Binance.US is halting USD deposits and has warned users to withdraw all US dollar funds by June 13th, although its dollar withdrawal service is currently not working.

Also, all USD trading pairs will be removed next week.

A statement on its Twitter account in part reads: “The SEC has taken to using extremely aggressive and intimidating tactics in its pursuit of an ideological campaign against the American digital asset industry. Binance.US and our business partners have not been spared in the use of these tactics, which has created challenges for the banks with whom we work.

“As a result, in an effort to protect our customers and platform, today we are suspending USD deposits and notifying customers that our banking partners are preparing to pause fiat (USD) withdrawal channels as early as June 13, 2023. We encourage customers to take appropriate action with their USD.”

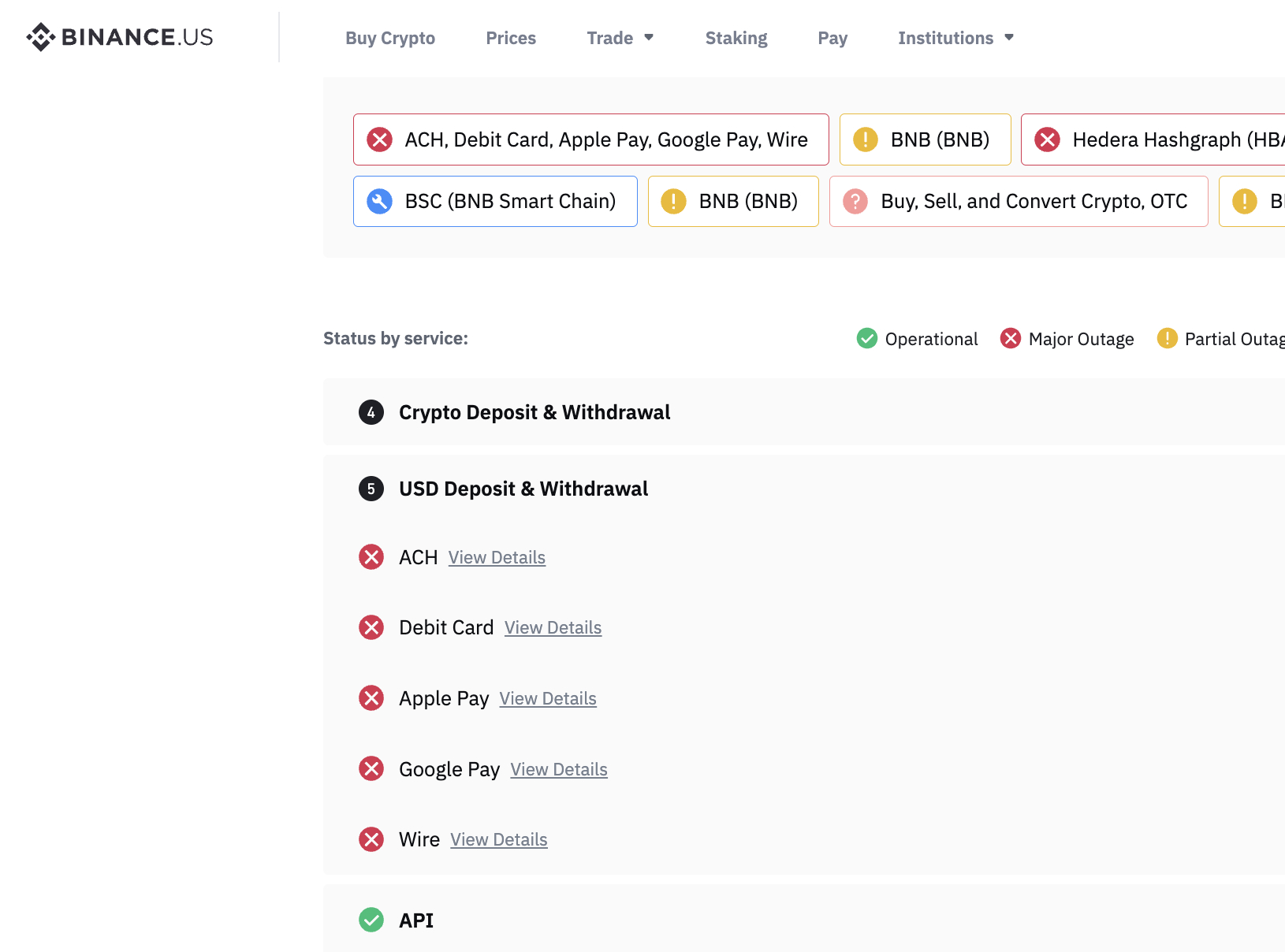

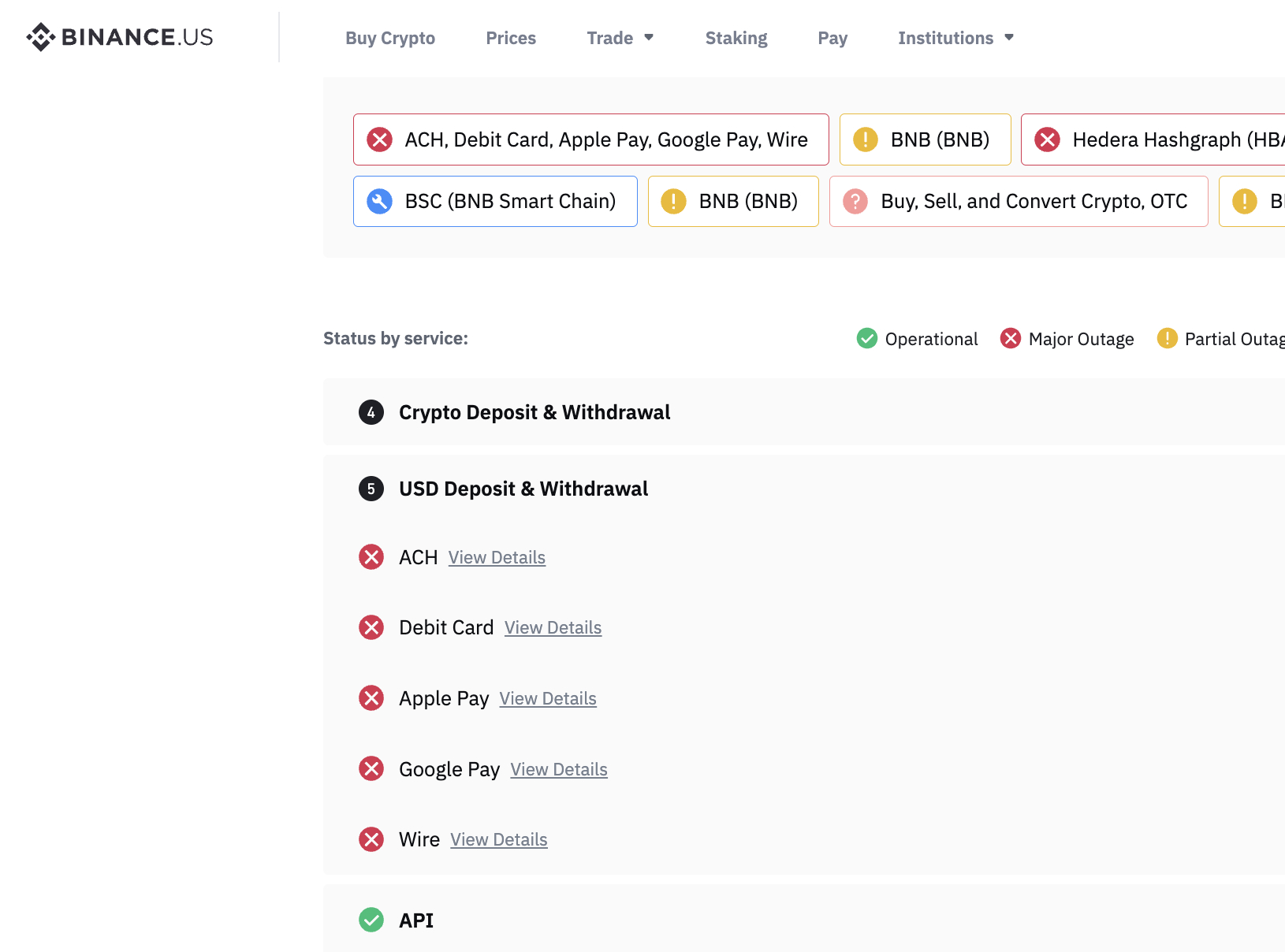

The notice on the status page of the US-facing part of the Binance trading group warned that there might be delays in withdrawing USD funds.

However, the site currently reports a major outage for USD withdrawals via bank transfer (ACH), debit card, Apple Pay, Google Pay and Wire. T

There is no indication as yet when withdrawal services will be back up, leaving Binance.US clients in limbo.

Binance.US is being sued by the US Securities and Exchange Commission (SEC) and the government is attempting to freeze the institutions assets. The agency on Tuesday sort to freeze the US assets of Biance.

The US SEC and its chairman Gary Gensler are accused by the crypto industry of wanting to close down the industry in the US.

In related news Binance claims that Gensler tried to get a job at Binance in 2019 and should recuse himself from the lawsuit.

Coinbase, the largest US exchange, is also being sued by the SEC.

Since the announcement that Binance US was being sued, net flows at the exchange have turned negative, according to crypto data analysts Hansen.

Netflow was previously $78M positive for Binance US 24 hours after the SEC sued Binance

That’s now turned negative to -$123.6M after the SEC filed to seek a temporary restraining order to freeze Binance US assets.

Binance.US and CZ troubles are mounting – but are all US exchanges under threat now?

In a court filing released on Wednesday the SEC details how Binance entities moved as much as $50 billion of dollar funds using the services of Silvergate Bank and Signature Bank. Read the report from our Washington DC correspondent.

