Bitcoin, the world’s largest cryptocurrency, has recently seen a decrease in value, currently trading at $30,330, a drop of 1.07% as of Thursday.

With the government reportedly transferring approximately 10,000 Bitcoin, equivalent to over $300 million, investor sentiment seems to be affected.

Meanwhile, as Bitcoin mining sales surge to record highs, the intricacy involved in mining Bitcoin has simultaneously reached an unprecedented level.

US Government Transfers Bitcoin Worth Over $300 Million

The US government has reportedly transferred around 10,000 Bitcoins, valued at over $300 million. This transaction is believed to have impacted Bitcoin prices, which are currently experiencing a decline.

The price drop is linked to recent activities involving a cryptocurrency wallet connected to the US Department of Justice (DOJ).

On July 12, about 9,825.25 Bitcoins, which is nearly $299 million, were involved in these transactions. It’s worth noting that the US government had previously declared its intention to sell the remaining Bitcoins, seized from the Silk Road, in multiple batches throughout the year.

The exact nature of these transactions, which span over 800 wallet addresses, remains uncertain. The large volume of transactions and linked wallets makes tracking the government’s actions for each coin increasingly complex.

This uncertainty has led to a loss of confidence among some cryptocurrency enthusiasts, sparking concerns about the potential impact on Bitcoin’s future.

Despite these concerns, some cryptocurrency enthusiasts dismiss these fears as unfounded and driven by unnecessary skepticism.

The market’s reaction to these transactions has been relatively muted, with Bitcoin experiencing less than a 1% fluctuation even six hours after the transactions were logged.

Bitcoin Mining Difficulty Reaches All-Time High as Miner Sales Soar

As Bitcoin miner sales reach record highs, the complexity of mining Bitcoin has escalated. The network’s difficulty measure peaked following the recent adjustment on July 12, hitting an all-time high of 53.91 trillion units. This measure indicates the challenge of mining Bitcoin blocks.

The blockchain adjusts its difficulty level every two weeks to maintain a 10-minute processing time. As processing power increases, the network becomes more complex to mine, reducing the profitability for individual miners.

This latest adjustment is expected to put additional pressure on miners, who have been selling their generated Bitcoin since June. The absence of miner accumulation is speculated to be one of the factors preventing a price increase for Bitcoin.

The recent difficulty increase might push the profitability of medium and small-scale miners into negative territory, forcing them to switch off part of their ASIC equipment temporarily. This could lead to the capitulation of smaller miners, allowing stronger miners to accumulate more Bitcoin, potentially reducing the pressure on mining sales.

The recent surge of Bitcoin transfers to exchanges by miners, combined with the network’s record-high difficulty level, highlights the challenges miners face, which have contributed to the pressure on Bitcoin prices this Thursday.

Bitcoin Price Prediction

Looking at the technical aspects of Bitcoin, it’s trending upward after breaking past the $30,500 resistance level.

On a four-hour timeframe, the outward trend line supported Bitcoin around the $30,400 level. The formation of a series of Doji candles above this level has triggered a bullish bounce in Bitcoin.

If we examine the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD), we can observe the RSI holding in the buying zone, while the MACD has begun forming smaller histograms than before.

This is a clear indication of the weakening persistence of the bulls.

That being said, on the upside, Bitcoin has immediate resistance around the $30,950 level or, more precisely, the $31,000 level.

A bullish break above this level has the potential to push BTC toward the $31,500 level. Conversely, a break below the $30,400 level could drive BTC down toward the $30,000 level.

The key point to focus on today is the $30,400 level. As long as Bitcoin stays above this, we can expect a continuation of the bullish trend in Bitcoin.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

