The price of Bitcoin is steady at around $30,600, reflecting a nearly 0.50% increase on Wednesday.

The consumer price index saw a 0.2% rise in June, marking a 3% increase from a year ago, the lowest level since March 2021.

With the release of US core inflation data, investors are evaluating the potential impact on Bitcoin’s price. The question arises: is it the right time to buy?

Let’s find out.

US Core Inflation Data

US annual inflation eased to 3% in June, marking the lowest rate since March 2021.

This significant slowdown comes after a surge in energy costs drove inflation to a peak of 9.1% in June last year.

The Consumer Price Index (CPI) has now shown 12 consecutive months of easing inflation.

This decline in inflation has implications for the Bitcoin and cryptocurrency market.

Lower inflation rates could strengthen the case for Bitcoin as a hedge against traditional currency depreciation and inflationary pressures.

Investors may see Bitcoin as an attractive asset in a low inflation environment, potentially leading to increased demand and upward price pressure.

Moreover, the lower inflation figures may alleviate concerns of potential interest rate hikes by central banks.

A more accommodative monetary policy environment could provide further support to the cryptocurrency market, as low interest rates tend to make alternative investments like Bitcoin more appealing.

Bitcoin Price Prediction

Bitcoin is currently showing a slight bearish trend, trading around $30,500.

Despite facing resistance near the $31,000 level, it has managed to remain slightly below it, particularly around $30,500.

A successful breakthrough above this resistance level has the potential to drive Bitcoin’s price towards the next target around $32,500 or potentially even higher, approximately $34,150.

On the downside, Bitcoin has immediate support levels to consider, with possible support found around $30,300 or potentially around $29,650.

If the price significantly drops below $29,600, it may lead to a decline towards $28,700 or even lower, around $27,900.

Therefore, closely monitoring the $31,000 level is crucial as it could provide a significant indication of a potential selling opportunity in Bitcoin if the price remains below this level.

Top 15 Cryptocurrencies to Watch in 2023

Keep up-to-date with the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our meticulously curated collection of the top 15 digital assets to watch in 2023.

This carefully selected list has been compiled by industry experts from Industry Talk and Cryptonews, guaranteeing professional recommendations and valuable insights.

Stay ahead of the curve and uncover the potential of these cryptocurrencies as you navigate the dynamic landscape of digital assets.