The troubles for Binance, BAM Trading – the entity that contains Binance US – and Changpeng Zhao (CZ), the head of the group, deepened on Tuesday.

Former Binance US CEO Brian Brooks revealed in court documents that, “What became clear to me at a certain point was CZ was the CEO of BAM Trading, not me. That’s what became clear at a certain point.”

CZ has always claimed that Binance.US and the wider Binance group were separate organizations that were managed as distinct entities – Brook’s statement flatly contradicts that.

The attack on Binance and Coinbase are raising doubts about the viability of centralized exchanges operating in the US.

At the time of writing the bitcoin price remains little changed at $26,437.

Meme Coins Still Bullish as Crypto Fights back – $SEC, $GENSLR, $WSM

In the aftermath of the SEC lawsuit news, a number of meme coins have been launched, including FucktheSEC ($SEC) and $GENSLR.

After an initial correction, the crypto market has remained calm as traders begin to rationalize the SEC’s move as a US-centric problem, even if the US is still the premier crypto market.

In a sign of the continuing bullish sentiment in corners of crypto such as meme coins, Wall Street Memes ($WSM) has raised nearly $5.5 million in its ongoing presale that’s less than two weeks old.

Wall Street Meme’s retail trading community is one-million strong and rooted in the Covid pandemic era meme stock craze. It is now bringing the fight for the little guy to crypto – and what better time to do that, given the SEC’s current war on crypto.

Visit Wall Street Memes website

Binance.US is halting USD deposits and has warned users to withdraw all US dollar funds by June 13th, although its dollar withdrawal service is currently not working.

Also, all USD trading pairs will be removed next week.

A statement on its Twitter account in part reads: “The SEC has taken to using extremely aggressive and intimidating tactics in its pursuit of an ideological campaign against the American digital asset industry. Binance.US and our business partners have not been spared in the use of these tactics, which has created challenges for the banks with whom we work.

“As a result, in an effort to protect our customers and platform, today we are suspending USD deposits and notifying customers that our banking partners are preparing to pause fiat (USD) withdrawal channels as early as June 13, 2023. We encourage customers to take appropriate action with their USD.”

The notice on the status page of the US-facing part of the Binance trading group warned that there might be delays in withdrawing USD funds.

However, the site currently reports a major outage for USD withdrawals via bank transfer (ACH), debit card, Apple Pay, Google Pay and Wire. T

There is no indication as yet when withdrawal services will be back up, leaving Binance.US clients in limbo.

Binance.US is being sued by the US Securities and Exchange Commission (SEC) and the government is attempting to freeze the institutions assets. The agency on Tuesday sort to freeze the US assets of Biance.

The US SEC and its chairman Gary Gensler are accused by the crypto industry of wanting to close down the industry in the US.

In related news Binance claims that Gensler tried to get a job at Binance in 2019 and should recuse himself from the lawsuit.

Coinbase, the largest US exchange, is also being sued by the SEC.

Since the announcement that Binance US was being sued, net flows at the exchange have turned negative, according to crypto data analysts Hansen.

Netflow was previously $78M positive for Binance US 24 hours after the SEC sued Binance

That’s now turned negative to -$123.6M after the SEC filed to seek a temporary restraining order to freeze Binance US assets.

Binance.US and CZ troubles are mounting – but are all US exchanges under threat now?

In a court filing released on Wednesday the SEC details how Binance entities moved as much as $50 billion of dollar funds using the services of Silvergate Bank and Signature Bank. Read the report from our Washington DC correspondent.

The troubles for Binance, BAM Trading – the entity that contains Binance US – and Changpeng Zhao (CZ), the head of the group, deepened on Tuesday.

Former Binance US CEO Brian Brooks revealed in court documents that, “What became clear to me at a certain point was CZ was the CEO of BAM Trading, not me. That’s what became clear at a certain point.”

CZ has always claimed that Binance.US and the wider Binance group were separate organizations that were managed as distinct entities – Brook’s statement flatly contradicts that.

The attack on Binance and Coinbase are raising doubts about the viability of centralized exchanges operating in the US.

At the time of writing the bitcoin price remains little changed at $26,437.

Meme Coins Still Bullish as Crypto Fights back – $SEC, $GENSLR, $WSM

In the aftermath of the SEC lawsuit news, a number of meme coins have been launched, including FucktheSEC ($SEC) and $GENSLR.

After an initial correction, the crypto market has remained calm as traders begin to rationalize the SEC’s move as a US-centric problem, even if the US is still the premier crypto market.

In a sign of the continuing bullish sentiment in corners of crypto such as meme coins, Wall Street Memes ($WSM) has raised nearly $5.5 million in its ongoing presale that’s less than two weeks old.

Wall Street Meme’s retail trading community is one-million strong and rooted in the Covid pandemic era meme stock craze. It is now bringing the fight for the little guy to crypto – and what better time to do that, given the SEC’s current war on crypto.

Visit Wall Street Memes website