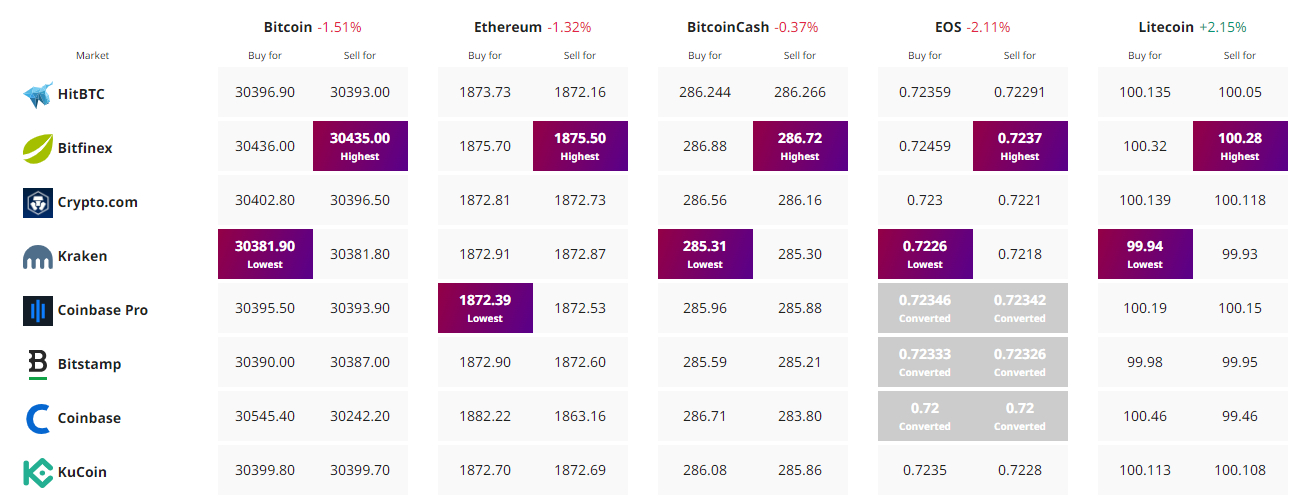

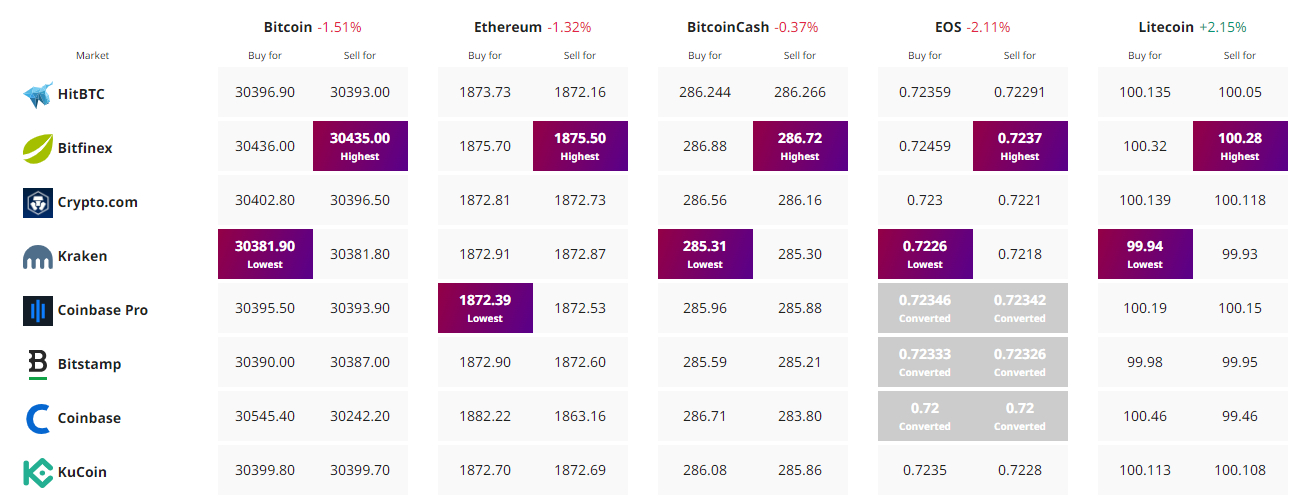

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

Bitcoin, the world’s largest cryptocurrency, has recently seen a decrease in value, currently trading at $30,330, a drop of 1.07% as of Thursday.

With the government reportedly transferring approximately 10,000 Bitcoin, equivalent to over $300 million, investor sentiment seems to be affected.

Meanwhile, as Bitcoin mining sales surge to record highs, the intricacy involved in mining Bitcoin has simultaneously reached an unprecedented level.

US Government Transfers Bitcoin Worth Over $300 Million

The US government has reportedly transferred around 10,000 Bitcoins, valued at over $300 million. This transaction is believed to have impacted Bitcoin prices, which are currently experiencing a decline.

The price drop is linked to recent activities involving a cryptocurrency wallet connected to the US Department of Justice (DOJ).

On July 12, about 9,825.25 Bitcoins, which is nearly $299 million, were involved in these transactions. It’s worth noting that the US government had previously declared its intention to sell the remaining Bitcoins, seized from the Silk Road, in multiple batches throughout the year.

The exact nature of these transactions, which span over 800 wallet addresses, remains uncertain. The large volume of transactions and linked wallets makes tracking the government’s actions for each coin increasingly complex.

This uncertainty has led to a loss of confidence among some cryptocurrency enthusiasts, sparking concerns about the potential impact on Bitcoin’s future.

Despite these concerns, some cryptocurrency enthusiasts dismiss these fears as unfounded and driven by unnecessary skepticism.

The market’s reaction to these transactions has been relatively muted, with Bitcoin experiencing less than a 1% fluctuation even six hours after the transactions were logged.

Bitcoin Mining Difficulty Reaches All-Time High as Miner Sales Soar

As Bitcoin miner sales reach record highs, the complexity of mining Bitcoin has escalated. The network’s difficulty measure peaked following the recent adjustment on July 12, hitting an all-time high of 53.91 trillion units. This measure indicates the challenge of mining Bitcoin blocks.

The blockchain adjusts its difficulty level every two weeks to maintain a 10-minute processing time. As processing power increases, the network becomes more complex to mine, reducing the profitability for individual miners.

This latest adjustment is expected to put additional pressure on miners, who have been selling their generated Bitcoin since June. The absence of miner accumulation is speculated to be one of the factors preventing a price increase for Bitcoin.

The recent difficulty increase might push the profitability of medium and small-scale miners into negative territory, forcing them to switch off part of their ASIC equipment temporarily. This could lead to the capitulation of smaller miners, allowing stronger miners to accumulate more Bitcoin, potentially reducing the pressure on mining sales.

The recent surge of Bitcoin transfers to exchanges by miners, combined with the network’s record-high difficulty level, highlights the challenges miners face, which have contributed to the pressure on Bitcoin prices this Thursday.

Bitcoin Price Prediction

Looking at the technical aspects of Bitcoin, it’s trending upward after breaking past the $30,500 resistance level.

On a four-hour timeframe, the outward trend line supported Bitcoin around the $30,400 level. The formation of a series of Doji candles above this level has triggered a bullish bounce in Bitcoin.

If we examine the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD), we can observe the RSI holding in the buying zone, while the MACD has begun forming smaller histograms than before.

This is a clear indication of the weakening persistence of the bulls.

That being said, on the upside, Bitcoin has immediate resistance around the $30,950 level or, more precisely, the $31,000 level.

A bullish break above this level has the potential to push BTC toward the $31,500 level. Conversely, a break below the $30,400 level could drive BTC down toward the $30,000 level.

The key point to focus on today is the $30,400 level. As long as Bitcoin stays above this, we can expect a continuation of the bullish trend in Bitcoin.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.