitcoin, we observe a significant pullback after failing to surpass the crucial resistance level at $31,793. This level presents a double hurdle for Bitcoin’s price action.

Currently, Bitcoin is trading around the $30,300 level, finding support near the $30,000 level, which is further reinforced by an upward trendline. The closing of candles above the trendline indicates a persistent bullish sentiment.

However, potential resistance lies around the $30,411 mark, which could impede Bitcoin’s upward movement.

Thus, we can identify immediate support for Bitcoin around the $30,000 level. If this level is breached, the next support level to watch would be around $29,500.

The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators are residing in the bearish territory, aligning with the 50-day exponential moving average, which acts as a significant resistance level near $30,750.

A decisive break below the $30,000 level could lead Bitcoin toward the next target of around $29,500, potentially continuing the downtrend to $28,711.

Conversely, if Bitcoin surpasses the $30,400 level, it could pave the way for further upside potential, with price targets of $30,700 and $31,350.

It is important to closely monitor the price action around the $30,000 level as it is a crucial pivot point.

A breach above this level could signal a bullish trend continuation, while a failure to hold above it may indicate a resumption of the downtrend.

The current technical analysis suggests that Bitcoin’s price faces significant hurdles in surpassing resistance levels.

Immediate support is observed at around $30,000, and a breach below this level could lead to further downward pressure towards $29,500.

Conversely, a break above the $30,400 level could open the doors for potential gains toward $30,700 and $31,350.

Traders and investors should closely monitor these key levels to gain insights into Bitcoin’s short-term price direction and adjust their strategies accordingly.

Top 15 Cryptocurrencies to Watch in 2023

Keep yourself updated on the newest initial coin offering (ICO) ventures and alternative cryptocurrencies by regularly exploring our meticulously chosen assortment of the top 15 digital assets to monitor in 2023.

This meticulously crafted compilation has been assembled by industry professionals from Industry Talk and Cryptonews, guaranteeing that you receive expert suggestions and valuable perspectives.

Stay at the forefront and uncover the possibilities presented by these cryptocurrencies as you navigate the dynamic landscape of digital assets.