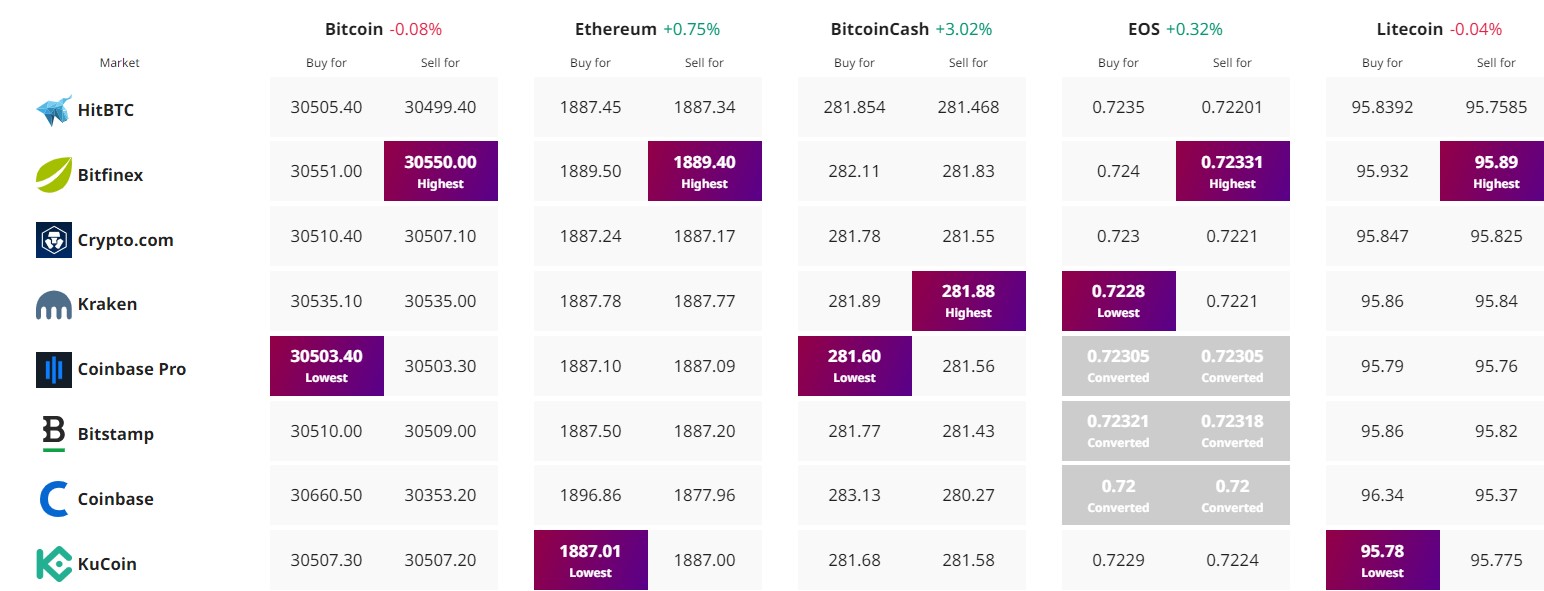

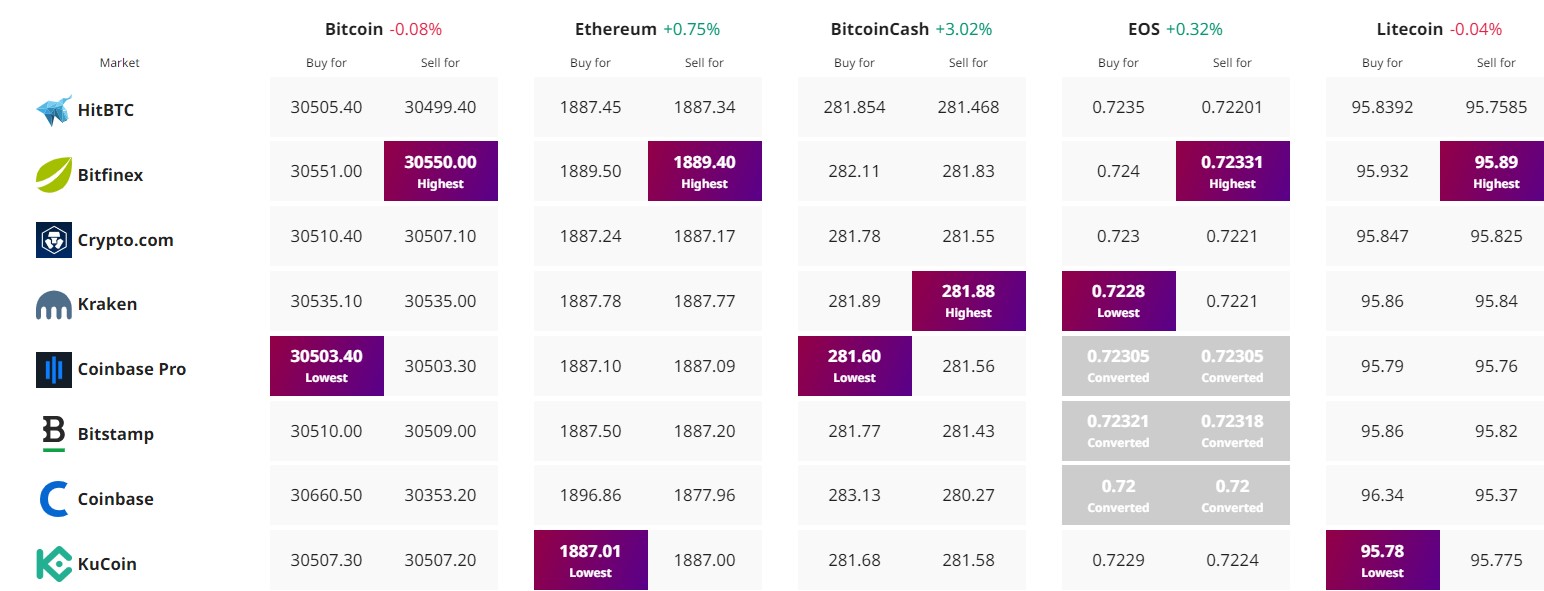

Find The Best Price to Buy/Sell Cryptocurrency

The price of Bitcoin is steady at around $30,600, reflecting a nearly 0.50% increase on Wednesday.

The consumer price index saw a 0.2% rise in June, marking a 3% increase from a year ago, the lowest level since March 2021.

With the release of US core inflation data, investors are evaluating the potential impact on Bitcoin’s price. The question arises: is it the right time to buy?

Let’s find out.

US Core Inflation Data

US annual inflation eased to 3% in June, marking the lowest rate since March 2021.

This significant slowdown comes after a surge in energy costs drove inflation to a peak of 9.1% in June last year.

The Consumer Price Index (CPI) has now shown 12 consecutive months of easing inflation.

This decline in inflation has implications for the Bitcoin and cryptocurrency market.

Lower inflation rates could strengthen the case for Bitcoin as a hedge against traditional currency depreciation and inflationary pressures.

Investors may see Bitcoin as an attractive asset in a low inflation environment, potentially leading to increased demand and upward price pressure.

Moreover, the lower inflation figures may alleviate concerns of potential interest rate hikes by central banks.

A more accommodative monetary policy environment could provide further support to the cryptocurrency market, as low interest rates tend to make alternative investments like Bitcoin more appealing.

Bitcoin Price Prediction

Bitcoin is currently showing a slight bearish trend, trading around $30,500.

Despite facing resistance near the $31,000 level, it has managed to remain slightly below it, particularly around $30,500.

A successful breakthrough above this resistance level has the potential to drive Bitcoin’s price towards the next target around $32,500 or potentially even higher, approximately $34,150.

On the downside, Bitcoin has immediate support levels to consider, with possible support found around $30,300 or potentially around $29,650.

If the price significantly drops below $29,600, it may lead to a decline towards $28,700 or even lower, around $27,900.

Therefore, closely monitoring the $31,000 level is crucial as it could provide a significant indication of a potential selling opportunity in Bitcoin if the price remains below this level.

Top 15 Cryptocurrencies to Watch in 2023

Keep up-to-date with the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our meticulously curated collection of the top 15 digital assets to watch in 2023.

This carefully selected list has been compiled by industry experts from Industry Talk and Cryptonews, guaranteeing professional recommendations and valuable insights.

Stay ahead of the curve and uncover the potential of these cryptocurrencies as you navigate the dynamic landscape of digital assets.

Find The Best Price to Buy/Sell Cryptocurrency