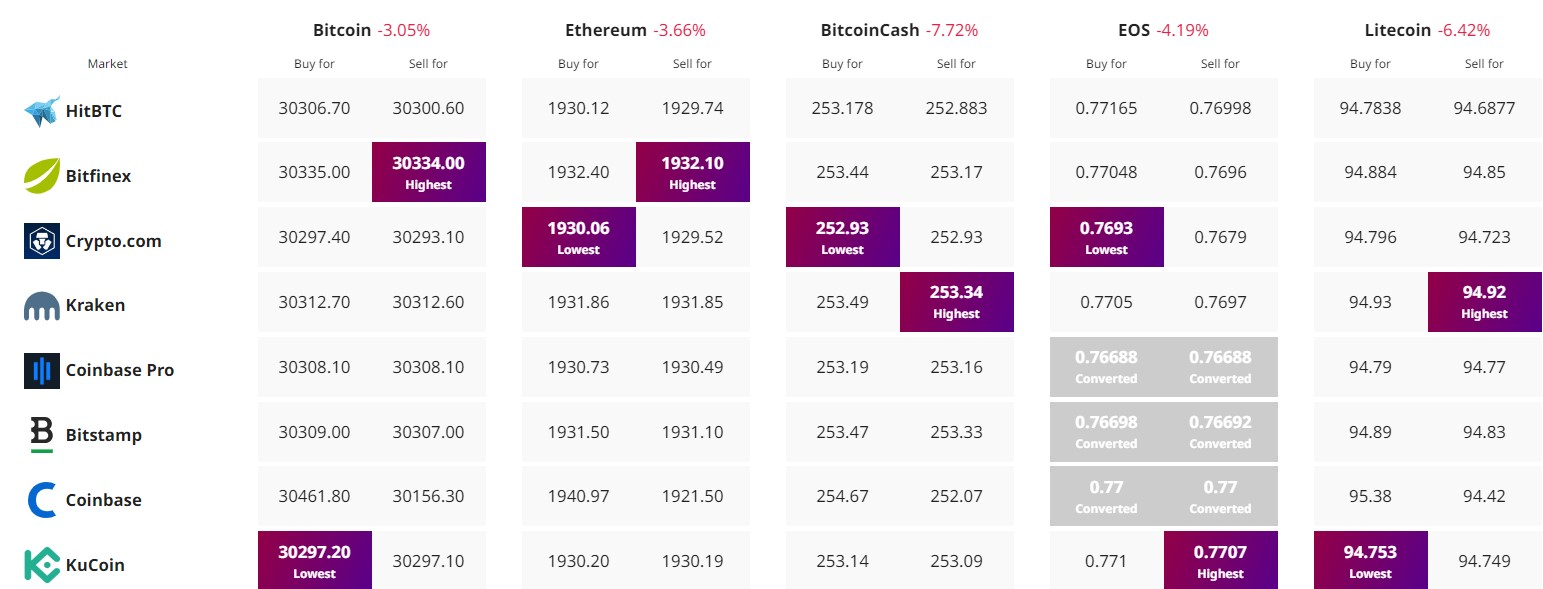

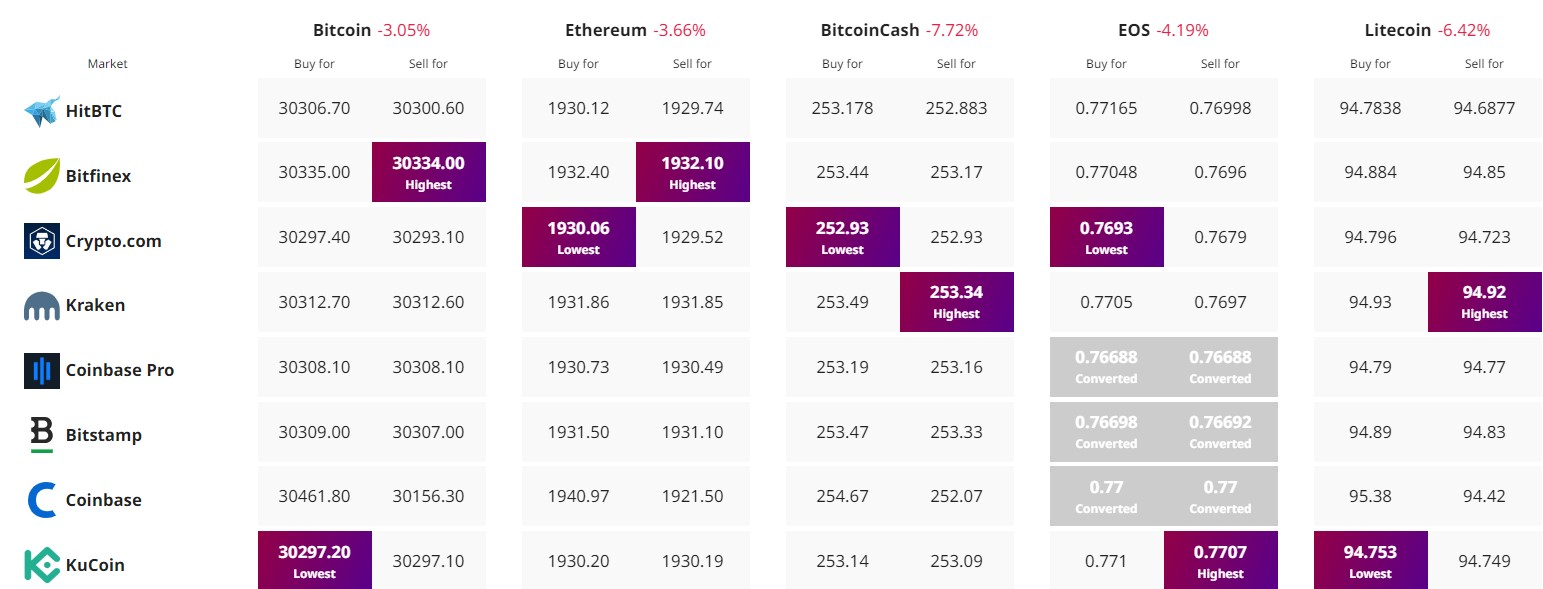

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

In a surprising turn of events, the cryptocurrency market witnessed a sudden sell-off, causing Bitcoin price to plummet by more than 3% from its previous level of $31,750 to $30,290.

The rapid decline has caught many investors off guard and left them wondering about the next target for Bitcoin’s price.

While the exact reasons behind this sudden sell-off remain unclear, one possible factor could be the influence of stronger-than-expected Preliminary University of Michigan (UoM) Consumer Sentiment figures on BTC.

The preliminary data from the University of Michigan’s consumer sentiment index reveals a reading of 72.6, surpassing expectations of 65.5 and June’s figure of 64.4.

Positive consumer sentiment often indicates a healthier economy and can result in increased investor confidence in traditional markets, potentially diverting funds away from cryptocurrencies like Bitcoin.

Following this sell-off, traders and investors are closely monitoring the price levels and market indicators in order to identify the next potential Bitcoin price target.

Bitcoin Price Prediction

Taking a closer look at the technical analysis of Bitcoin, we observe a significant pullback after failing to surpass the crucial resistance level at $31,793. This level presents a double hurdle for Bitcoin’s price action.

Currently, Bitcoin is trading around the $30,300 level, finding support near the $30,000 level, which is further reinforced by an upward trendline. The closing of candles above the trendline indicates a persistent bullish sentiment.

However, potential resistance lies around the $30,411 mark, which could impede Bitcoin’s upward movement.

Thus, we can identify immediate support for Bitcoin around the $30,000 level. If this level is breached, the next support level to watch would be around $29,500.

The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators are residing in the bearish territory, aligning with the 50-day exponential moving average, which acts as a significant resistance level near $30,750.

A decisive break below the $30,000 level could lead Bitcoin toward the next target of around $29,500, potentially continuing the downtrend to $28,711.

Conversely, if Bitcoin surpasses the $30,400 level, it could pave the way for further upside potential, with price targets of $30,700 and $31,350.

It is important to closely monitor the price action around the $30,000 level as it is a crucial pivot point.

A breach above this level could signal a bullish trend continuation, while a failure to hold above it may indicate a resumption of the downtrend.

The current technical analysis suggests that Bitcoin’s price faces significant hurdles in surpassing resistance levels.

Immediate support is observed at around $30,000, and a breach below this level could lead to further downward pressure towards $29,500.

Conversely, a break above the $30,400 level could open the doors for potential gains toward $30,700 and $31,350.

Traders and investors should closely monitor these key levels to gain insights into Bitcoin’s short-term price direction and adjust their strategies accordingly.

Top 15 Cryptocurrencies to Watch in 2023

Keep yourself updated on the newest initial coin offering (ICO) ventures and alternative cryptocurrencies by regularly exploring our meticulously chosen assortment of the top 15 digital assets to monitor in 2023.

This meticulously crafted compilation has been assembled by industry professionals from Industry Talk and Cryptonews, guaranteeing that you receive expert suggestions and valuable perspectives.

Stay at the forefront and uncover the possibilities presented by these cryptocurrencies as you navigate the dynamic landscape of digital assets.

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.